Get the free pdffiller

Show details

2016 U.S. Legal Forms, Inc. ARIZONA BENEFICIARY DEED Individual to Husband and Wife Control Number: AZ03377I. TIPS ON COMPLETING THE FORMS The form(s) in this packet may contain form fields created

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 481377423 form

Edit your pdffiller form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pdffiller form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pdffiller form online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit pdffiller form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

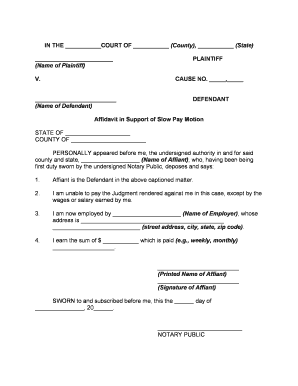

How to fill out pdffiller form

How to fill out Arizona beneficiary deed:

01

Obtain the necessary forms: You can obtain the Arizona beneficiary deed form from the county recorder's office or through online legal document providers.

02

Read the instructions carefully: Before filling out the form, carefully read the instructions provided with the form to ensure that you understand the requirements and legal implications.

03

Identify the property: Clearly identify the property by providing its legal description, which can usually be found on the property's deed or tax records.

04

Name the beneficiary: Indicate the name(s) of the beneficiary(ies) who will inherit the property upon your death. Include their full legal names and contact information.

05

Specify the owner(s) and current interest: Clearly state your name(s) as the current owner(s) of the property, along with your address. Also, specify the type of interest you currently have in the property, such as fee simple or life estate.

06

Notarize the deed: Sign the beneficiary deed in the presence of a notary public. The notary will verify your identity and witness your signature. Make sure to provide any additional documentation that may be required for notarization.

07

Record the deed: After it has been notarized, take the completed beneficiary deed to the county recorder's office where the property is located. Pay the required recording fees and have the deed officially recorded to make it legally binding.

Who needs an Arizona beneficiary deed:

01

Homeowners: Arizona beneficiary deeds are typically used by homeowners who want to transfer ownership of their property to a designated beneficiary upon their death.

02

Individuals with specific inheritance plans: Those who wish to have control over who inherits their property and avoid the probate process may choose to use an Arizona beneficiary deed.

03

Couples with joint property ownership: Married couples who jointly own property can utilize an Arizona beneficiary deed to specify how the property is to be passed to the surviving spouse or another designated beneficiary.

04

Aging individuals or those with terminal illnesses: People who are aging or facing terminal illnesses may use an Arizona beneficiary deed to ensure a smooth transfer of property to their chosen beneficiary without the need for probate.

05

Anyone seeking to avoid probate: By using an Arizona beneficiary deed, individuals can bypass the probate process, which can be time-consuming and costly, and instead transfer the property directly to their chosen beneficiary upon their death.

Fill

form

: Try Risk Free

People Also Ask about

Where do you file beneficiary deed in Maricopa County?

BENEFICIARY DEEDS §33-405 (statute includes a sample form) available from the Arizona Legislature Website. ➢ Beneficiary deeds are filed in the Maricopa County Recorder's Office. ➢ See the Maricopa County Recorder's Website for information on form requirements and filing fees.

Does a beneficiary deed need to be notarized in Arizona?

A beneficiary deed has to be signed by the property owner and notarized, recorded in the county where the property is located during the owner's lifetime, and must accurately state the property's legal description.

How much is a beneficiary deed in Arizona?

An estate attorney may prepare a Beneficiary Deed for approximately $250 to $750. There will also be a nominal recording fee in the county where the property is located.

How much does a beneficiary deed cost in Arizona?

An estate attorney may prepare a Beneficiary Deed for approximately $250 to $750. There will also be a nominal recording fee in the county where the property is located.

How do I get a beneficiary deed in Arizona?

To establish a beneficiary deed in Arizona, the deed must: Grant the real estate property to a beneficiary designated by the owner of said property. Be recorded in the office of the county where the property is located. Be recorded in the county office before the property owner's death.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the pdffiller form in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your pdffiller form directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Can I edit pdffiller form on an iOS device?

You certainly can. You can quickly edit, distribute, and sign pdffiller form on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I complete pdffiller form on an Android device?

Use the pdfFiller mobile app and complete your pdffiller form and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is arizona beneficiary deed?

An Arizona beneficiary deed is a legal document that allows a property owner to designate a beneficiary to receive the property automatically upon the owner's death, bypassing the probate process.

Who is required to file arizona beneficiary deed?

Any property owner in Arizona who wishes to transfer their property to a beneficiary after their death can file an Arizona beneficiary deed, but it is not mandatory.

How to fill out arizona beneficiary deed?

To fill out an Arizona beneficiary deed, the property owner must complete a specific form that includes details such as the property description, the owner's name, the beneficiary's name, and any relevant legal language required by Arizona state laws.

What is the purpose of arizona beneficiary deed?

The purpose of an Arizona beneficiary deed is to simplify the transfer of property upon death, avoiding the lengthy and often costly probate process for the beneficiaries.

What information must be reported on arizona beneficiary deed?

The information that must be reported on an Arizona beneficiary deed includes the legal description of the property, the name of the owner, the name of the beneficiary, the date of execution, and notarization.

Fill out your pdffiller form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pdffiller Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.