Last updated on Feb 20, 2026

Get the free deed individual trust

Show details

2016 U.S. Legal Forms, Inc. MISSOURI QUITCLAIM DEED Individual to Trust Control Number: MO02477I. TIPS ON COMPLETING THE FORMS The form(s) in this packet may contain form fields created using Microsoft

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is deed individual trust

A deed individual trust is a legal document that establishes a trust for the benefit of a specific individual, detailing how the trust's assets will be managed and distributed.

pdfFiller scores top ratings on review platforms

Good company with a great product

This is a good company with a great product. I am a retired attorney who was in need of a certification of trust for our family living trust. I checked pdfFiller and found what I needed but then realized that in my experience as a lawyer, I already knew the basics of what had to be done. So I cancelled the subscription and within minutes, received word from pdfFiller that the subscription would be cancelled. An honest company that is responsive, with good products - can't do better than that.

Everything is easy to use

Everything is easy to use. I was having some issues faxing and got a quick response from support. Other than that great experience so far. It would be cool if I could request documents from clients where they can upload and it would go to my docs in pdf filler.

Such a great tool for editing PDF

Such a great tool for editing PDF! totally recommended! thank you pdffiller, I'll forever be in debt w you. God Bless!

Easy Cancellation

I don't usually need to fill a pdf but this one time I did. I was pleased that I got the free trial. I used it the one time and was able to cancel the next day.

Thank you, pdfFiller!

I love that I can make multiple…

I love that I can make multiple documents into one that I can send to clients

It's easy to Edit on a PDF Document. Thanks

Who needs deed individual trust?

Explore how professionals across industries use pdfFiller.

Complete Guide to the Individual Trust Deed Form

What is an Individual Trust Deed?

An Individual Trust Deed is a formal document that specifies the terms of a trust, detailing how assets are to be managed and distributed. It serves to protect both the grantor and the beneficiaries, ensuring that assets are safeguarded according to the grantor's wishes. Many individuals choose to use a deed of trust for its legal clarity and efficiency in property transfer.

-

It clarifies the intent behind creating the trust and protects the interests of all parties involved.

-

Unlike typical property transfers, a trust deed involves a third party – the trustee – who administers the trust.

-

Individuals often employ trust deeds for estate planning, asset protection, and avoiding probate.

What are the key components of the Individual Trust Deed Form?

The Individual Trust Deed Form consists of several critical components that must be accurately filled out for the deed to be valid. Essential details include the names and addresses of the parties involved, as well as the exact property details being placed into trust.

-

This includes the full names and contact information of the grantor, trustee, and beneficiaries.

-

Key sections include roles designated to the grantor, trustee, and beneficiaries, each with specific legal implications.

-

Understanding terms such as 'grantor', 'trustee', and 'beneficiary' is crucial for proper completion.

How can you fill out the Individual Trust Deed Form efficiently?

Filling out the Individual Trust Deed Form can be streamlined with specific tools and software. Utilizing platforms like pdfFiller aids in the completion process, allowing for easy editing and management of the document.

-

Begin with a clear understanding of each field in the form, ensuring all required information is accurately filled.

-

Applications like Adobe Acrobat and Microsoft Word provide features that simplify data entry through form fields.

-

Be familiar with common issues such as formatting errors or missing signatures, and learn how to rectify them promptly.

How to ensure compliance with local regulations?

Navigating regulatory requirements is vital. Each state, including Missouri, has specific regulations regarding trust deeds that must be adhered to, ensuring the instrument is legally sound.

-

Understanding Missouri's regulations on trust deeds can prevent costly missteps and legal issues.

-

Engaging a legal professional can provide clarity and confirm the validity of the document.

-

Use checklists to ensure all necessary elements are included and that the form complies with state laws.

How to edit and customize your Individual Trust Deed?

Customization and editing are essential aspects of managing your Individual Trust Deed. pdfFiller offers robust editing tools that allow users to modify the deed to better fit their needs.

-

Explore pdfFiller's editing functionalities to conveniently customize the deed as needed.

-

When making changes, it’s important to document amendments properly to maintain the legality of the trust.

-

Engage in thorough review post-edits to ensure all changes are accurately reflected in the document.

How to sign and manage the deed in the cloud?

Managing your Individual Trust Deed in the cloud offers fantastic flexibility, making it easier to sign and store documents securely. pdfFiller's eSignature capabilities simplify this process.

-

pdfFiller's eSigning functionality allows for quick and secure signing of trust deeds remotely.

-

Storing documents in the cloud enhances accessibility and collaboration among teams or individuals.

-

Adhering to security best practices is crucial when managing sensitive documents like trust deeds online.

What common mistakes should you avoid when completing a trust deed?

Making errors in the Individual Trust Deed Form can lead to significant problems down the line. Understanding common pitfalls can help you avoid costly mistakes.

-

Common mistakes may include missing signatures, incorrect property descriptions, or failure to list beneficiaries.

-

Continually check all information entered into the form to confirm its accuracy before submission.

-

Thoroughness is key; overlooking any part of the deed can have legal ramifications.

What final reminders and legal considerations should you keep in mind?

Before finalizing your Individual Trust Deed, be sure to keep several legal considerations in mind. Consulting with a qualified legal professional is always recommended to ensure your deed complies with state laws.

-

Seeking guidance from a lawyer specializing in trusts in Missouri can provide valuable insights.

-

Determine if your deed requires filing with the local county recorder to be legally recognized.

-

Maintaining accurate legal documentation is essential for protecting your assets.

How to fill out the deed individual trust

-

1.Access the deed individual trust template on pdfFiller.

-

2.Start by filling in the title of the trust at the top of the document.

-

3.Provide the full name and address of the trustor (the individual creating the trust).

-

4.Clearly identify the beneficiary or beneficiaries who will receive assets from the trust.

-

5.Include details about the trust assets, specifying what is included in the trust.

-

6.Designate a trustee who will manage the trust according to its terms.

-

7.Outline any specific instructions or terms under which the trust operates.

-

8.Review all filled sections for accuracy and completeness.

-

9.Save your document and proceed to sign it, if required, according to local regulations.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

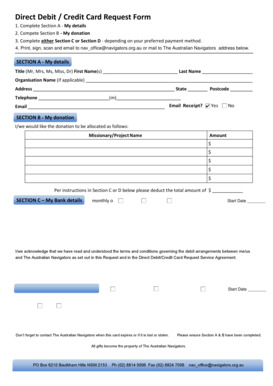

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.