Last updated on Feb 20, 2026

PA-040-78 free printable template

Show details

2016 U.S. Legal Forms, Inc. PENNSYLVANIA WARRANTY DEED Trust to Individual Control Number: PA04078I. TIPS ON COMPLETING THE FORMS The form(s) in this packet may contain form fields created using Microsoft

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is PA-040-78

PA-040-78 is a form used for documenting specific administrative processes within an organization.

pdfFiller scores top ratings on review platforms

its great

I love using it, very simple

very good. Useful and easy to use

ALL IS GREAT HERE.

Nice

The best trial experience of a pdf editor

Who needs PA-040-78?

Explore how professionals across industries use pdfFiller.

Ultimate Guide to the PA-040-78 Form on pdfFiller

The PA-040-78 form is crucial for residents and entities in Pennsylvania undertaking specific legal processes. This guide provides a comprehensive overview of the PA-040-78 form, including its purpose, features, and editing methods available on pdfFiller.

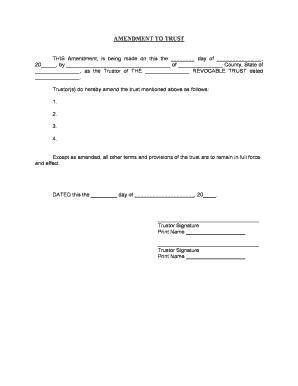

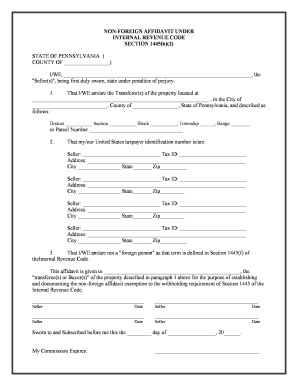

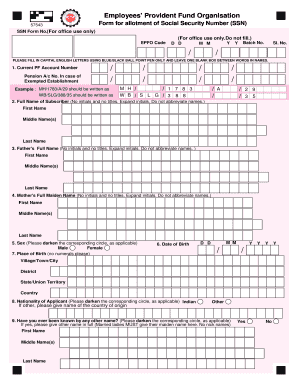

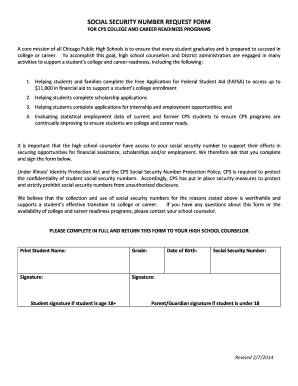

What is the PA-040-78 form?

The PA-040-78 form serves as a necessary tool within Pennsylvania for various legal procedures. It complies with Pennsylvania statutes designed to facilitate the appropriate submission of specific information to government bodies. Anyone requiring services like name changes or petitions in Pennsylvania typically needs to complete this form.

What are the features of the PA-040-78 form?

-

The PA-040-78 form includes sections for personal details, specific requests, and any additional required documentation.

-

It is structured into distinct areas that address essential information required for processing by governmental entities.

-

This form includes fillable digital fields, allowing users to complete the document easily and add electronic signatures where necessary.

How do navigate the PDF editing tools on pdfFiller?

Navigating pdfFiller's editing functions is user-friendly and designed for efficiency. Users can locate various form fields effortlessly, allowing quick access to input areas.

-

pdfFiller offers tools for editing text, incorporating images, and adjusting formats to tailor the PA-040-78 form to specific needs.

-

Forms on pdfFiller are equipped with interactive fields, making it straightforward to enter required information digitally.

-

After completing edits and signing the form, users can securely save it to their pdfFiller account for later access or sharing.

What are the tips for completing the PA-040-78 form?

Accuracy is essential when filling out the PA-040-78 form to avoid processing delays or rejections.

-

Follow a systematic approach, starting from personal information to the specific legal requests, ensuring all fields are correctly filled.

-

Avoid missing sections or providing incorrect details, such as IDs or signatures that can lead to a denial of your submission.

-

Review the completed form thoroughly before submitting and ensure that all necessary attachments are included.

How do eSign the PA-040-78 form?

eSigning the PA-040-78 form on pdfFiller is a straightforward process that aligns with Pennsylvania's electronic signature laws.

-

Users can easily add their signatures through pdfFiller's secure eSigning tool, following prompts to validate their identity.

-

In Pennsylvania, electronic signatures hold the same legal weight as traditional signatures, making them appropriate for official documents.

-

Once signed, users can send the document directly from pdfFiller to relevant parties or download it for offline use.

How can manage my PA-040-78 documents with pdfFiller?

pdfFiller’s document management capabilities allow users to maintain high security and easy access to their PA-040-78 forms.

-

Completed forms can be stored securely in the user's cloud account, ensuring they're retrievable anytime.

-

Users can quickly search for past documents using specific parameters like date, document type, or keywords.

-

pdfFiller allows sharing of completed forms via email or by generating secure links for other users.

What are the legal implications of the PA-040-78 form?

Understanding the legal implications of the PA-040-78 form is crucial to ensure compliance and avoid potential legal issues.

-

The form comes with specific disclaimers regarding its use and the information provided, which users must acknowledge.

-

It's advisable to consult a legal professional if you are unsure about certain aspects of completing the PA-040-78 form.

-

It is vital to note that any submitted forms maintain certain warranties which can affect their acceptance.

How to fill out the PA-040-78

-

1.Access the pdfFiller website and log in to your account.

-

2.Search for the PA-040-78 form in the template library.

-

3.Select the form to open it in the editing interface.

-

4.Fill in the required fields with accurate information, ensuring all entries are complete.

-

5.Use the provided options for signing, if applicable, by clicking on the signature field.

-

6.Review your entries for any errors or omissions before submission.

-

7.Save your completed form by clicking on the 'Save' option in the toolbar.

-

8.If necessary, download the filled form or share it directly with relevant stakeholders using the sharing options.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.