Last updated on Feb 20, 2026

Get the free Accounts Receivable - Guaranty

Show details

GUARANTY OF ACCOUNTS RECEIVABLE In consideration of and in order to induce, Payee(s), to do extend credit to, Customer, the undersigned (the “Guarantor “) hereby: 1. Unconditionally and absolutely

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is accounts receivable - guaranty

Accounts receivable - guaranty is a financial document that ensures a third party agrees to fulfill payment obligations in case the primary debtor fails to do so.

pdfFiller scores top ratings on review platforms

Easy to use and a very beneficial program

They are great to work with.

easy to use

AMAZING

no

good

Who needs accounts receivable - guaranty?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Guaranty of Accounts Receivable

Filling out an accounts receivable guaranty form can be straightforward when you follow a structured approach. This guide will outline the necessary steps and considerations to ensure you accurately complete the form.

What is the guaranty of accounts receivable?

A guaranty of accounts receivable is a legal agreement that ensures payment for owed amounts. It plays a vital role in financial transactions, enhancing trust among parties involved.

-

A guaranty agreement ensures that a third party (the guarantor) will assume responsibility for a debt or obligation if the primary party fails to fulfill it.

-

It protects the payee by reducing the risk associated with extending credit to a customer.

-

The key parties include the payee (the entity owed money), the customer (the debtor), and the guarantor (the entity promising to cover the debt).

What are the essential elements of the guaranty document?

-

The document must clearly identify the payee and customer, including their legal names and addresses.

-

A statement asserting that the guarantor will unconditionally pay the debts in full if the customer defaults.

-

Clauses that specify the maximum amount for which the guarantor is liable, defining the limits of their responsibility.

-

Terms that allow the payee to waive certain rights against the guarantor or agree to compromises.

What are the responsibilities of a guarantor?

-

The guarantor takes on responsibilities for any charges related to the account receivable once the customer defaults.

-

By agreeing to the contract, the guarantor waives the right to receive notice before action is taken against them.

-

Any changes made to the terms of the accounts receivable are acknowledged, with the guarantor agreeing to these modifications.

-

Outlines how and when the guarantor’s liability ceases, ensuring clarity on responsibilities.

How to fill out the guaranty form: Step-by-step instructions

-

Collect all necessary information such as names, addresses, amounts owed, and the creditor's terms before starting the form.

-

Follow the guidelines to fill in each section accurately, ensuring all data aligns with provided documents.

-

Avoid leaving sections blank, misspelling names, or mistakenly inputting incorrect financial figures.

-

Utilize pdfFiller's features for editing, signing, and securely managing your documents online.

What legal considerations should be acknowledged?

-

Signing a guaranty form can lead to significant financial obligations for the guarantor, and they should fully understand these before agreeing.

-

Laws governing guaranties can differ state by state; it's essential to ensure compliance with local regulations.

-

Some states may require notarization or acknowledgments for the guaranty to be legally enforceable.

What are best practices for managing accounts receivable guaranties?

-

Continuously review and update guaranty agreements as accounts receivable change to safeguard against risks.

-

Maintain clear lines of communication among all parties involved to address issues promptly and effectively.

-

Leverage pdfFiller for tracking document changes, sharing updates, and managing all your guaranties in one centralized online platform.

How to fill out the accounts receivable - guaranty

-

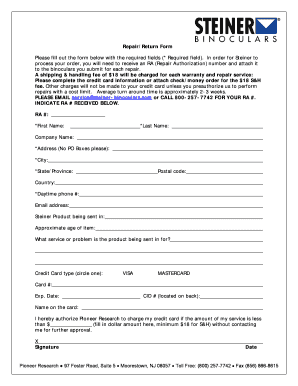

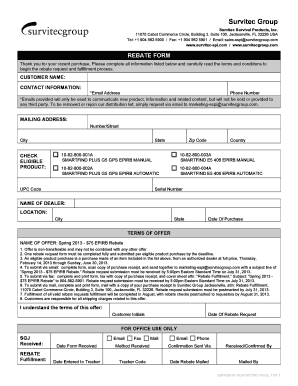

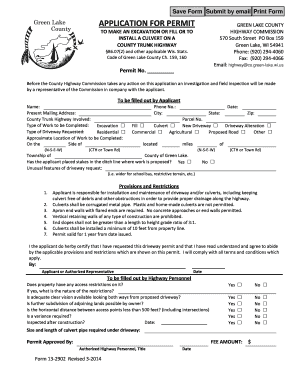

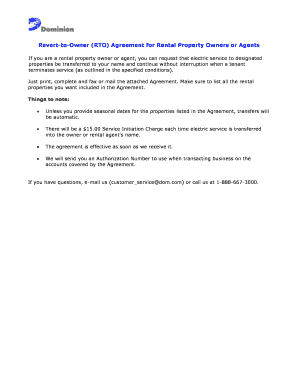

1.Open the PDF document for the accounts receivable - guaranty form in pdfFiller.

-

2.Review the instructions provided at the top of the form for any specific requirements.

-

3.Fill in the debtor's information, including name, address, and account details accurately.

-

4.Provide the guarantor's information, ensuring to include all necessary identification details.

-

5.Specify the amounts guaranteed and any relevant terms, such as the duration of the guaranty.

-

6.Make sure to read through the terms and conditions section clearly before signing.

-

7.Have the designated parties sign the document where indicated, including any witnesses if required.

-

8.Use the features in pdfFiller to save the document as a PDF or print it out for physical distribution.

-

9.Submit the completed form to the relevant parties and keep a copy for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.