Last updated on Feb 20, 2026

Get the free 481376688

Show details

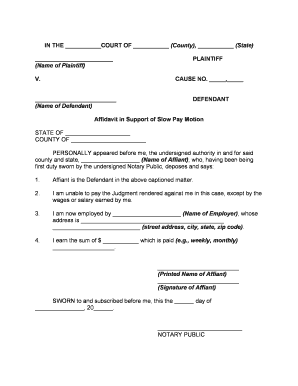

Testamentary Trust Provision in Will with Spouse to Receive a Life Estate in Farm Land with Remainder Interest in Land to Pass to Trust for the Benefit of Children I. I give and devise to my (Name

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

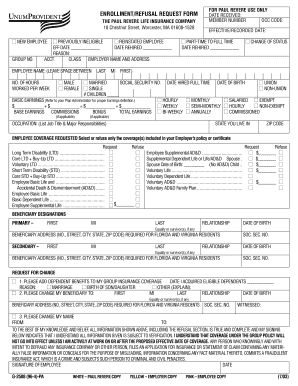

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is testamentary trust

A testamentary trust is a legal arrangement established in a will that specifies how a person's assets will be managed and distributed after their death.

pdfFiller scores top ratings on review platforms

GOOD EXPERIENCE , EASY TO USE, WOULD LIKE TO LEARN WHAT ELSE THEY CAN DO

It's been great and has worked for my needs

I use pdf filler on a computer and an iPad. It is much better and easier to use on the computer. I use it primarily for real estate contracts.

It serves my needs 100% and saves me a lot of time.

Great tool!!! It does everything I could think of doing with a PDF.

Great program to help complete legal forms

Who needs 481376688 form?

Explore how professionals across industries use pdfFiller.

Creating a Testamentary Trust: A Comprehensive Guide

How does a testamentary trust function?

A testamentary trust is a legal structure established through a will, activated after the death of the testator (the individual who created the trust). It provides a means to control how assets are distributed to beneficiaries, offering a level of protection and management, particularly for minors or individuals with special needs.

The primary purpose of creating a testamentary trust is to ensure that the testator's wishes regarding asset management and distribution are followed. Unlike an inter vivos trust, which is created while the testator is alive, a testamentary trust comes into effect only upon death, making it a valuable tool in estate planning.

What components are essential in a testamentary trust form?

To create an effective testamentary trust, several key components must be included in the form. These elements guide the administration of the trust and ensure clarity in the wishes of the testator.

-

The individual who establishes the trust must be clearly identified, usually as part of the will.

-

The individuals or entities who will receive the assets from the trust should be specified, with provisions for any contingencies.

-

A trustee manages the trust, ensuring that the assets are distributed according to the terms set forth in the testamentary trust.

-

The form needs to specify the types of property included in the trust, life estates, and remainder interests.

-

Legal descriptions of properties ensure precise identification of real estate or other assets included in the trust.

How do fill out a testamentary trust form?

Filling out a testamentary trust form involves a structured approach to ensure compliance with legal requirements and clarity in intention. Begin by gathering all necessary personal information as well as details about the assets to be placed in the trust.

-

Collect the names, addresses, and birthdates of the testator, beneficiaries, and trustee.

-

Draft provisions that clearly outline the distribution of the trust assets, considering any specific conditions or rules.

-

Ensure the testamentary trust is documented properly within the will, potentially requiring legal validation.

What legal considerations should keep in mind?

Establishing a testamentary trust comes with several legal considerations that ensure compliance with regional laws and regulations. It's crucial to consult legal professionals familiar with local laws regarding estate planning.

-

Each region may have specific requirements for the creation and maintenance of testamentary trusts, including necessary documentation.

-

Reviewing legal standards within the area where the trust is being established can help prevent future disputes.

-

Understanding tax implications is vital, as testamentary trusts can affect estate taxes and income tax liability for beneficiaries.

How do manage and modify a testamentary trust?

Management of a testamentary trust is crucial to ensure its effectiveness. The trustee plays an essential role, guided by the terms laid out in the trust form.

-

Trustees must act in the best interest of the beneficiaries, making prudent decisions regarding the management and distribution of assets.

-

Certain life events or changes in beneficiary needs may necessitate modifications to the trust's terms, requiring formal processes for amendment.

-

Conducting annual or biennial reviews of the trust can help adapt to changing circumstances and ensure continued alignment with the testator's wishes.

How can pdfFiller assist with testamentary trust forms?

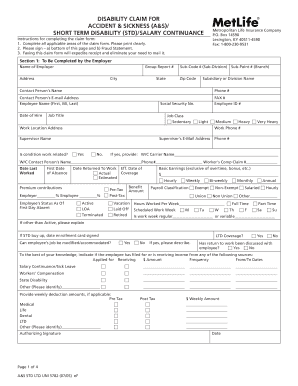

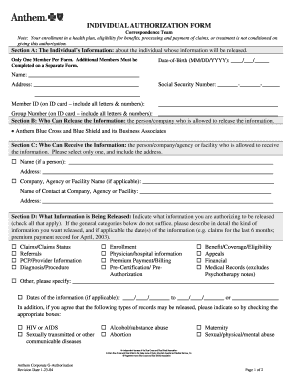

pdfFiller provides an efficient solution for individuals and teams needing to manage testamentary trust forms effectively. With its cloud-based platform, users can edit, sign, and collaborate on documents seamlessly.

-

pdfFiller simplifies the process of filling out testamentary trust forms, ensuring that all necessary fields are completed accurately.

-

Users can take advantage of tools to edit, sign, and validate documents directly through the platform.

-

Securely sharing and storing trust documents in the cloud ensures they are accessible from anywhere, with protection against unauthorized access.

How to fill out the 481376688 form

-

1.Obtain a copy of your will where the testamentary trust is mentioned.

-

2.Visit pdfFiller and upload the will document in PDF format.

-

3.Locate the section that outlines the testamentary trust provisions.

-

4.Use the text tool to fill in the trustee's name and contact information.

-

5.Specify the beneficiaries of the trust and their respective shares or conditions.

-

6.Include any specific instructions regarding the management and distribution of trust assets.

-

7.Review all entries for accuracy and completeness before saving the document.

-

8.Download or save the filled-out testamentary trust document in your desired format.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.