Last updated on Feb 20, 2026

Get the free pdffiller

Show details

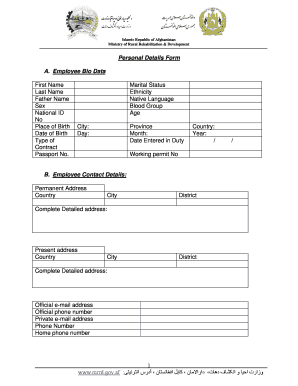

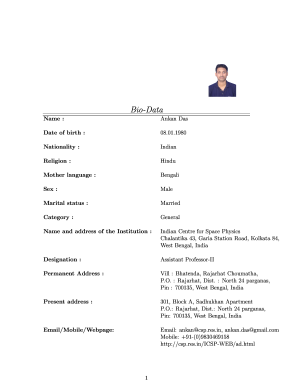

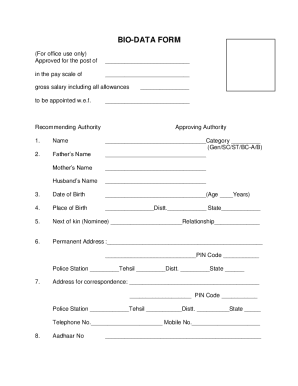

Prepared by, recording requested by and return to: Name: Company: Address: City: State: Zip: Phone: Fax: Nature of Document: Notice of Release of Lien and Substitution of Alternate Security Above

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is utah release lien

A Utah release lien is a legal document that formally removes a lien from a property, indicating that debt has been paid or obligations fulfilled.

pdfFiller scores top ratings on review platforms

With the exception of the scam you have going to get people to sign up for your service... (i.e., On a holiday I came into my office to get work done quickly so I could then spend time with my family. I was soo pleased with your service as it let me upload a document and seamlessly edit it for 2 hours and the peace of mind that everything was working properly as your program continually provided feedback saying that 'all changes have been saved'. Then when I finally finished, after triple checking my work and feeling thrilled that I could go celebrate the holiday and be with my family, I selected the big bright button that says, Done!. And only THEN, after 2 hours of work, did you tell me, there is an error and I need to sign up for your program. You should be ashamed of yourselves. I was so excited to tell other people about your program and how well it works. After being scammed, ripped off in terms of money and precious time, I won't be telling anyone about your service. If you prefer to keep me as a happy customer, perhaps you will find a way to make up for this inconvenience (e.g., give me a discounted membership, upgrade my membership, some other kind gesture?) and correct this misunderstanding that you are covertly enticing people to use your program with an inconsiderate scam. I'd love if you followed up with me about this survey. Thank you. Sarah

Very user friendly. Great assistant to office and document signatures from a far\!

Could improve with advanced copy pasting features like copying 1 or multiple fields and allowing to paste them in other pages docs etc

The service works well and is very convenient, however I was disappointed by the way I was able to complete an entire form but was not advised it was not free until the form was completed after spending a couple hours working on it. Since this is a pay service, the consumer should be advised immediately upon accessing any forms on an internet search. In order to preserve my work, I had no choice but to subscribe. Perhaps you should market a new service that charges by the document. I would have gladly paid for that up front. The service itself works very well.

Worked great for me, better than filling 20 forms manually.

The service is quick to learn and efficient to use..in enjoyed it!

Who needs pdffiller form?

Explore how professionals across industries use pdfFiller.

Utah Release Lien Form Guide

How to fill out a Utah release lien form

To properly fill out a Utah release lien form, gather the required information including property details, contractor information, and compliance requirements. This process helps ensure that property owners and contractors can officially document the release of a lien on a property that has been paid for. Use pdfFiller's features to create and edit your form easily.

What is the release of lien?

A Release of Lien in Utah is a legal document that signifies the removal of a lien placed on property when a debt is satisfied. Its purpose is to declare that the contractor or supplier no longer has a legal claim to the property due to unpaid services or materials provided. Property owners and contractors should understand its importance to avoid future claims and ensure clear ownership.

-

Definition and purpose: A Release of Lien serves to free the property from any financial claims linked to unpaid work.

-

Importance: This document provides peace of mind to property owners by confirming that all dues have been settled.

-

Consequences: Failing to file can lead to confusion, additional claims, or difficulties in selling the property.

What are the key components of the Utah release lien form?

The Utah release lien form contains several key components that must be accurately completed. Each section gathers essential information from parties involved in the lien resolution process.

-

Prepared By Section: This section indicates who is responsible for filling out the form and must include the contractor or lien claimant's details.

-

Detailed Identification: Include name, company, and contact information to ensure all parties are accurately documented.

-

Legal Nature: The document must explicitly state that it is a 'Notice of Release of Lien' to clarify its legal standing.

-

Official Use Only: Certain fields may be designated for official use, ensuring better tracking and record-keeping.

How should one fill out the form step-by-step?

Completing the Utah release lien form involves several crucial steps to ensure that the document is valid and legally sound.

-

Gather necessary information including the parties involved, property details, and lien information.

-

Carefully fill out each field, ensuring all required information is accurate and complete to avoid rejection.

-

Verify if a surety bond or cash deposit is needed, as this may be a requirement in certain cases.

-

Review the form in compliance with Utah Code Ann to ensure legal adherence before filing.

What common errors should be avoided when filing?

Filing a Utah release lien form can lead to further issues if errors are present. It's essential to be aware of some common pitfalls.

-

Incomplete information: Ensure all fields are filled to avoid delays or unintended legal consequences.

-

Misunderstanding deadlines: Familiarize yourself with the timeline for submitting notices to prevent complications.

-

Errors in legal descriptions: Accurately describe the property to avoid disputes regarding the lien's validity.

Where should the Utah release lien form be filed?

Once the Utah release lien form is completed, the next step is filing it with the appropriate authority.

-

Filing location: The completed document should be filed at the local county recorder's office where the property is located.

-

Applicable fees: Ensure you are aware of any fees related to the filing process and acceptable payment methods.

-

Post-filing actions: After submitting the form, track its status to confirm that the release has been officially recorded.

What should be done in response to a pending lien foreclosure suit?

If a lien foreclosure suit is pending, it's crucial to understand your obligations as defined by the Utah Code Ann.

-

Obligations: Be prepared to provide added security as required under Utah law when notified about a lien foreclosure.

-

Timeliness: Lien claimants need to act swiftly upon receiving a notice to avoid negative legal repercussions.

-

Consequences: Failing to initiate legal proceedings can lead to automatic loss of interest in the property.

What are the key legal references for the Utah release of lien?

Understanding the legal framework around lien releases is essential for compliance and effective management.

-

Utah Code Ann: Familiarize yourself with pertinent sections that outline the rules governing lien releases in Utah.

-

Relevant case law: Review case law examples that may influence how releases are treated and filed.

-

Consultation: Seek assistance from legal professionals when dealing with complex lien situations to ensure compliance.

How can pdfFiller assist with the release lien form?

Utilizing pdfFiller can streamline the process of creating and managing the release lien form effectively.

-

Digital creation: Use pdfFiller to create and edit the Release of Lien form digitally, adding ease to the process.

-

Features: Take advantage of eSignature and document sharing features for efficient collaboration with teams.

-

Security: Store and access important documents securely from the cloud, enhancing file management.

How to fill out the pdffiller form

-

1.Obtain the appropriate Utah release lien template from a reliable source.

-

2.Open the PDF form in pdfFiller for editing.

-

3.Begin by entering your name and contact information in the designated fields.

-

4.Input the details of the lien being released, including the date of original lien and lien holder’s information.

-

5.Include the property details, such as address and parcel number, to specify which lien is being addressed.

-

6.Clearly state that this document serves as a release of the lien, using language prescribed by Utah law.

-

7.Optionally, include a brief statement confirming all obligations related to the lien have been satisfied.

-

8.Review all entered information for accuracy and completeness before proceeding.

-

9.Sign the document electronically, ensuring it complies with Utah’s legal standards for signatures.

-

10.Save the completed document and download or print copies for both yourself and the lien holder.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.