Get the free texas gift deed form

Show details

This document is a Gift Deed between husband and wife, facilitating the transfer of property as a gift while detailing the obligations and rights of the grantors and grantees.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign texas gift deed form

Edit your texas gift deed form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas gift deed form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit texas gift deed form online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

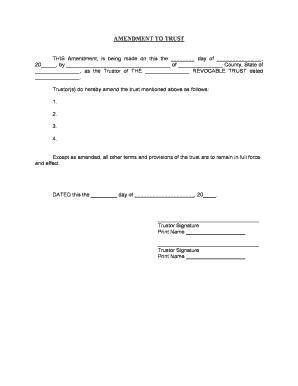

Edit texas gift deed form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out texas gift deed form

How to fill out gift deed form texas?

01

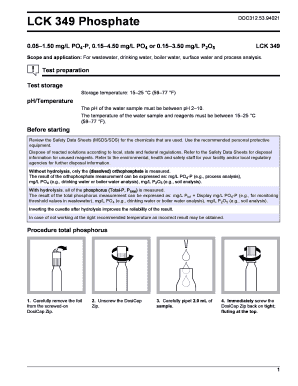

Obtain a copy of the gift deed form texas from the appropriate legal authority or online source.

02

Begin by filling out the basic information section of the form, including the name and contact information of the grantor (the person giving the gift) and the recipient (the person receiving the gift).

03

Provide a detailed description of the gift being transferred, including any specific identifying information or relevant details.

04

Clearly state the intent of the gift and any conditions or restrictions attached to it, if applicable.

05

Include any necessary signatures and notarizations as required by Texas law.

06

Submit the completed gift deed form to the appropriate legal authority or party involved in the transfer of the gift.

Who needs gift deed form texas?

01

Individuals who wish to transfer real estate or property as a gift in the state of Texas may need a gift deed form.

02

Parties involved in family gifting situations, such as parents gifting property to their children, may also require a gift deed form.

03

Estate planners, attorneys, or legal professionals involved in facilitating gift transfers may also need gift deed forms as part of their professional duties.

Fill

form

: Try Risk Free

People Also Ask about

How do you write a gift letter deed?

How To Write a Gift Letter The exact dollar amount of the gift. The donor's name, address, and phone number. The donor's relationship to the loan applicant. The date when the funds were or will be transferred. A statement that no repayment is expected. The address of the property being purchased (if known at the time)

Can someone gift you a house in Texas?

Gift deeds are one option in Texas for transferring real property to someone who is not included on the original deed. They can be either a special warranty deed or a general warranty deed. The gift deed transfers property ownership as a gift. The person making the gift, the grantor, wants nothing in return.

What is a gift deed letter of explanation?

Letter of Explanation (LOE): gift letter A gift letter is required when a borrower is using gift money as part or all of their down payment on a mortgage. The gift letter requests a statement from the donor confirming that no repayment is expected from the borrower.

How to transfer a property deed to a family member in Texas?

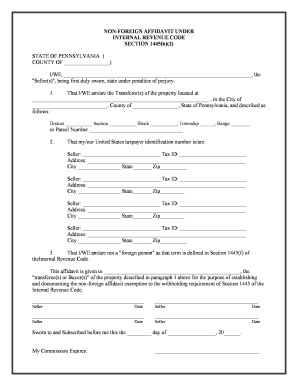

Transfers of real property must be in writing and notarized. Deeds should be recorded in the county where the property is located. To ensure a legal change to the property title, you'll want the services of an attorney. A qualified attorney will prepare and file the real estate transfer deed.

How do I file a gift deed in Texas?

These deeds need to be in writing and signed by the person giving the property in front of any notary. Once it has been properly prepared and signed, the deed needs to be filed with the county clerk for the county in which the property is located. The county will charge a filing fee of about $30 to $40.

What is an example of a gift statement?

I/We [name of gift-giver(s)] intend to make a GIFT of $ [dollar amount of gift] to [name(s) of recipient(s)] , my/our [relationship, such as son or daughter], to be applied toward the purchase of property located at: [address of the house you're buying, if known] .

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

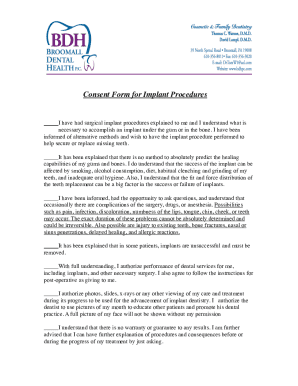

How can I send texas gift deed form for eSignature?

Once your texas gift deed form is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I make changes in texas gift deed form?

With pdfFiller, it's easy to make changes. Open your texas gift deed form in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How can I edit texas gift deed form on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit texas gift deed form.

What is gift deed form texas?

A gift deed form in Texas is a legal document used to transfer ownership of real property from one person to another without any exchange of money or consideration. It is typically used when the owner wishes to give the property as a gift.

Who is required to file gift deed form texas?

The person who is gifting the property, known as the grantor, is typically responsible for filing the gift deed form in Texas.

How to fill out gift deed form texas?

To fill out a gift deed form in Texas, the grantor must provide details such as their name and address, the recipient's name and address, a description of the property being gifted, and the effective date of the transfer. It must then be signed and notarized.

What is the purpose of gift deed form texas?

The purpose of a gift deed form in Texas is to legally document the transfer of property ownership as a gift. This helps to prevent disputes regarding ownership in the future and ensures a clear record of the transaction.

What information must be reported on gift deed form texas?

The information that must be reported on a gift deed form in Texas includes the grantor's name and address, the grantee's name and address, a legal description of the property, the date of the gift, and any applicable warranties or covenants.

Fill out your texas gift deed form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Texas Gift Deed Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.