Last updated on Feb 17, 2026

Get the free texas holder

Show details

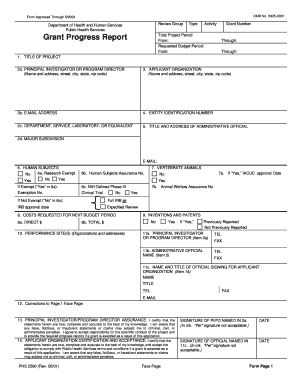

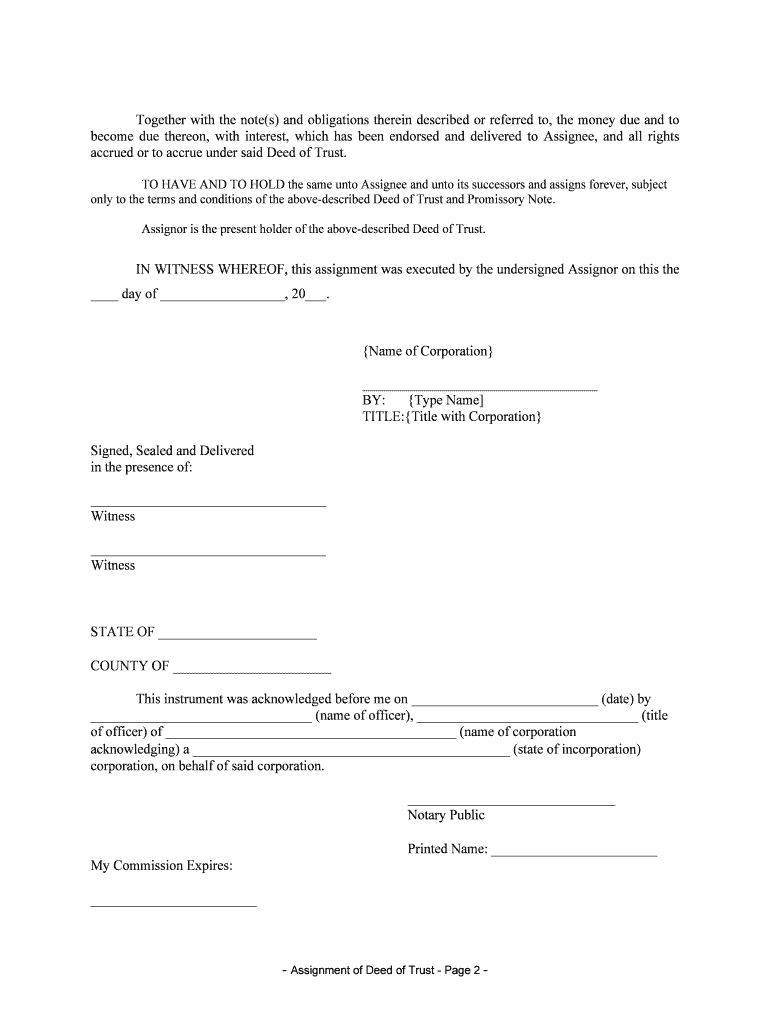

Prepared by and after Recording Return to:

Name:

Firm/Company:

Address:

Address 2:

City, State, Zip:

Phone:Assessors Property Tax Parcel/Account Number:))))))))))

Above This Line Reserved For Official

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

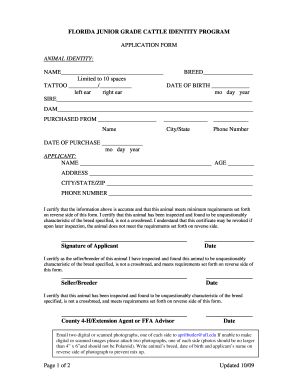

What is texas holder

A Texas holder is a legal form used in the state of Texas, often concerning property or assets.

pdfFiller scores top ratings on review platforms

So easy and affective

So easy and affective. Love this!

Very easy to learn and I like the layout of the tool bar. I haven't tried all the features but for now it is working out for what I need.

easy to use

Easy use and simple!

Easy use and simple!

Great

So much more than just a pdf editor

Accidentally subscribed after the free…

Accidentally subscribed after the free trial but the customer service team was super helpful at refunding.

Also the software seemed really good when I briefly used it.

A very trustworthy company.

Who needs texas holder?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Texas Holder Form

How to fill out a Texas holder form

Completing a Texas holder form involves gathering necessary information such as the names, addresses, and details of the property parcel involved in the transaction. Each section of the form needs to be filled with accurate information to ensure the submission is valid. Ensuring compliance with Texas laws and regulations is critical for a hassle-free experience.

What is the Texas holder form?

The Texas holder form serves as a legal document utilized in property transactions to outline the specifics of a real estate holding. Its primary purpose is to secure the interests of all parties involved in the transaction while ensuring adherence to regulatory requirements within the state. Understanding its function is essential for both buyers and sellers.

-

The Texas holder form denotes a contractual agreement that safeguards the interests of parties involved in real estate dealings, ensuring clarity and compliance.

-

It plays a crucial role in property transactions, acting as legal protection and a reference point during disputes.

-

The form is governed by Texas real estate laws, making it imperative for users to be familiar with relevant regulations.

How do you complete the Texas holder form?

Completing the Texas holder form requires careful attention to detail, as each section is vital for the document's validity. Starting with basic information, you'll need to enter details such as party names, addresses, and any relevant property parcel numbers accurately.

-

Begin with the introductory section, clearly specifying the parties involved and their roles.

-

Include relevant information about the property, including legal descriptions and any attached agreements or disclosures.

-

Identify any sections that require confidentiality to protect sensitive data during the transaction process.

What key fields should you be aware of?

Several vital fields need special consideration to avoid legal pitfalls during the submission process. Understanding these areas can prevent future complications and ensure the effective protection of your rights.

-

These fields specify who completed the form and where it should be returned post-recording, critical for the processing of the document.

-

It is essential to disclose any confidentiality rights to protect the interests and privacy of parties involved.

-

Clearly outline terms related to the deed of trust, which is integral for lending and property rights.

What common mistakes should you avoid?

Filing the Texas holder form may seem straightforward, but many individuals overlook crucial details that lead to complications or invalid submissions. Awareness of these common pitfalls can safeguard against potential legal repercussions.

-

Double-checking names, dates, and property details is essential, as missing these can invalidate the form.

-

Inaccuracies or omissions can trigger disputes or complications with property rights.

-

Always have a second set of eyes review the completed form before submission for additional assurance.

How can pdfFiller aid in managing Texas holder forms?

pdfFiller offers robust functionalities designed to streamline your experience with Texas holder forms, from editing to eSigning. The platform empowers you to manage all your document needs conveniently while ensuring compliance.

-

Easily upload and modify your Texas holder forms in the cloud, making corrections and updates simple.

-

Utilize electronic signing to expedite your transactions without needing physical presence.

-

Experience seamless collaboration by sharing documents among team members for real-time input and feedback.

What does submitting your Texas holder form entail?

Once the Texas holder form is completed, it's crucial to understand the submission process to ensure correct filing. This involves knowing where and how to officially submit your form in Texas.

-

Comprehend the entire process from completion to official filing, avoiding any missteps.

-

Determine the appropriate county clerk's office where the form needs to be submitted.

-

Be aware of any associated fees and processing timelines that might affect your transaction.

What to expect after submission?

After submitting your Texas holder form, various follow-up actions are necessary to ensure that your document is recognized and processed. Tracking its status is an important part of this process.

-

Keep an eye out for any additional documents that may require your attention once the form is processed.

-

Learn how to monitor the progress of your Texas holder form submission through official channels.

-

Maintain important dates and deadlines related to the form for future reference and compliance.

How to fill out the texas holder

-

1.Access the PDF version of the Texas holder form.

-

2.Begin by entering your name and contact information at the top of the document.

-

3.In the designated sections, provide details about the property or assets in question, including addresses and descriptions.

-

4.Next, fill in the information regarding the holder or parties involved, making sure to include their names and contact details.

-

5.Review all entered information for accuracy and completeness, correcting any errors you may find.

-

6.If applicable, sign and date the form at the designated areas, ensuring compliance with Texas laws regarding signatures.

-

7.Save the completed form to your device and consider printing a hard copy for your records and for any necessary physical signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.