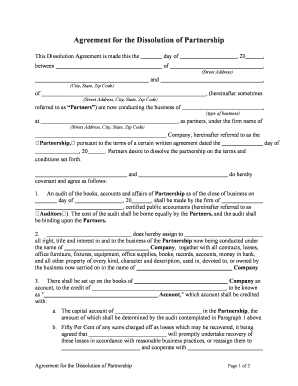

Get the free professional limited liability company

Show details

PROFESSIONAL LIMITED LIABILITY COMPANY

for LICENSED PROFESSIONALS

STATE OF WASHINGTON

Electronic VersionStatutory Reference

Revised Code of Washington, Title 25, Chapter 25.15: Limited Liability Companies

25.15.046:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign professional limited liability company

Edit your professional limited liability company form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your professional limited liability company form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing professional limited liability company online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit professional limited liability company. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out professional limited liability company

How to fill out WA-00PLLC

01

Gather necessary information about your LLC, including the name and address.

02

Determine the members of the LLC and their ownership percentages.

03

Fill in the 'Name of Limited Liability Company' section with the desired name.

04

Provide the 'Principal Office Address' where business operations will occur.

05

List the 'Registered Agent' and their address for service of process.

06

Indicate the duration of the LLC, whether it’s perpetual or for a specific period.

07

Complete any other required sections that apply to your specific LLC.

08

Review the document for any errors or missing information.

09

Sign the form and date it to verify its accuracy.

10

Submit the completed WA-00PLLC form along with the required filing fee to the appropriate state office.

Who needs WA-00PLLC?

01

Individuals or groups looking to establish a Limited Liability Company (LLC) in Washington state.

02

Existing businesses wishing to formalize their structure under state law.

03

Professionals seeking liability protection for their business activities.

Fill

form

: Try Risk Free

People Also Ask about

Is a PLLC the same as an LLP?

PLLC vs. In that way, an LLP is a lot like a PLLC. However, some states don't allow licensed professionals to form LLPs. Messer says, “A PLLC differs from an LLP in that a PLLC can be required if the type of business to be transacted requires a license from the state.

What is a professional LLC in Texas?

The professional limited liability company (hereinafter PLLC) is a limited liability company that is formed for the purpose of providing a professional service.

What is the difference between a limited liability partnership and a professional limited liability partnership?

A professional limited liability partnership functions like a regular limited liability company. The latter is, however, being used more often for tax purposes, as it is being taxed as a single entity. A limited liability company is a type of business owned by one or more people.

What does being a limited liability company mean?

LLC stands for limited liability company, which means its members are not personally liable for the company's debts. LLCs are taxed on a “pass-through” basis — all profits and losses are filed through the member's personal tax return.

What is the difference between Washington limited liability company and professional limited liability company?

A PLLC is an LLC formed by a person or group of people who provide professional services. (PLLC stands for “professional limited liability company.”) Unlike the members of a regular Washington LLC, the members of a Washington PLLC are required to maintain licenses with the state ing to their profession.

Why would someone have a limited liability company?

The LLC has two main advantages: It prevents its owners from being held personally responsible for the debts of the company. If the company goes bankrupt or is sued, the personal assets of its owner-investors cannot be pursued. It allows all profits to be passed directly to those owners to be taxed as personal income.

What does it mean when a company is limited liability?

A limited liability company (LLC) is a structure that separates companies and their owners. It prevents individuals from being liable for the company's financial losses, debts, and other liabilities.

What is the difference between a professional corporation and an LLC in Texas?

The difference between a PC and a PLLC is ultimately the same as the difference between a regular corporation and a regular LLC. One major difference is how these entities are taxed. The PLLC has a few options for taxation, and all of them are likely to save ownership money compared to a PC.

What is the difference between an LLC and an LLP?

Limited Liability Partnership (LLP) A limited liability partnership is similar to a limited liability company (LLC) in that all partners are granted limited liability protection. However, in some states the partners in an LLP get less liability protection than in an LLC. LLP requirements vary from state to state.

What is the difference between an LLC and a PLLC in New York?

PLLCs are geared for groupings of people in professions like medicine, architecture, or law. The main difference between an LLC and a PLLC is how the company handles malpractice claims. A PLLC holds each member separately responsible for their own malpractice claims.

How long does it take to form a PLLC in NY?

New York LLC Processing Times Normal LLC processing time:Expedited LLC:New York LLC by mail:8 months (plus mail time)24-hours ($25 extra) plus 2 other optionsNew York LLC online:immediatelyNot available Mar 8, 2023

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify professional limited liability company without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your professional limited liability company into a dynamic fillable form that you can manage and eSign from anywhere.

How do I make changes in professional limited liability company?

The editing procedure is simple with pdfFiller. Open your professional limited liability company in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit professional limited liability company on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign professional limited liability company right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is WA-00PLLC?

WA-00PLLC is a specific form used in the state of Washington for reporting the activities and financial information of Professional Limited Liability Companies (PLLCs).

Who is required to file WA-00PLLC?

All Professional Limited Liability Companies operating in Washington are required to file the WA-00PLLC form to comply with state regulations.

How to fill out WA-00PLLC?

To fill out the WA-00PLLC form, visit the Washington Secretary of State's website, download the form, provide accurate information about the PLLC's name, address, members, and financial details, and submit it as required.

What is the purpose of WA-00PLLC?

The purpose of WA-00PLLC is to provide transparency regarding the operations and financial standing of Professional Limited Liability Companies, ensuring compliance with state laws.

What information must be reported on WA-00PLLC?

The WA-00PLLC form must report the PLLC's name, address, names of members or managers, the nature of the professional service provided, and relevant financial information.

Fill out your professional limited liability company online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Professional Limited Liability Company is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.