Last updated on Feb 10, 2026

Get the free fl note

Show details

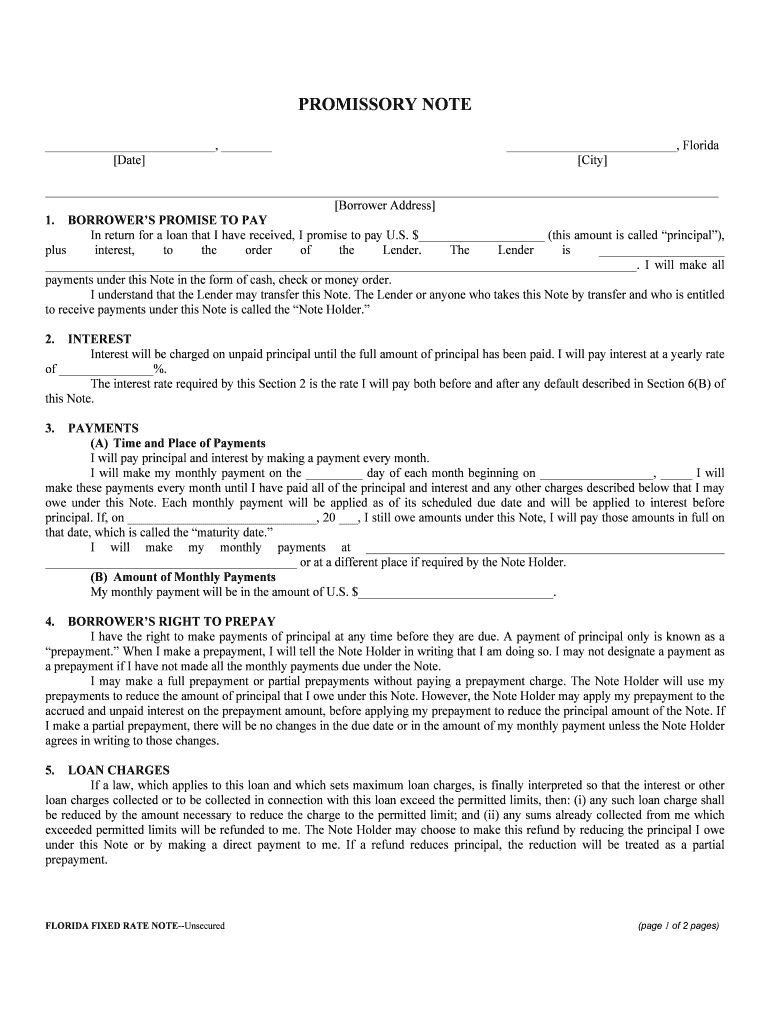

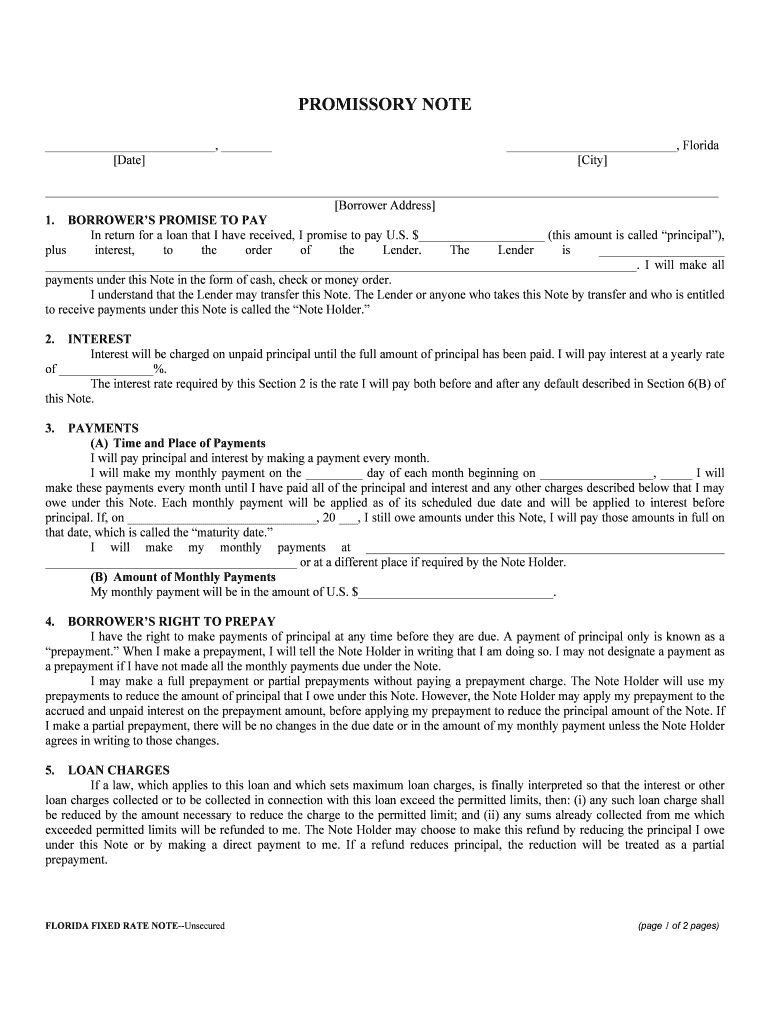

PROMISSORY NOTE, Date, Florida City Borrower Address 1. BORROWERS PROMISE TO PAY In return for a loan that I have received, I promise to pay U.S. $ (this amount is called principal), plus interest,

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is fl note

An FL note is a financial document used to request or authorize a transfer of funds, typically related to a loan or financial transaction.

pdfFiller scores top ratings on review platforms

Great Service

Very good stuff

the app is legitly good and very helpful

Not very user friendly

Not very user friendly. The "sign-up" commitment is not good... Inevitably some people will forget to cancel and then will be hit with a high annual charge...

Awesome!!

Awesome!!! Great site for filling out applications.

Important C.A.R

Important C.A.R. documents were not available I I had to use this form instead.

GREAT!

GREAT! sO EASY TO USE. LOVE IT!

Who needs fl note?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Florida Promissory Note Forms

What is a Florida promissory note?

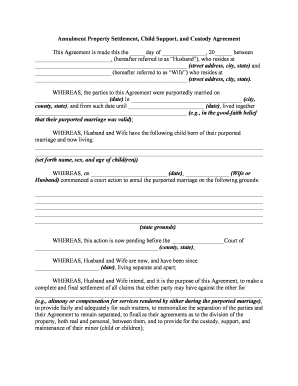

A Florida promissory note is a legal document in which one party, known as the borrower, promises to pay a specified sum of money to another party, the lender, under defined terms. This document establishes clear obligations, specifying details such as interest rates, repayment schedules, and terms of default. The enforceability of such notes ensures that lenders can seek legal recourse in the event of non-payment.

-

A financial agreement promising repayment.

-

Includes borrower and lender data, loan amount, and terms.

-

Enforceable in court, making it critical for borrowers to understand obligations.

What types of Florida promissory notes exist?

There are two primary categories of Florida promissory notes: secured and unsecured. A secured promissory note is backed by collateral, such as property or other assets, providing the lender with greater security. In contrast, unsecured notes do not require any collateral, which may pose a higher risk to lenders but can be easier for borrowers to obtain.

-

Backed by collateral, providing peace of mind to lenders.

-

No collateral, higher risk but easier for borrowers.

-

Assess personal financial situation and risk tolerance before choosing.

How do you fill out a Florida promissory note?

Filling out a Florida promissory note can be efficiently managed with tools like pdfFiller. Begin by downloading the appropriate form and identifying the fields requiring completion. Input information such as the loan amount, interest rate, and both parties' details. Use interactive tools provided by pdfFiller to validate entries and ensure all sections are addressed properly.

-

Download the Florida promissory note template from pdfFiller.

-

Fill in the required fields with borrower and lender details.

-

Ensure to include the loan amount, interest rate, and payment schedule.

-

Review for common errors to avoid mistakes that could void the agreement.

What interest rates and usury laws apply in Florida?

Interest rates for promissory notes in Florida are subject to specific regulations under state usury laws. These laws cap the maximum allowable interest rate on unsecured loans to 18% per annum, while secured loans may have higher limits based on the type of collateral. Understanding these laws is crucial for both borrowers and lenders to ensure compliance and the validity of the agreement.

-

18% cap for unsecured loans; higher limits may apply to secured loans.

-

Ensures legality and prevents manipulation of interest rates.

-

Secured notes can have varying rates based on collateral type.

How can you manage your Florida promissory note?

Effective management of a Florida promissory note is essential for both lenders and borrowers. Keeping track of payment schedules and interest calculations can protect against default. Platforms like pdfFiller offer features that facilitate document tracking, allowing users to maintain organization and access past versions of agreements swiftly.

-

Maintain regular payment records and monitor interest.

-

Consider how to transfer or sell the note if needed.

-

Use pdfFiller to keep documents organized and accessible.

What rights and responsibilities do borrowers have?

Borrowers have specific rights and responsibilities when signing a promissory note. Primarily, they must fulfill their promise to pay as outlined in the agreement. Failure to comply can result in serious consequences, including legal action from lenders to reclaim owed amounts. However, borrowers also maintain the right to prepay their note, which could save on interest costs.

-

A legally binding commitment to repay according to terms.

-

Possibility of foreclosure, legal actions, or loss of collateral.

-

Potential benefits include reduced interest costs.

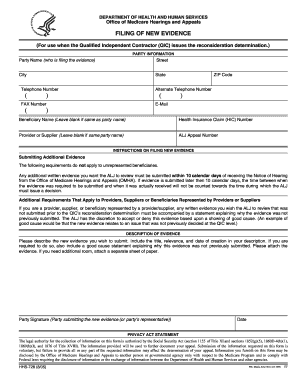

How to fill out the fl note

-

1.Open the PDF file containing the FL note on pdfFiller.

-

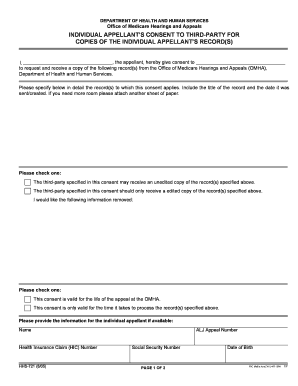

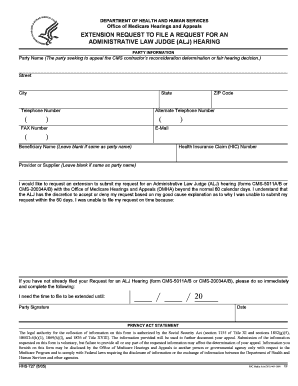

2.Locate the sections that require information, including sender details, recipient details, and transfer amount.

-

3.Fill in your name and contact information in the sender details section.

-

4.Enter the recipient's name and information in the corresponding fields.

-

5.Specify the amount of funds to be transferred in the designated area.

-

6.Review the document for accuracy to ensure all details are complete and correct.

-

7.If required, add your signature and the date at the bottom of the document.

-

8.Save your changes and download the filled FL note, or submit it directly through the platform if options are available.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.