Last updated on Feb 20, 2026

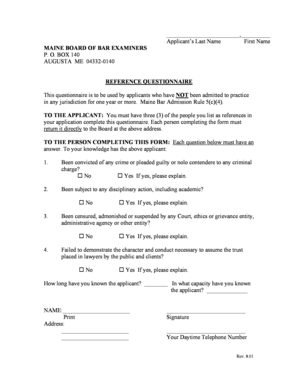

NJ-P099 free printable template

Show details

Prepared by recording requested by and return to Name Company Address City State Zip Phone Fax ----------------------Above this Line for Official Use Only--------------------SPECIAL POWER OF ATTORNEY FOR CLOSING REAL ESTATE TRANSACTION Agent for Seller STATE OF NEW JERSEY COUNTY OF KNOW ALL MEN BY THESE PRESENT THAT I whose address is SPECIAL POWER OF ATTORNEY hereby appoint of County New Jersey as my Attorney-in-Fact to act as follows GRANTING unto my Attorney-in-Fact full power to To do all...things necessary to close on the sale of the property described below commonly known as no block number is available recognized by account number for me and in my name to execute any and all documents necessary to effect the sale conveyance and settlement on said property to any person or persons of his choosing including but not limited to deeds checks receipts releases warranties affidavits contracts addenda settlement statements loan commitments and disclosure statements truth-in-lending...statements all forms of commercial papers endorsements to checks or the like and any such other instrument or instruments in writing of whatever kind character and nature as may be necessary to complete the sale financing arrangements and the settlement process. FURTHER GRANTING full power and authority to collect and receive any funds or proceeds of said sale in any manner which in his sole discretion he sees fit. The legal description of the property is as follows to-wit INSERT DESCRIPTION OR...ATTACH EXHIBIT I hereby ratify and confirm all that said attorney-in-fact shall lawfully do or cause to be done by virtue of this Power of Attorney and the rights and powers herein granted* All acts done by means of this power shall be done in my name and all instruments and documents executed by my Attorney hereunder shall contain my name followed by that of my attorney and the description Attorney-in-Fact excepting however any situation where local practice differs from the procedure set forth...herein in that event local practice may be followed* This SPECIAL POWER OF ATTORNEY shall be valid and may be relied upon by any third parties until such time as any revocation is recorded in the recorder s office of the county where the land is located* DATED this the day of 20. Signature Print Name State of New Jersey County of ss I CERTIFY that on came before me and acknowledged under oath to my satisfaction that this person or if more than one each person a is named in and personally signed...the attached document and b signed and delivered this document as his/her/their act and deed* Notary Public My commission expires Principal Name and Address Name Address Attorney-in-Fact Name and Address City State Phone Zip. FURTHER GRANTING full power and authority to collect and receive any funds or proceeds of said sale in any manner which in his sole discretion he sees fit. The legal description of the property is as follows to-wit INSERT DESCRIPTION OR ATTACH EXHIBIT I hereby ratify and...confirm all that said attorney-in-fact shall lawfully do or cause to be done by virtue of this Power of Attorney and the rights and powers herein granted* All acts done by means of this power shall be done in my name and all instruments and documents executed by my Attorney hereunder shall contain my name followed by that of my attorney and the description Attorney-in-Fact excepting however any situation where local practice differs from the procedure set forth herein in that event local...practice may be followed* This SPECIAL POWER OF ATTORNEY shall be valid and may be relied upon by any third parties until such time as any revocation is recorded in the recorder s office of the county where the land is located* DATED this the day of 20.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is NJ-P099

NJ-P099 is a form used in New Jersey for reporting changes in child support information.

pdfFiller scores top ratings on review platforms

Great program. Easy to use and priced fairly. Keep up the great work!

I t is my first use. I just convert the first document and it is too early to analise the software.

A nice and easy software that make PDFs more enjoyable

I love this app just wish when using the Text Feature, when filling in a form with white space, that you could move the text box if it is not aligned .

very easy to fill and amazing you have every single form

I love the program. I could wish it had some other features for editing the existing documents but for what I generally need (real estate forms) it is fantastic!

Who needs NJ-P099?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to NJ-P099 Form for Real Estate Transactions on pdfFiller

What is the NJ-P099 form?

The NJ-P099 form is a Special Power of Attorney used in New Jersey to grant authority to another person to act on behalf of a property owner in real estate transactions. This form is essential as it allows for transactions to proceed even when the property owner is unable to be present. Understanding the key components of the NJ-P099 is critical for smooth real estate dealings.

Why is the NJ-P099 form important in real estate transactions?

The NJ-P099 form is crucial because it facilitates the legal transfer of property rights and obligations without the property owner being physically present. Its purpose is to ensure that all legal formalities are adhered to, avoiding confusion or disputes in property transactions.

What are the essential fields in the NJ-P099 form?

Key fields in a NJ-P099 form include the names of the property owner and the Attorney-in-Fact, their addresses, and contact details. Special attention is needed in the ‘Granting’ section to clearly outline the powers being conferred. Legal disclaimers and signature requirements must also be fulfilled to ensure the document's validity.

-

Full name of the property owner and the Attorney-in-Fact.

-

Complete addresses for both parties involved.

-

Contact information to communicate effectively.

How to fill out the NJ-P099 form effectively?

-

Collect all required details, including personal information and property specifics, before starting.

-

Ensure that all fields are filled precisely to avoid discrepancies later.

-

Go over the completed form thoroughly to ensure all information is correct before submission.

How can pdfFiller help manage the NJ-P099 form?

pdfFiller provides an intuitive platform to upload, edit, and fill out the NJ-P099 form seamlessly. Additionally, the eSignature features offer a legally binding method for signing documents electronically. Users can save and share completed documents effortlessly, streamlining the entire process.

What legal considerations are there when using the NJ-P099 form?

It is imperative to ensure compliance with New Jersey laws when using the NJ-P099 form, particularly concerning Power of Attorney regulations. Common pitfalls, such as incomplete information or invalid signatures, can lead to legal challenges down the line. Consulting with a legal expert is recommended if there are uncertainties regarding the form.

What are the next steps after completing the NJ-P099 form?

-

File the completed NJ-P099 form with the relevant authorities or parties involved in the transaction.

-

Retain copies of the completed form for future reference or legal verification.

-

Be prepared to fill out any additional forms or take further steps required to finalize a real estate transaction.

How to fill out the NJ-P099

-

1.Access the NJ-P099 form on pdfFiller.

-

2.Log in to your pdfFiller account or create a new one if necessary.

-

3.Open the NJ-P099 form from the dashboard.

-

4.Review the form fields that need to be filled out, such as personal details and changes in support.

-

5.Enter your information in the required fields accurately, including your name, address, and case number.

-

6.If applicable, provide details regarding changes in income or employment status.

-

7.Include any additional information relevant to your case in the provided sections.

-

8.Use the annotation tools to highlight any important changes or notes.

-

9.Once completed, review the form for any errors or missing information.

-

10.Save your changes and then choose to print or submit the form electronically.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.