Last updated on Feb 17, 2026

US-231LLC free printable template

Show details

RESOLUTION TO BORROW MONEY, LLC (hereinafter, the Company) I, the undersigned Member of the above named Company, hereby Certify that the Company exists and is organized under the laws of the state

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is US-231LLC

The US-231LLC is a form used for officially registering a Limited Liability Company (LLC) in the United States.

pdfFiller scores top ratings on review platforms

So far very good, it is very convenient. I may continue after the trial

Not much instruction for how to use so spent more time than I would have liked in trial and error mode.

easy to use

VERY GOOD EXPERIENCE

Works wonderfully.

ok

Who needs US-231LLC?

Explore how professionals across industries use pdfFiller.

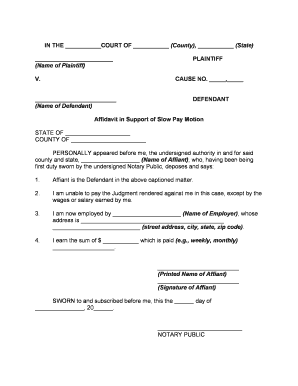

A Comprehensive Guide to Completing the US-231LLC Form

What is the US-231LLC Form?

The US-231LLC form serves as a critical document in establishing and managing a Limited Liability Company (LLC). This form outlines essential information required for compliance with state laws and facilitates the fundamental operational processes of an LLC. Understanding its purpose is vital for anyone intending to operate an LLC successfully.

-

To document essential information about the LLC and its adherence to legal requirements.

-

Failure to complete the US-231LLC form can lead to legal complications and problems in establishing a legitimate business.

What are the essential components of the resolution to borrow money for an ?

When seeking to borrow money, an LLC must adopt a formal resolution. This resolution outlines the expectations and responsibilities regarding the borrowed funds.

-

These statements assert the credibility of the information and the authority of individuals making decisions regarding borrowing.

-

This document provides foundational information about the organizational structure necessary for financial institutions.

-

Details how resolutions should be guided and executed in alignment with the company's by-laws.

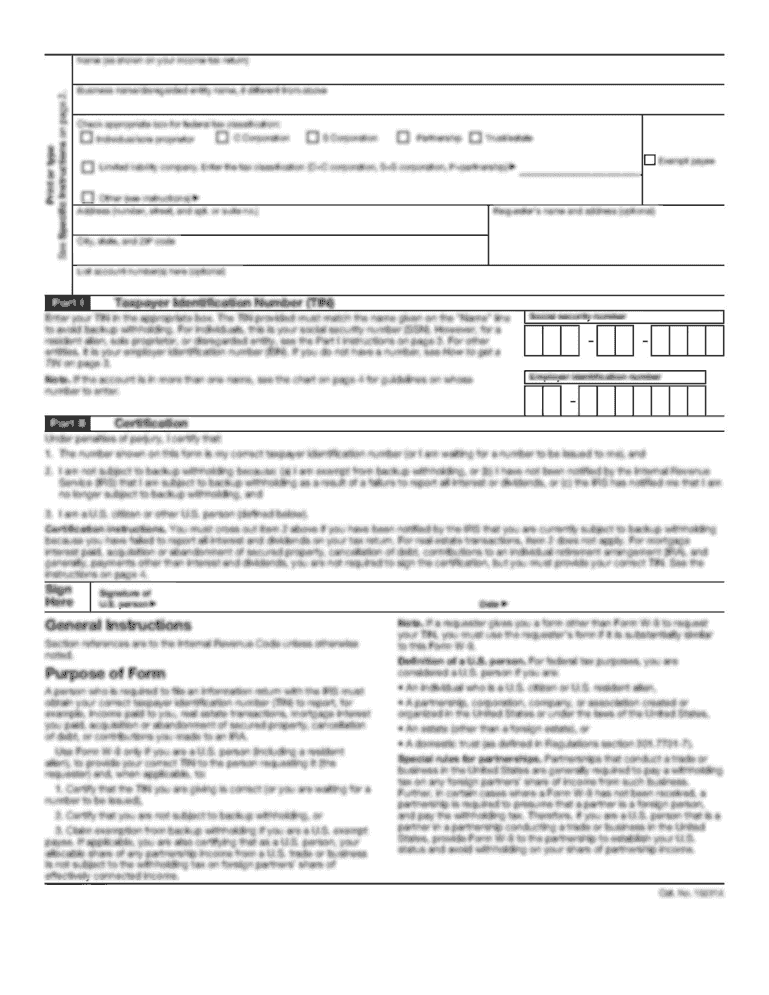

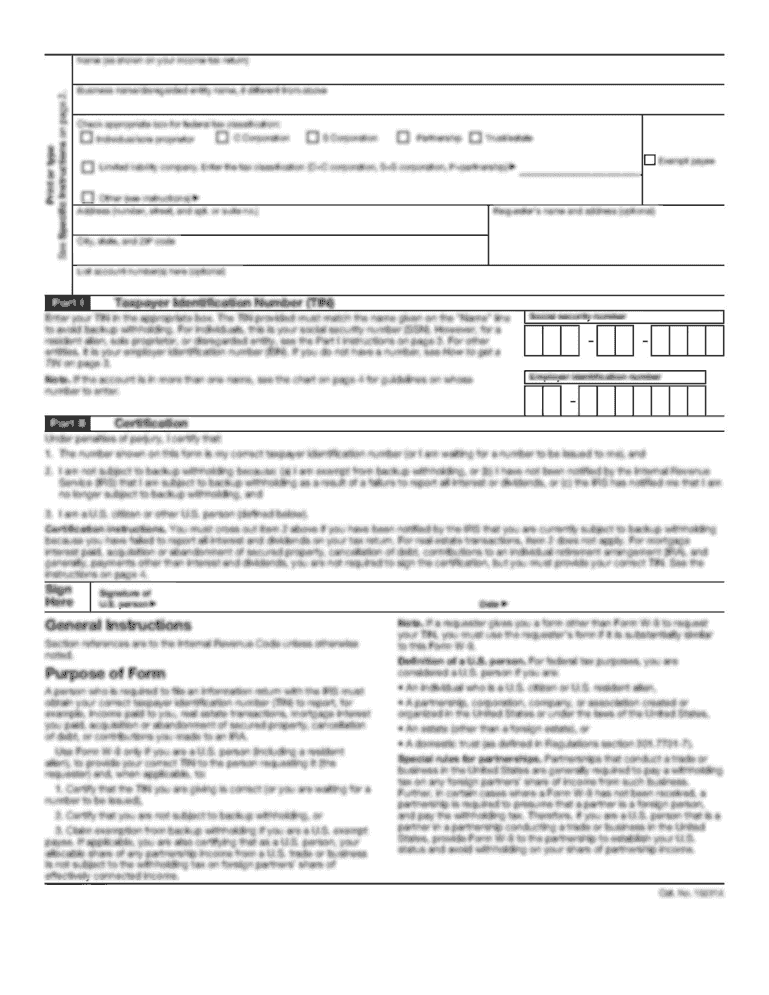

How can you fill out the US-231LLC Form?

Completing the US-231LLC form requires careful attention to detail. Following a step-by-step guide can simplify the process significantly.

-

Break down filling out the form into manageable steps. Each section needs precise information to prevent errors.

-

Leveraging tools available on pdfFiller can help streamline the completion and ensure accuracy.

-

Ensure consistent information that aligns with your LLC's official records to achieve compliance and avoid future issues.

Who can borrow on behalf of the company?

Identifying key roles authorized to borrow money is crucial for maintaining the integrity of the borrowing process.

-

Only designated company officials should be empowered to initiate borrowing, to maintain transparency.

-

Financial institutions will require documentation to verify the authority of those borrowing on behalf of the company.

-

Understanding the necessary signatures and validation processes is essential to finalize borrowing agreements.

What are the legal implications of adopted resolutions?

Resolutions adopted by the LLC can have significant legal implications. Awareness of these implications is vital for compliance.

-

Legal standing requires previous actions to be ratified through formal resolutions.

-

Understanding how long these resolutions remain effective is crucial for ongoing business operations.

-

Companies need to follow procedural guidelines to notify stakeholders of changes to previously adopted resolutions.

How do financial institutions rely on resolutions?

Financial institutions often depend on the resolutions adopted by an LLC when making loan decisions.

-

Financial institutions may only rely on resolutions under defined conditions. Understanding these can strengthen lending relationships.

-

Written notice is often required when revoking a resolution to ensure transparency and legal compliance.

-

Existing agreements play a pivotal role in shaping the feasibility and acceptance of new resolutions.

How to finalize the US-231LLC Form with pdfFiller?

Using pdfFiller makes finalizing the US-231LLC form both efficient and straightforward, allowing for seamless execution.

-

pdfFiller provides eSigning capabilities that simplify the approval process for the US-231LLC form.

-

Post-creation, users can save and manage the completed form easily within the pdfFiller platform.

-

Efficiently collaborate with team members on pdfFiller to ensure all necessary inputs and changes are captured effectively.

How to fill out the US-231LLC

-

1.Open pdfFiller and upload the US-231LLC form.

-

2.Begin by entering your LLC's name in the designated field, ensuring it complies with state naming requirements.

-

3.Fill in the address of your LLC's principal place of business.

-

4.Provide the name and address of the registered agent who will be responsible for receiving legal documents.

-

5.Indicate the duration of the LLC if it's not perpetual.

-

6.Complete sections regarding the management structure, specifying whether members or managers will manage the LLC.

-

7.Add your name, signature, and date in the appropriate boxes, referencing your authority to sign.

-

8.Review all entered information for accuracy.

-

9.Once verified, save your form and choose your preferred method for submitting the form to the appropriate state office.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.