Get the free 481377953

Show details

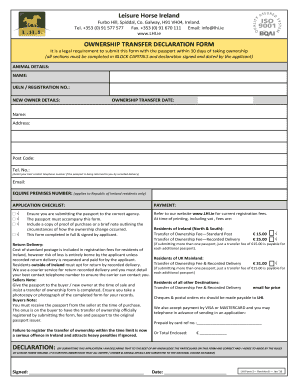

2016 U.S. Legal Forms, Inc. WISCONSIN TRANSFER ON DEATH DEED Individual to Trust Control Number: WI0783I. TIPS ON COMPLETING THE FORMS The form(s) in this packet may contain form fields created using

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer death deed

A transfer death deed is a legal document that allows a property owner to transfer their property to a beneficiary upon their death without going through probate.

pdfFiller scores top ratings on review platforms

fanatstic

Good

the site is good

It is amazing and it is of a less…

It is amazing and it is of a less struggle

good

good and satisfy

Easy to use and understand!

Who needs 481377953 form?

Explore how professionals across industries use pdfFiller.

How to fill out a transfer death deed form: A Step-by-Step Guide

Understanding the Transfer on Death Deed

A Transfer on Death Deed (TODD) is a unique legal document allowing property owners to pass real estate directly to beneficiaries upon their death, bypassing the probate process. This form serves as a powerful estate planning tool, ensuring that your assets are transferred according to your wishes without the delays often associated with traditional property transfer methods. For residents in Wisconsin, understanding the legal implications of a TODD is crucial given the state's specific requirements.

What are the key components of the Wisconsin Transfer on Death Deed?

-

The form must include details such as the name of the grantor (the person transferring the property) and the grantee (the beneficiary receiving the property).

-

Clearly defining these roles is crucial as it identifies who holds the property rights during life and who will receive them after death.

-

In Wisconsin, it is essential to name the beneficiaries to ensure that property is transferred directly to them as intended, allowing for smoother transactions and reduced chances of disputes.

How to complete the Transfer on Death Deed Form

Filling out the Transfer on Death Deed Form is a straightforward process. Start by accessing and downloading the form from pdfFiller, which offers easy access to legal documents. The platform provides interactive tools to help you complete the form accurately, guiding you through each field with precise instructions.

-

Follow the prompts for entering relevant details, ensuring accuracy to avoid legal issues later.

-

Carefully select beneficiaries and ensure their names and details are accurate to prevent complications.

How to navigate form tools and features on pdfFiller

pdfFiller offers a suite of cloud-based tools specifically designed for editing PDFs, which make completing forms easier than ever. Users can enjoy e-sign functionality, allowing documents to be signed electronically, and enjoy collaboration features that enable multiple users to work on the same form simultaneously.

-

After filling out and signing your Transfer on Death Deed, utilize pdfFiller’s document management features to store your completed forms securely in the cloud.

Importance of state-specific compliance for Wisconsin residents

Complying with Wisconsin laws regarding Transfer on Death Deeds is crucial for ensuring that your property is passed on without legal hindrances. Wisconsin has distinct regulations that dictate how TODDs should be filled out and executed, and failing to adhere to these can lead to complications in property transfer.

-

Familiarize yourself with Wisconsin statutes that outline the requirements for a valid TODD, including notarization and witness signatures.

-

Consider local laws when designing your deed. An example could include how spousal rights affect property distribution.

-

Knowing state-specific statutes will save you time and hassle in the long run, ensuring your wishes are legally recognized.

Conclusion and next steps for effective document management

In summary, the Transfer on Death Deed Form provides a straightforward means for property transfer upon death without going through probate. Using pdfFiller to create, edit, and manage your document ensures a smooth process, with all necessary tools available at your fingertips. Plan ahead and prepare for future real estate transactions by leveraging these resources effectively.

How to fill out the 481377953 form

-

1.Go to the pdfFiller website and sign in or create an account.

-

2.Search for 'transfer death deed' in the template library.

-

3.Select the appropriate template for your state and download it.

-

4.Open the template in the pdfFiller editor.

-

5.Fill in the name of the grantor (property owner) and their address.

-

6.Enter the name and address of the beneficiary receiving the property.

-

7.Provide a legal description of the property, which can be found on the property deed.

-

8.Include any additional required information, such as the county where the property is located.

-

9.Review all entries for accuracy and completeness.

-

10.Sign the document in the designated area, ensuring that any witnesses or notaries are in compliance with state laws.

-

11.Save the filled form and print it if necessary.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.