Last updated on Feb 20, 2026

Get the free 481378968

Show details

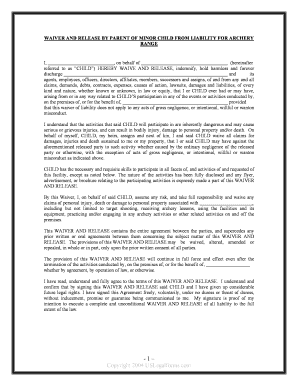

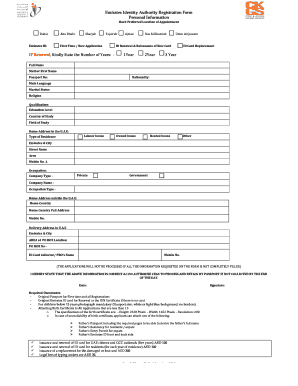

Prepared by and after Recording Return to: Name: Firm/Company: Address: Address 2: City, State, Zip: Phone:Assessors Property Tax Parcel/Account Number:)))))))))))))Above This Line Reserved For Official

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is alaska deed trust

An Alaska deed trust is a legal document that establishes a trust for holding and managing property in Alaska.

pdfFiller scores top ratings on review platforms

it is very easy to use

works perfect

has been very easy to navigate

learning more about how it can enhance my work and make it better in everyway

Takes some getting used to. I need training. But it is intuitive and I was able to get things done quickly.

great -- I wish you had a free version for schools/teachers.

Who needs 481378968 form?

Explore how professionals across industries use pdfFiller.

Alaska Deed Trust Form Guide

TL;DR: How to fill out a Alaska deed trust form

To fill out an Alaska deed trust form, clearly identify the trust parties, provide property details, and complete all required sections such as signatures and acknowledgments. Ensure you check for mistakes and adhere to local forms and regulations.

What is a Deed of Trust and its purpose?

A deed of trust is a legal document that secures a loan against a property by transferring the title of the property to a trustee until the loan is repaid. In Alaska, this document is critical in real estate transactions, ensuring a borrower (mortgagor) can buy property while providing the lender (beneficiary) a legal claim if the borrower defaults.

-

A deed of trust protects lenders’ interests while providing borrowers access to funding.

-

The mortgagor (borrower), trustee (neutral third party), and beneficiary (lender) play essential roles.

-

Failure to adhere to the terms of the deed can result in foreclosure or loss of property.

What components make up the Alaska deed trust form?

Each Alaska deed trust form contains requisite sections that ensure it is legally valid and comprehensive. Missing information could lead to complications or disputes over the property.

-

To provide clarity on who prepared the document and the recording details.

-

Includes crucial information such as the names, addresses, and company details of involved parties.

-

Identifies the specific property for accurate tax assessment and record-keeping.

-

A detailed description is essential for clarity and prevents disputes regarding property boundaries.

-

Signatures validate consent, while acknowledgments confirm the identities and willingness of the parties.

How do you fill out the Alaska deed trust form?

Filling out the Alaska deed trust form requires precision and attention to detail. Here’s a step-by-step guide:

-

Collect names, addresses, property details, and any needed identification numbers to ensure a smooth process.

-

Carefully complete each section of the form, adhering to the prescribed layout and instructions.

-

Review the document for missing details or errors that might invalidate the trust.

-

Check that all entries comply with Alaska laws and local regulations before submitting.

What interactive tools can be used for document management?

Using pdfFiller, users can efficiently manage their Alaska deed trust forms with a range of interactive tools tailored for document editing and collaboration.

-

Easily upload your document and make necessary edits directly on the platform without hassle.

-

Facilitate teamwork by allowing multiple users to view and edit the document simultaneously.

-

Streamline the signing process with electronic signatures that are easy to create and manage.

What is a partial release from a deed of trust?

A partial release refers to the process where a portion of the property secured under a deed of trust is released, often used in situations like refinancing or selling part of the secured property. Proper documentation of this process is crucial to avoid future claims.

-

A legal process to remove a portion of the property from a deed of trust.

-

Typically occurs during refinancing, property sales, or when segments of property are paid off.

-

Ensuring proper documentation protects against potential disputes in the future.

How to navigate compliance in Alaska?

Understanding compliance regarding Alaska deed trust forms is essential for preventing legal complications. Various local laws dictate how these documents must be filed and maintained.

-

Familiarizing yourself with laws governing deeds of trust in Alaska can prevent future problems.

-

All deeds of trust must be filed in accordance with local county recorder specifications.

-

Failing to comply with these regulations may result in invalidation of the deed, leading to potential legal issues.

What are some examples and case studies?

Real-world examples highlight the practical application of the Alaska deed trust form, showing its relevance in various scenarios.

-

Utilizing the Alaska Deed of Trust Form may vary by urban or remote locations, changing specific needs.

-

A detailed walkthrough of completing a deed of trust for a residential property acquisition illustrates common procedural steps.

-

Feedback from users reveals the importance of accuracy in form submissions to avoid delays.

How to fill out the 481378968 form

-

1.Open the PDF of the Alaska deed trust on pdfFiller.

-

2.Start by entering the date at the top of the document in the format specified.

-

3.Fill in the name of the trustor, who is the person creating the trust.

-

4.Next, input the name of the trustee, which can be the trustor or another individual.

-

5.Provide a list of the beneficiaries who will receive the trust assets upon trust termination.

-

6.Specify the property details in the section provided, including the legal description and address.

-

7.Indicate any desired conditions or instructions for managing the property within the trust.

-

8.Review all entered information for accuracy and completeness before submission.

-

9.Once confirmed, proceed to sign the document electronically if required.

-

10.Finally, save the completed document and download or print it for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.