Get the free New Mexico Assignment of Mortgage by Individual Mortgage Holder

Show details

Prepared by and after Recording Return to:

Name:

Firm/Company:

Address:

Address 2:

City, State, Zip:

Phone:Assessors Property Tax Parcel/Account Number:))))))))))

Above This Line Reserved For Official

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is new mexico assignment of

A New Mexico Assignment of is a legal document that allows a party to transfer their rights or interests in a contract to another party.

pdfFiller scores top ratings on review platforms

EASY TO FILL FORMS. GREAT FOR A SMALL BUSINESS

I just need something simple for my small business it does the trick.

It too early to give it a proper review...

Little confusing at first till I figured out

GREAT WEBSITE AND EASY WAY TO DO THE FORMS

This application makes my life easier during stressful tax times... The application is awesome and extremely easy to use.

Who needs new mexico assignment of?

Explore how professionals across industries use pdfFiller.

Long-Read How-to Guide on New Mexico Assignment of Form

How does the assignment of mortgage work in New Mexico?

An Assignment of Mortgage in New Mexico is a legal document that transfers the rights and obligations of a mortgage from the original lender (Assignor) to a new lender (Assignee). This process helps streamline financing and allows for the transfer of property ownership while underlying debt obligations are managed. It’s critical for all parties involved to understand the implications of this assignment, as it affects both financial responsibilities and legal rights.

-

The Assignment of Mortgage serves the purpose of legally transferring mortgage rights, ensuring that the Assignee can enforce the mortgage obligations.

-

The transfer has significant legal effects, potentially impacting payment obligations and rights to foreclosure.

-

A well-documented assignment prevents disputes and ensures clarity regarding who holds the mortgage rights.

Who are the key participants in the assignment process?

The assignment process involves several key players, mainly the Assignor, Assignee, Mortgagor, and Mortgagee. The Assignor is the original lender who transfers the rights, while the Assignee is the new lender who receives those rights. Ensuring that each party is correctly identified is vital, as it avoids future legal complications that might arise from misidentification.

-

Assignors must provide accurate transfer of rights, while Assignees must ensure they accept these responsibilities.

-

Identification of Mortgagor and Mortgagee is crucial for ensuring the correct parties are held accountable for the mortgage.

-

Neglecting to identify parties can lead to disputes and invalidation of the assignment.

How to prepare the assignment document?

Preparation of the Assignment of Mortgage form requires attention to detail. A step-by-step approach is essential to ensure all necessary fields are completed correctly. These include details such as the names of the Assignor and Assignee, property information, and the date of the original mortgage.

-

Accurate completion of the Assignor's and Assignee’s details is critical, alongside precise property data.

-

Misrepresentation in any section can lead to legal challenges down the line.

-

Utilizing tools like pdfFiller can simplify the process by guiding users through each section of the form.

What crucial legal language and terms must be understood?

In any legal document, understanding the terminology is paramount. Specific phrases must be included in the Assignment of Mortgage to ensure its enforceability. Failure to include necessary legal language could render the document invalid.

-

Understanding phrases like 'assign' and 'mortgagee' ensures clarity in the assignment process.

-

Proper legal terminology safeguards the document's legality and enforceability.

-

Familiarity with phrases commonly found in Assignments can help demystify the documentation process.

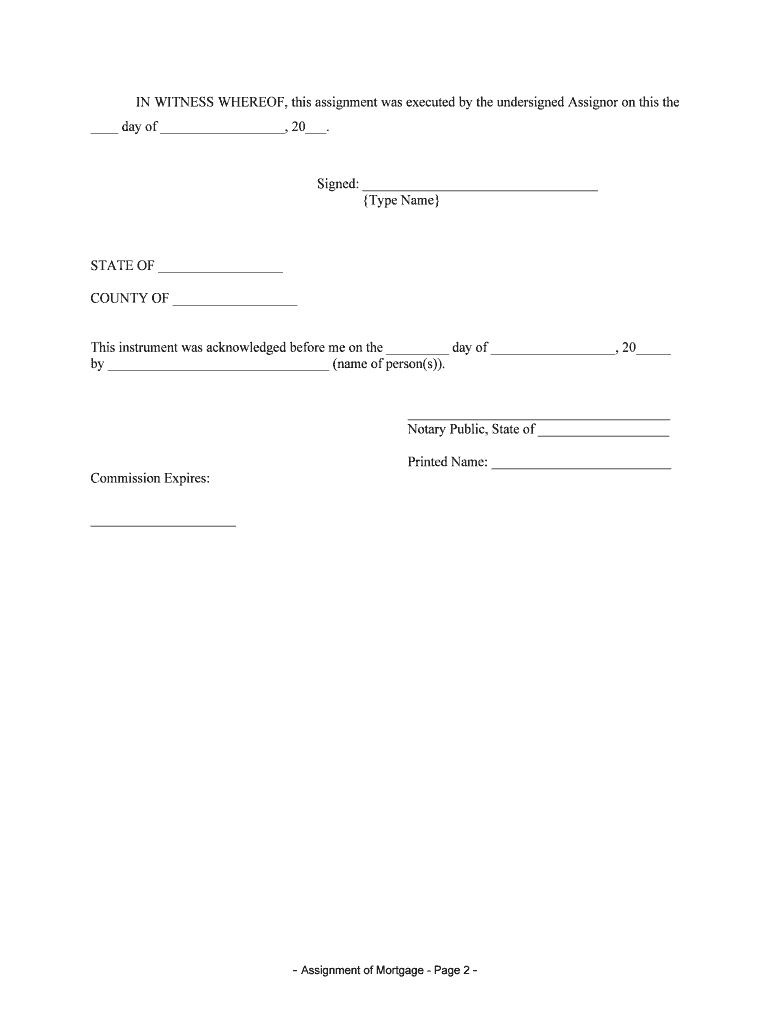

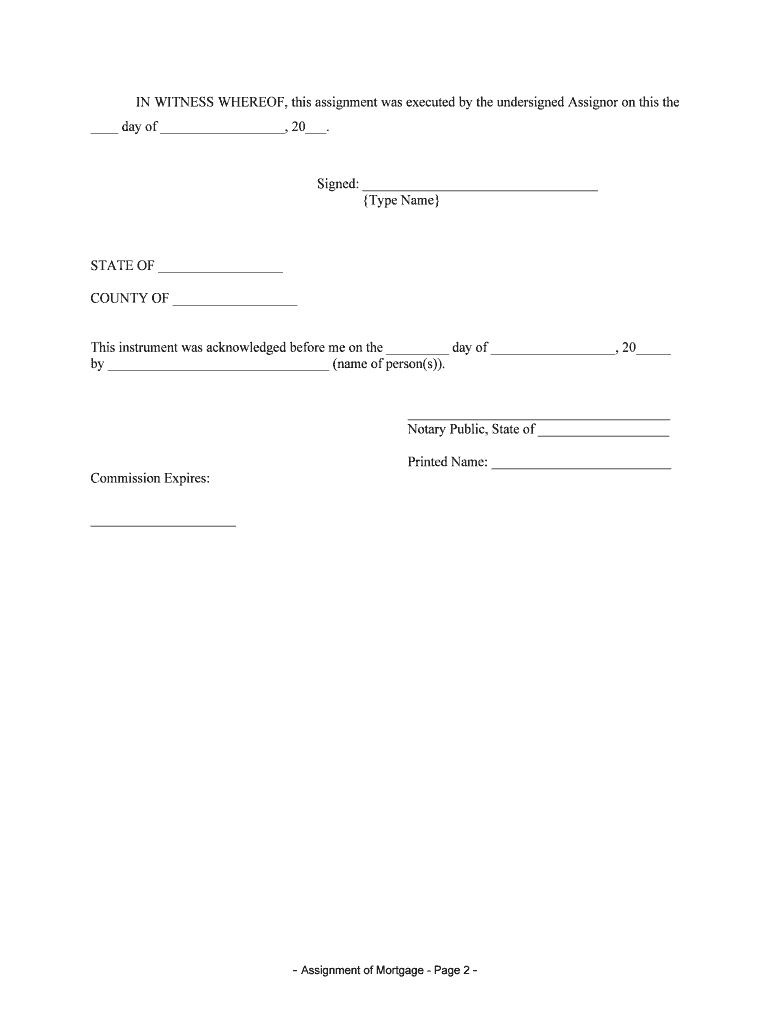

Why are notary and acknowledgment requirements important?

Notarization is a crucial step in the Assignment of Mortgage, providing authenticity and legal recognition to the document. In New Mexico, specific details must be included in the acknowledgment section of the assignment to comply with state laws. Knowing who can perform notarization can help streamline this process.

-

It ensures that the Assignment of Mortgage is legally binding and credible.

-

Accurate inclusion of required information can prevent future legal complications.

-

Understanding New Mexico laws regarding notarization helps adhere to legal standards.

How do you file the assignment with the county clerk?

Filing the Assignment of Mortgage is a critical step that formalizes the transfer of rights. To ensure successful filing, one must follow specific procedures and be aware of any fees or processing times associated with the county clerk's office. Recording the assignment serves as public notice of the change in mortgage rights.

-

Follow the procedure provided by the county clerk's office to ensure proper submission.

-

Being aware of filing fees can help avoid unexpected costs.

-

Recording the assignment protects the rights of the new Assignee by making the transfer public.

What potential challenges might arise during the assignment process?

Common issues can arise during the assignment process, such as documentation errors or misunderstandings between the parties involved. Understanding these challenges allows one to anticipate and address them effectively. Knowing when to seek legal assistance is crucial to navigating any complexities.

-

Errors in documentation or miscommunication can derail the assignment process.

-

Being proactive in addressing issues can simplify the process significantly.

-

Consulting with a legal professional may be necessary if substantial complications arise.

How does pdfFiller simplify the assignment of mortgage process?

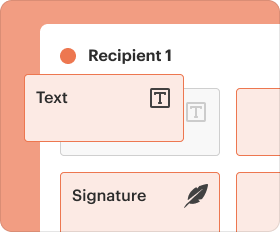

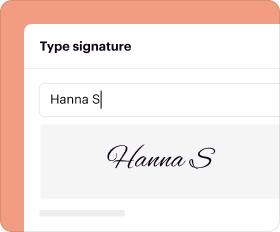

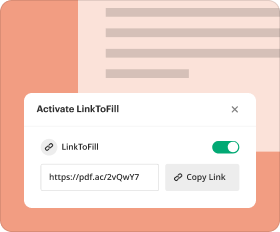

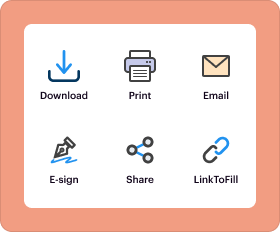

pdfFiller is an invaluable tool that facilitates the preparation and management of the Assignment of Mortgage. It offers features that enable users to fill out, edit, and sign documents easily. Additionally, its collaboration tools make it an excellent choice for teams working together on assignments.

-

Users can fill out the Assignment of Mortgage using guided steps provided by pdfFiller.

-

Editing, signing, and securely storing documents in the cloud enhances usability.

-

Facilitates teamwork by enabling multiple users to work on the same document seamlessly.

How to fill out the new mexico assignment of

-

1.Open pdfFiller and upload the New Mexico Assignment of form.

-

2.Begin by filling in your name and contact information at the top of the document.

-

3.Identify the contract from which you are assigning rights by including its title and date.

-

4.Specify the parties involved: the assignor (you) and the assignee (the party receiving the rights).

-

5.Clearly outline the specific rights or interests being assigned in the designated section.

-

6.Include any pertinent terms related to the assignment, such as conditions or limitations, if applicable.

-

7.Provide the date of assignment and have both parties sign the document at the bottom, ideally in the presence of a notary.

-

8.Review the completed assignment for accuracy and completeness before saving or printing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.