Last updated on Feb 17, 2026

Get the free trust agreement form sample

Show details

Amendment to Trust Agreement in Order to Change Beneficiaries I, (Name of Trust or), of (street address, city, county, state, zip code), am the Trust or under a Trust Agreement dated (date), by which

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is trust change make

Trust change make is a document facilitating the process of building trust and implementing change effectively within an organization.

pdfFiller scores top ratings on review platforms

Quick and easy

Had no idea how to make an electronic signature and this program made it so easy

So simple to use!

was great

was great and easy to use

easyer to edit the pdf.

The online system works well and it is…

The online system works well and it is easy to change PDF docs

Great Service

I had an issue with the billing, so I contacted customer service; the response was fast and the problem was solved promptly. I love pdfFiller for all of my document needs.

Who needs trust agreement form sample?

Explore how professionals across industries use pdfFiller.

A complete guide to making a trust amendment form

Changing the terms of a trust can be essential to reflect current family dynamics or financial decisions. A trust amendment form allows individuals to make these necessary adjustments legally and efficiently.

-

Trust amendments are formal documents used to alter the terms of an existing trust.

-

Modifying a trust can have significant legal ramifications, necessitating careful consideration.

Understanding trust amendments

A trust amendment is a legal change made to the terms of a trust document. This process allows trustor—the person who creates the trust—to update or modify its provisions without creating a completely new document. Amending a trust is crucial because it helps ensure that the trust reflects the most current wishes and circumstances, providing peace of mind for everyone involved.

-

If family dynamics change due to marriage, divorce, or death, beneficiary designations in the trust may need updates.

-

A trust amendment can also be used to change how assets are distributed among beneficiaries.

What is a trust amendment?

Legally, a trust amendment is defined as any alteration made to a trust agreement. These changes can range from minor adjustments to significant revisions of the trust's overall structure. Unlike creating a new trust, amending an existing one is usually more cost-efficient and simpler, requiring less legal documentation than establishing a new trust.

-

Amendments can include changes to beneficiary lists, trustee roles, or trust terms.

-

Trust amendments differ from reinventing estate planning documents such as wills, as they specifically target modifications to the trust.

When to use a trust amendment form

Several scenarios might necessitate using a trust amendment form. Life events such as marriage, divorce, or the death of a beneficiary often trigger the need to revise trust documents to ensure they align with the current state of affairs. Moreover, periodic reviews of trust provisions are essential to accommodate changes in financial situations or family structures.

-

Weddings, births, deaths, or significant financial changes all warrant a trust amendment.

-

Ensuring that the beneficiary list is current is critical for equitable asset distribution.

Cost considerations for amending a trust

When contemplating amendments, it's vital to consider the potential costs involved. These costs can vary greatly depending on whether you hire an attorney or opt to amend the document yourself. While hiring a legal expert can incur higher fees, it often ensures that the amendment is executed correctly and legally compliant.

-

Engaging an attorney can provide peace of mind, while DIY options save money but may carry risks.

-

Fee structures may vary depending on local laws, so it's crucial to check local regulations.

How to fill out a trust amendment form

Filling out a trust amendment form involves several critical steps to ensure it is accurately completed and legally binding. Begin by gathering necessary information including the trustor's name, address, date, and details of the trustee and beneficiaries. Following this, complete the required fields on the form provided by pdfFiller and prepare for the signing and notarization process.

-

Follow the outlined structure to systematically fill out each section, avoiding errors.

-

Ensure to follow local laws regarding signing and notarization to validate the form.

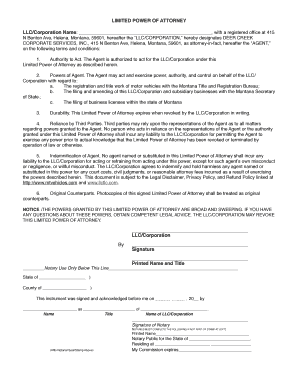

Sample trust amendment form

A completed trust amendment form serves as an excellent reference for individuals looking to modify their trust. Key sections should be highlighted to provide clarity on the required information necessary for submission. When completing the form, avoid common pitfalls, such as leaving sections blank or misidentifying the trustor and beneficiaries.

-

Providing a visual reference can help clarify how to correctly complete a trust amendment form.

-

Reread each section to confirm all information is correct to avoid complications.

Can an irrevocable trust be amended?

While an irrevocable trust generally cannot be changed once established, specific legal frameworks allow for modifications under certain circumstances. Factors such as changes in tax laws or needs of beneficiaries may provide grounds for amendments, so it’s essential to review state laws and consult legal professionals for advice.

-

This is a type of trust that cannot be altered after it’s created, thus presenting limitations.

-

In some cases, legal rulings may permit changes if they're deemed necessary for beneficiaries' welfare.

Legal considerations of trust amendments

Amending a trust carries legal implications that can vary significantly by state. It is vital to be aware of specific state laws governing trust amendments to ensure compliance and avoid potential legal pitfalls. Consulting with an estate planning attorney can provide personalized guidance tailored to your situation.

-

Each amendment must adhere to state-specific laws regarding how trusts are modified.

-

Engaging an attorney can help navigate complex legal requirements and ensure proper execution.

Using pdfFiller for trust amendment forms

pdfFiller offers innovative solutions to simplify the process of creating and editing trust amendment forms. With tools like templates, electronic signatures, and document storage features, users can complete their paperwork efficiently from any location. This cloud-based platform not only streamlines document management but also facilitates collaboration with multiple stakeholders involved in the trust.

-

User-friendly interfaces allow for straightforward navigation and form filling.

-

Ability to share and edit documents with team members enhances efficiency.

How to fill out the trust agreement form sample

-

1.Open pdfFiller and log in to your account.

-

2.Locate the 'trust change make' template in your documents.

-

3.Click on the template to open it for editing.

-

4.Review the document sections that require input, such as stakeholder trust levels and proposed changes.

-

5.Fill in each section as prompted, providing specific details relevant to your organization's situation.

-

6.Use the text boxes to write clearly and concisely about your trust-building strategies and change implementation plan.

-

7.Check the document for any required signatures or additional fields.

-

8.Once completed, save your document by clicking the 'Save' button.

-

9.To share, use the ‘Send’ option to email or share a link to the document, making it accessible to relevant parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.