Get the free Indiana Living Trust for individual, Who is Single, Divorced or Widow or Widower wit...

Show details

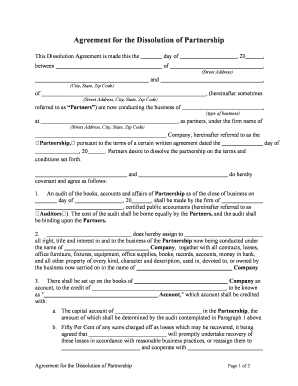

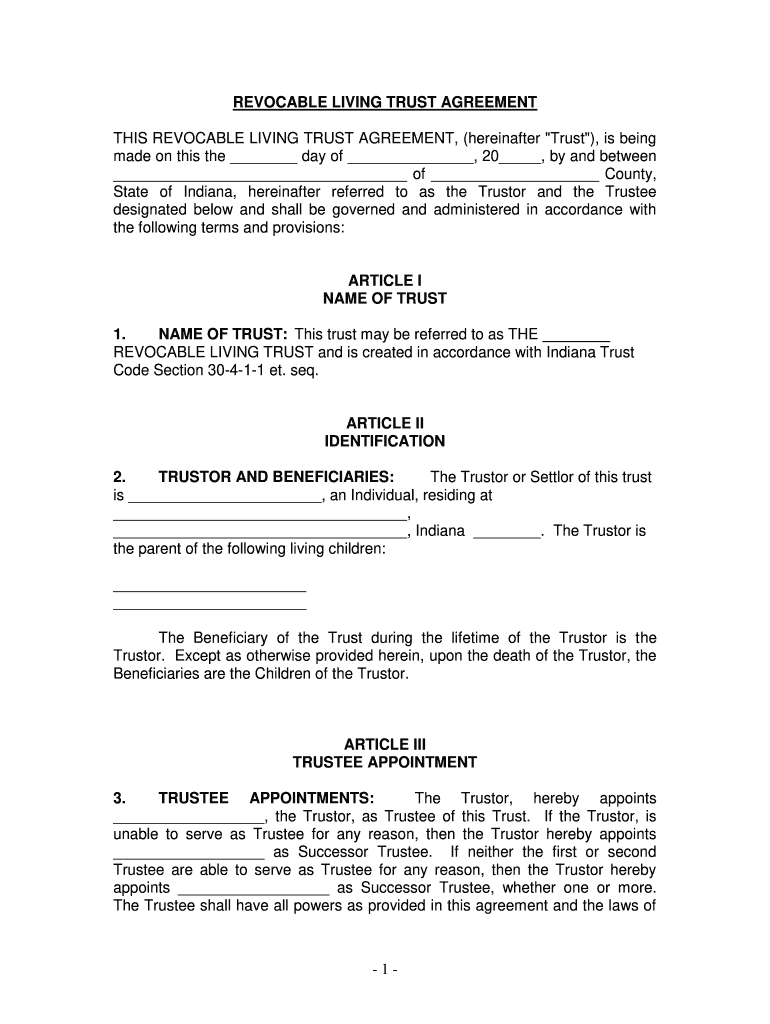

REVOCABLE LIVING TRUST AGREEMENT THIS REVOCABLE LIVING TRUST AGREEMENT, (hereinafter “Trust “), is being made on this the day of, 20, by and between of County, State of Indiana, hereinafter referred

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign indiana living trust for

Edit your indiana living trust for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your indiana living trust for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit indiana living trust for online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit indiana living trust for. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out indiana living trust for

How to fill out indiana living trust for

01

Gather all necessary information: Before filling out an Indiana living trust, gather relevant information such as your personal details, assets, beneficiaries, and specific instructions.

02

Determine the type of living trust: Choose between a revocable or irrevocable living trust based on your needs and goals.

03

Create the trust document: Prepare the living trust document using an online legal service or consult an attorney for assistance.

04

Identify the trustee: Select a trustee who will manage and distribute the assets in your trust according to your instructions.

05

Transfer assets to the trust: Transfer ownership of your assets to the trust by changing titles and deeds as required.

06

Execute the trust document: Sign and date the living trust document in the presence of a notary public or witnesses, as required by Indiana state law.

07

Review and update regularly: Periodically review your trust document to ensure it aligns with your current circumstances and wishes, making any necessary updates or amendments.

Who needs indiana living trust for?

01

Individuals with substantial assets: Indiana living trusts can provide a means to efficiently manage and distribute wealth for individuals with substantial assets.

02

Those who desire privacy: Living trusts offer privacy as they are not subject to the probate process, allowing assets to pass directly to beneficiaries without public disclosure.

03

Individuals with specific instructions: If you have specific instructions on how your assets should be managed and distributed after your passing, a living trust can ensure these instructions are followed.

04

Those who want to avoid conservatorship: Living trusts can include provisions for managing your assets in the event of incapacity, potentially avoiding the need for court-appointed conservatorship.

05

Families with minor children: By establishing a living trust, parents can appoint a trustee to manage assets on behalf of their minor children until they reach a certain age.

06

Individuals seeking to minimize estate taxes: Properly structured living trusts can help minimize estate taxes and preserve more assets for future generations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my indiana living trust for directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your indiana living trust for as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I execute indiana living trust for online?

Completing and signing indiana living trust for online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I sign the indiana living trust for electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your indiana living trust for.

What is indiana living trust for?

Indiana living trust is a legal document that allows individuals to transfer their assets into a trust to be managed for their benefit during their lifetime and transferred to beneficiaries upon their death.

Who is required to file indiana living trust for?

Individuals who wish to establish a trust to manage their assets during their lifetime and transfer them to beneficiaries upon their death are required to file an Indiana living trust.

How to fill out indiana living trust for?

To fill out an Indiana living trust, individuals must gather information about their assets, decide on beneficiaries, appoint a trustee, and outline their wishes for asset distribution.

What is the purpose of indiana living trust for?

The purpose of an Indiana living trust is to provide a means for individuals to manage their assets during their lifetime and ensure they are distributed according to their wishes upon their death.

What information must be reported on indiana living trust for?

Information such as a list of assets, beneficiaries, trustee information, and instructions for asset distribution must be reported on an Indiana living trust.

Fill out your indiana living trust for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Indiana Living Trust For is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.