Get the free account transfer trust

Show details

FINANCIAL ACCOUNT TRANSFER TO TRUST To:THIS Assignment, is being made on this the day of, 20, by, County, State of Oregon, as the Assignor(s), whether one or more, and, as Trustee of THE REVOCABLE

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

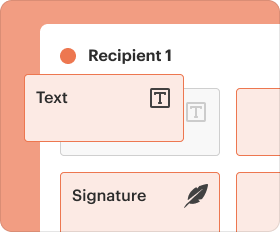

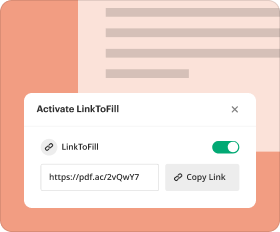

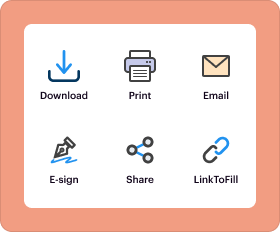

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

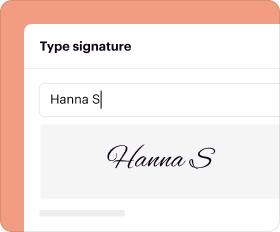

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is oregon trust

An Oregon trust is a legal arrangement that allows for the management and distribution of a person's assets during their lifetime and after their death, following specific wishes outlined in the trust document.

pdfFiller scores top ratings on review platforms

Easy to use> Its help me fill out forms.

First time using the tool. So far so good. Will have more feedback after I complete a document successfully

FIRST TIME USING PDF FILLER NEED MORE EXPERIENCE IN FILLING FORMS EXPERIENCE WAS GREAT. THANK YOU

good enough, cheaper that Creative Studio

I found it good for filling in words and transfering data

It makes doing my business so much easier!

Who needs account transfer trust form?

Explore how professionals across industries use pdfFiller.

How to fill out the account transfer trust form

-

1.Begin by gathering all necessary information regarding your assets, beneficiaries, and the terms you wish to set in the trust.

-

2.Open the PDF template for the Oregon trust on pdfFiller.

-

3.Enter your full name and address in the designated fields to establish your identity as the trustor.

-

4.List the assets you want to place into the trust, including real estate, bank accounts, and personal property, providing accurate details for each.

-

5.Specify the beneficiaries who will receive assets from the trust, including their names, relationships, and share of the assets.

-

6.Detail the terms of the trust, such as how and when the beneficiaries will receive their assets, along with any conditions or restrictions.

-

7.Designate a trustee, the person or institution responsible for managing the trust, by listing their name and contact information.

-

8.Review all entered information for accuracy and completeness before finalizing the document.

-

9.Save your completed trust document and consider consulting with an attorney for legal advice and compliance with Oregon laws.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.