Last updated on Feb 20, 2026

Get the free indiana 2 1

Show details

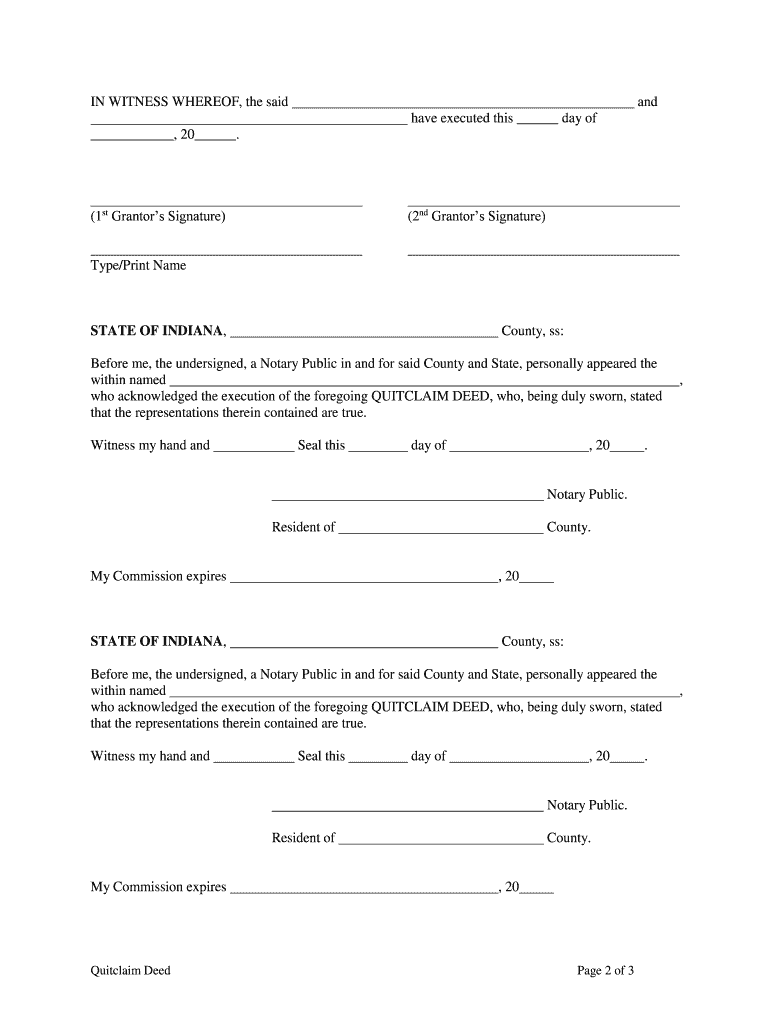

Grantee (name, address and telephone):QUITCLAIM DEED Two Individuals to One Individual THIS INDENTURE WITNESSED, That of County, in the State of and, of in the State of., County, RELEASE AND QUITCLAIM

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is indiana 2 1

The Indiana 2-1 form is a document used for reporting a change in a child's custody or parenting time arrangement in the state of Indiana.

pdfFiller scores top ratings on review platforms

Your service helped me greatly for a last minute task. Runs perfect .

Maybe I haven't found it, but it would help if there was a way to stop the fillable areas from snapping to each other. I had to figure out work-arounds for a lot of them.

I've found your program invaluable for making my PDF docs professional and presentable.

I've Seen No Other Program Like This On The Market. I'm In Appreciation. Peace

Wish there was a more basic version that allowed you to be per page or per document rather than per yea

The intricacies of weaving through browser and google app to use this plugin are quite noteworthy. I consider it a great achievement that the plugin seems to work, even when it encounters strange circumstances. For all that this is a bit ungainly, there were some things I wished worked a little better, but overall quite good.

Who needs indiana 2 1?

Explore how professionals across industries use pdfFiller.

Long-Read How-to Guide on Indiana 2 1 Form Form

How to fill out an Indiana 2 1 form?

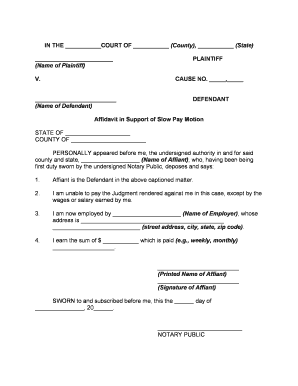

To fill out an Indiana 2 1 form, begin by completing the relevant sections for grantor and grantee information. Ensure you include the correct legal description of the property and calculate consideration carefully. Once filled, the form must be notarized before submission.

Understanding the quitclaim deed

A quitclaim deed is a legal document that transfers a person's interest in a property to another party without guaranteeing that the title is clear. It is commonly used in Indiana for property transfers between family members or in divorce settlements.

-

A quitclaim deed conveys whatever interest the grantor has in real property, with no warranty of title or rights.

-

This deed is ideal for situations where the parties willingly transfer property without disputes, such as in family transfers or gifting.

-

Unlike a warranty deed, which guarantees clear title, a quitclaim deed offers no such promises, leaving the grantee exposed to potential claims.

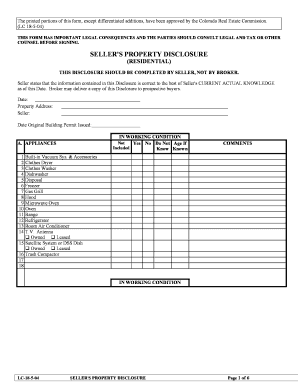

Components of the Indiana quitclaim deed

Filling out the Indiana quitclaim deed requires specific information for clarity and legality, ensuring proper property transfer.

-

This includes the name, address, and contact number of the person receiving the property.

-

The grantors, or those transferring the property, must be clearly identified. Their information should match official records.

-

The specific layout, boundaries, and location of the property should be accurately described to avoid future legal complications.

-

This refers to any monetary terms involved in the property transfer, which must be stated to fulfill legal requirements.

Step-by-step instructions to complete the form

Filling out the Indiana 2 1 form involves a few crucial steps that should be followed meticulously. Each detail matters when transferring property legally.

-

Have all pertinent documents ready, including previous deeds and identification, to ensure a smooth filling process.

-

Be thorough and precise in entering information to prevent errors that could delay processing.

-

Ensure that the document is notarized since Indiana law mandates notarization to validate the deed.

-

Double-check all entries for accuracy to prevent future disputes regarding the property ownership.

Using pdfFiller for document management

pdfFiller simplifies the management of legal documents, including the Indiana quitclaim deed. With its features, users can easily edit, sign, and store documents efficiently.

-

Easily modify your quitclaim deed using pdfFiller’s intuitive interface, allowing you to correct any mistakes promptly.

-

The platform provides easy-to-use eSignature options, streamlining the signing process without the need for printing.

-

Share documents with others for collaborative editing, ensuring everyone on your team stays informed.

-

Store your documents in the cloud, making them easily accessible from anywhere, which is vital for teams working remotely.

Compliance and legal considerations in Indiana

Understanding Indiana's laws governing quitclaim deeds is crucial to ensure compliance and avoid potential legal pitfalls.

-

Be familiar with Indiana's specific regulations regarding property deeds, including required forms and taxes.

-

Errors such as missing notarization or incorrect descriptions can lead to issues; careful review can mitigate these risks.

-

Ensure timely filing with the county recorder to officially register the property transfer.

Future considerations after filing the quitclaim deed

Post-filing, it's essential to monitor the property records to ensure the deed has been properly recorded and to address any future issues proactively.

-

Follow up with the county recorder’s office to verify that the quitclaim deed has been officially recorded.

-

Typically, you will receive a confirmation of recording, but be vigilant about any disputes that may arise.

-

Be prepared to address questions about the property title or future claims against it, particularly if conflicts arise.

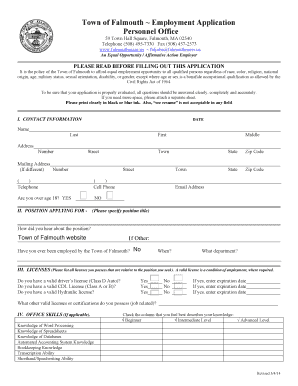

How to fill out the indiana 2 1

-

1.Access the Indiana 2-1 form on pdfFiller by searching its name in the document library.

-

2.Click on the form to open it in the editor.

-

3.Begin by filling out the header section with the case number, child's name, and names of the parents or guardians.

-

4.In the body of the form, clearly outline the requested changes to custody or parenting time, providing both current and desired arrangements.

-

5.Include any necessary details regarding the reasons for the modification.

-

6.If applicable, attach relevant documents or evidence supporting the request.

-

7.Carefully review the information you have entered to ensure accuracy and completeness.

-

8.Once you have completed the form, save your changes.

-

9.Follow the instructions for submitting the form, either by printing it and mailing it to the appropriate court or by submitting it electronically if allowed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.