Last updated on Feb 20, 2026

Get the free 481376676

Show details

Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion Multiple Trusts for Children Trust Agreement made on the day of, 20, between and who both reside at (street address, city, county,

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

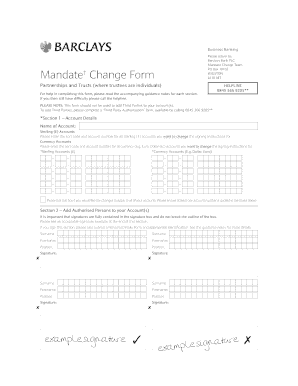

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is children trusts

Children trusts are financial arrangements set up to manage assets for underage beneficiaries until they reach a specified age.

pdfFiller scores top ratings on review platforms

It is easy to use and convenient for my needs.

EXCELLENT

Good fo far

N/A

none

easy to work

Who needs 481376676 form?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Children Trusts Form on pdfFiller

How do children trusts work?

Children trusts are legal arrangements designed to manage assets for minors until they reach adulthood or a predetermined age. By establishing a children's trust, parents or guardians can ensure that their children's financial future is secure. In this guide, we will explore everything you need to know about filling out a children trusts form, from its establishment to comprehensive management using pdfFiller.

If you're looking to set up a trust agreement for minors, understanding the basic concepts is critical. It’s important to note the trust's role in asset protection and tax strategy, especially in ensuring smooth transitions of wealth across generations.

What are the components of a children trust agreement?

-

The trust agreement must clearly identify all major parties involved, including the grantor, trustee, and beneficiaries. This ensures that everyone’s roles and responsibilities are well-defined.

-

Grantors are individuals who create and fund the trust, while trustees are responsible for managing the trust according to its terms. Understanding these roles helps in ensuring compliance and proper management of the trust.

-

It is essential to specify the primary beneficiaries who will benefit from the trust. This is typically the minor children for whom the trust is established, and clear definitions prevent future disputes.

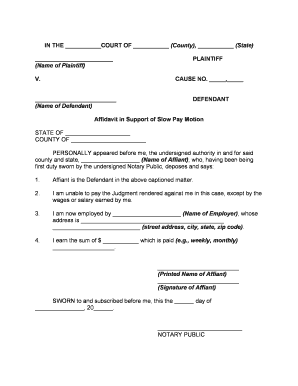

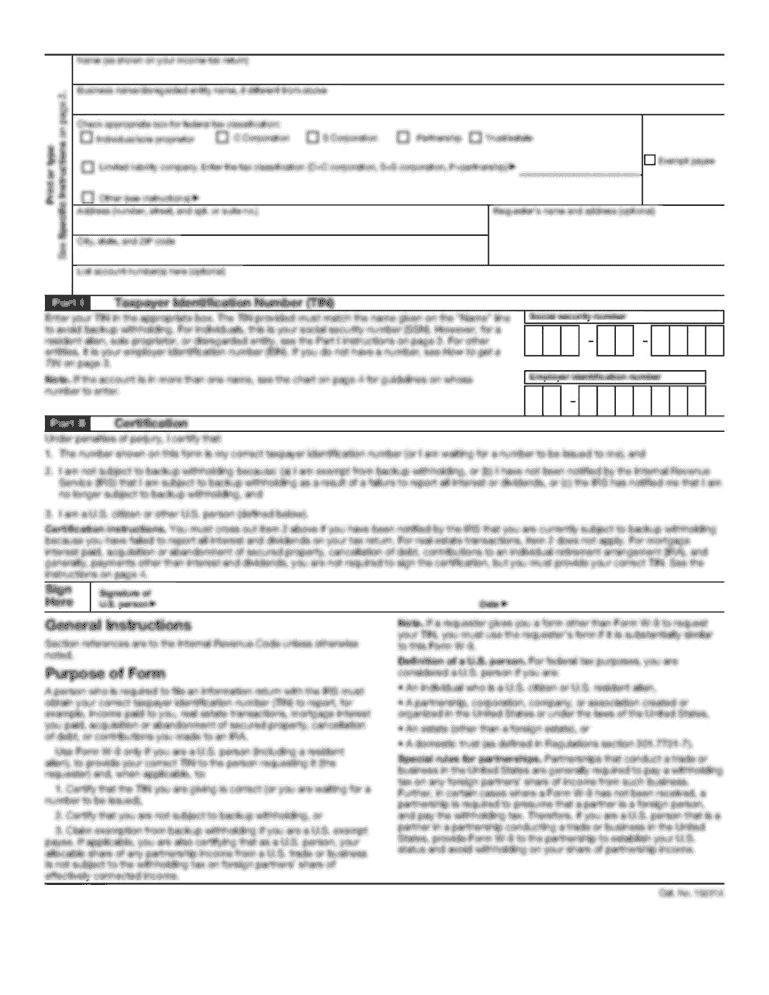

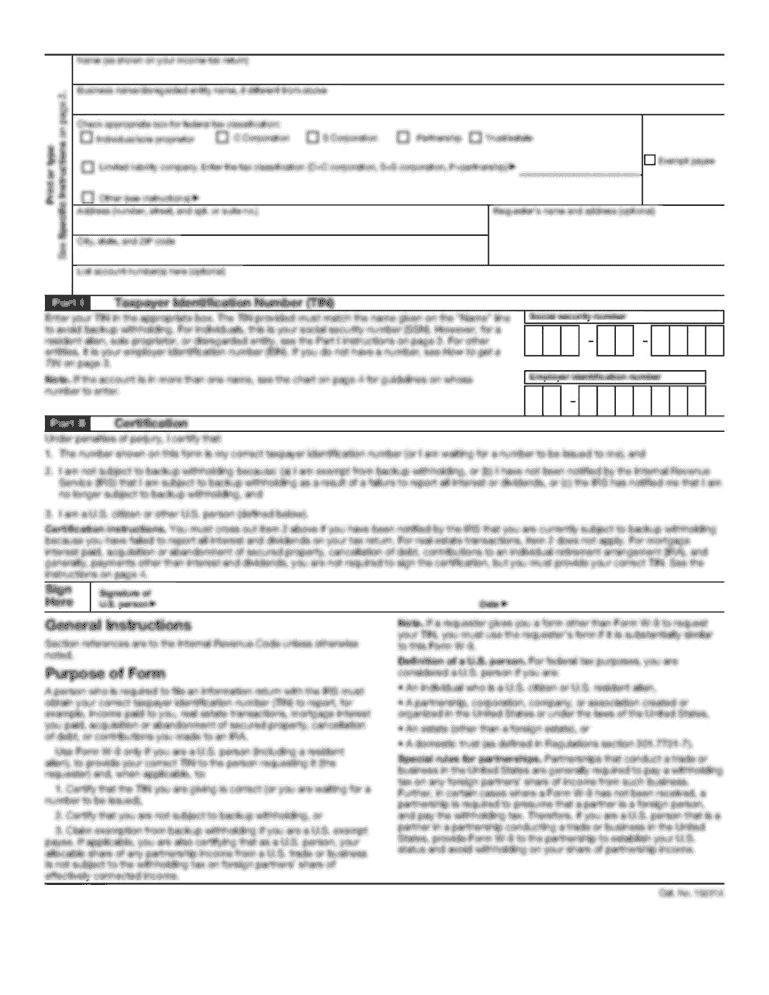

How to complete the children trust agreement?

-

Start by carefully completing the Grantor's section, which identifies the person creating the trust. Include full names and addresses for clarity.

-

When listing primary beneficiaries, ensure that their names and dates of birth are accurately entered to avoid future legal complexities.

-

Filling out the trustee information requires providing the trustee’s details, such as their name, address, and contact information to ensure compliance with state laws.

What sections are in the trust agreement?

-

This section outlines the reasons for creating the trust and details its goals, including asset management and protection.

-

Details how the trust property will be managed and eventually distributed, ensuring all terms are understood by beneficiaries.

-

This section explains the authority of the trust committee, which may include decisions about investments and distributions.

What are the advantages and disadvantages of using trusts for children?

-

Using trusts for children can provide significant tax breaks, controlled asset distribution, and protection from creditors, ensuring that funds are utilized for the intended purpose.

-

On the downside, trusts can be complex and may incur legal fees, which can deplete resources meant for beneficiaries.

What are the relevant state-specific trust laws?

Trust laws vary by region, impacting how children's trusts are established and managed. It's crucial to understand your local legislation to ensure compliance. Engaging with state-specific trust attorneys can provide invaluable insights.

What are some examples of successful trust setups?

-

Real-world examples illustrate how families can utilize trusts for their children's educational expenses, ensuring funds are available only when needed.

-

Case studies spotlight successful strategies where families effectively navigated the trust setup process to maximize benefits.

How to use interactive tools on pdfFiller?

-

pdfFiller offers powerful tools for document management, making it easy to upload, edit, and share trust agreements.

-

Utilizing the platform’s step-by-step directions can simplify the process of editing, signing, and sharing trust agreements.

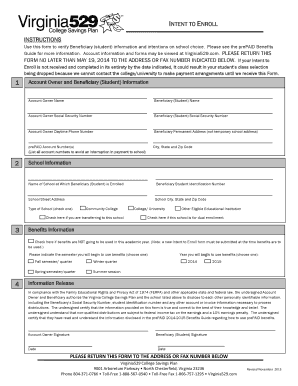

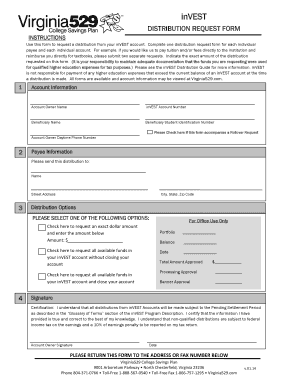

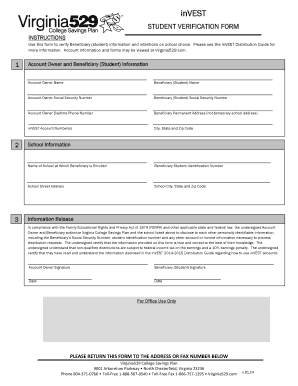

How to fill out the 481376676 form

-

1.Start by accessing the children trust form on pdfFiller.

-

2.Ensure you have all necessary information such as the beneficiaries' names, birthdates, and Social Security numbers.

-

3.Provide details about the trust's assets, including cash, property, or investments.

-

4.Fill out the section regarding the trust's terms, specifying when and how beneficiaries will receive the assets.

-

5.Include your information as the trust creator, along with your signature.

-

6.Review all entries for accuracy and completeness before submission.

-

7.Save the document, and if required, download or print it for legal purposes.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.