Get the free partial release mortgage template

Show details

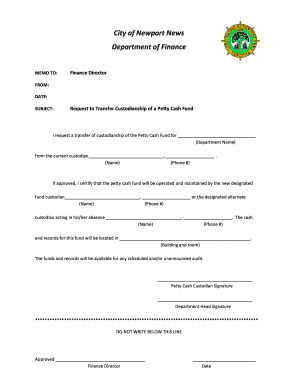

This document prepared by (and after recording return to): Name: Firm/Company: Address: Address 2: City, State, Zip: Phone:)))))))))) Above This Line Reserved For Official Use OnlyPARTIAL RELEASE

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is partial release mortgage template

A partial release mortgage template is a legal document allowing a lender to release part of the collateral securing a mortgage while keeping the remaining parts in effect.

pdfFiller scores top ratings on review platforms

Mostly terrific. Would like to see an option to create PDF forms.

Has some quirks that make filling out forms not as smooth as it could be.

So far so good, intuitive and easy to use

doesn't always fill in the correct boxes and had errors!

As a grant writer, I found PDFfiller to be very useful.

Affordable, reliable, and flexible with changes. Could use a little more explaining to become more user friendly without having to get technical assistance all the time.

Who needs partial release mortgage template?

Explore how professionals across industries use pdfFiller.

Understanding the Partial Release Mortgage Template Form

A partial release mortgage template form is an essential document for homeowners looking to manage their mortgage obligations effectively. This guide will help you understand this form and how to fill it out correctly.

What is a partial release mortgage?

A partial release mortgage allows a borrower to have a portion of the property freed from a mortgage lien while keeping the balance intact on the remaining property. This is particularly useful when a homeowner wants to sell part of their property but retain ownership of the rest.

-

The primary purpose is to facilitate the sale or use of a portion of a mortgaged property without affecting the overall mortgage.

-

In a full release, the entire mortgage is satisfied, whereas a partial release retains the mortgage on the remaining property.

-

This often occurs in cases where homeowners sell land, refinance, or seek a remodel while keeping existing mortgage terms.

Vital components of the template

Understanding the essential components of the partial release mortgage template form is crucial for a smooth process.

-

Includes information about who prepared the document, ensuring accountability.

-

Clearly outlines who the mortgagor (borrower) and mortgagee (lender) are, establishing the involved entities.

-

A detailed description of the property subject to the partial release is necessary for legal accuracy.

-

Certain legal verifications, like notarization, are essential to ensure the document is binding.

Step-by-step guide to completing the form

Completing the partial release mortgage template form requires attention to detail. Here’s a step-by-step guide.

-

Provide accurate names, addresses, and contact information for clarity and accountability.

-

Correctly detail the mortgage's specifics to avoid any legal issues down the line.

-

Use precise language and relevant property identifiers to prevent ambiguities.

-

Ensure you involve a licensed notary, who will verify identities and provide a seal for authenticity.

Common mistakes to avoid

Many individuals face hurdles when filling out the partial release template. Here are pitfalls to avoid.

-

Not filling out all required sections can lead to document rejection.

-

Provide precise details; errors could lead to disputes or delays.

-

Being unaware of the notarization requirements can invalidate your form.

-

Always keep a copy for your records to have proof of the release.

Legal considerations and compliance

In Alabama, specific regulations apply to partial release mortgages that you must understand.

-

Familiarize yourself with Alabama laws regarding property transactions and mortgages to avoid legal complications.

-

Both mortgagors and mortgagees have legal responsibilities during the process that must be adhered to.

-

A partial release can affect existing agreements; make sure to review the terms.

Utilizing pdfFiller for streamlined document management

Using pdfFiller can simplify the process of managing your partial release mortgage template form.

-

The platform allows for easy editing and tailoring of your mortgage release template.

-

Utilizing e-signatures expedites form processing while keeping it secure.

-

Engage with legal teams or financial institutions directly through the platform for efficiency.

Post-completion steps

After completing the partial release mortgage form, several essential actions must be taken.

-

File the partial release with the appropriate county office to finalize the process legally.

-

Inform relevant parties, including financial institutions, about the completion of the release.

-

Keep copies of all signed documents for future reference.

How to fill out the partial release mortgage template

-

1.Open the partial release mortgage template in pdfFiller.

-

2.Begin by entering the date at the top of the document.

-

3.Fill in the borrower's name and address in the designated fields.

-

4.Next, provide the lender's name and address.

-

5.Specify the property details, including the legal description and address.

-

6.Indicate the mortgage details, such as the mortgage number and date of origination.

-

7.Clearly describe the portion of the property that is being released.

-

8.Include any relevant sale details, such as buyer's name and sale price.

-

9.Review the document for accuracy and completeness.

-

10.Sign and date the document where required, and have it notarized if necessary.

-

11.Save your changes and download the final document in your preferred format.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.