Get the free california living trust

Show details

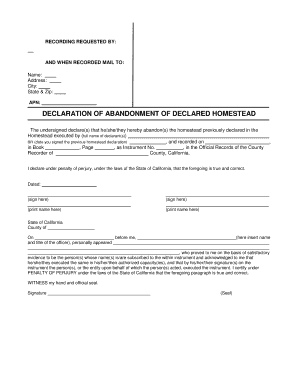

REVOCATION OF LIVING TRUSTEE NOTICE that, the Trust or(s) of THE REVOCABLE TRUST dated, as the Assignor, does hereby revoke said trust pursuant to the following provisions: 1. The trust is revoked

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign revocation living trust form

Edit your california living trust form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your california living trust form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit california living trust form online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit california living trust form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out california living trust form

How to fill out revocation living trust?

01

Begin by reviewing your existing living trust document. Understand the provisions and terms outlined in the trust.

02

Consult with an attorney specializing in estate planning to ensure you are following the correct legal procedures and requirements.

03

Prepare a revocation document that clearly states your intention to revoke the existing living trust. Include your full name, the date of revocation, and reference the original trust document.

04

Sign the revocation document in the presence of a notary public or witnesses, as required by state law. Make copies of the signed document for your records.

05

Notify all relevant parties, such as the trustee, beneficiaries, and any financial institutions or organizations involved in managing the trust. Provide them with a copy of the revocation document to ensure they are aware of the trust's termination.

Who needs revocation living trust?

01

Individuals who have created a living trust in the past but no longer wish to maintain it may need a revocation living trust.

02

Circumstances may change over time, such as changes in family dynamics, financial situations, or personal preferences, leading individuals to reconsider the need for a living trust.

03

Those who have determined that a revocation of their existing living trust is necessary to align their estate planning goals with their current circumstances should consider a revocation living trust. It allows for the formal termination of the original trust and the allocation of assets according to new plans or wishes.

Fill

form

: Try Risk Free

People Also Ask about

What assets Cannot be placed in a trust?

What assets cannot be placed in a trust? Retirement assets. While you can transfer ownership of your retirement accounts into your trust, estate planning experts usually don't recommend it. Health savings accounts (HSAs) Assets held in other countries. Vehicles. Cash.

What is the difference between a living trust and a revocable trust?

A revocable trust and living trust are separate terms that describe the same thing: a trust in which the terms can be changed at any time. An irrevocable trust describes a trust that cannot be modified after it is created without the beneficiaries' consent.

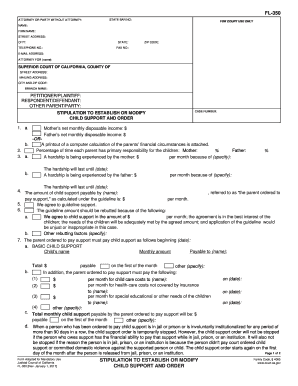

How do you remove a beneficiary from a revocable trust?

To remove a beneficiary from a trust, the trustee needs to submit a trust amendment form. This allows the trustee of a revocable trust to make changes to the original document while keeping it active. If the trust is jointly owned, both the trustees must agree to any amendments made.

What is the effect of revocation of trust?

If you created an individual living trust, you can revoke it at any time. Either grantor can revoke a shared trust, wiping out all terms of the trust. The trust property is returned to each person ing to how they owned it before transferring it to the trust.

What type of trust is best?

An irrevocable trust offers your assets the most protection from creditors and lawsuits. Assets in an irrevocable trust aren't considered personal property. This means they're not included when the IRS values your estate to determine if taxes are owed.

What is an example of a revocation of a trust?

Here is an example of a trust revocation declaration: “I, John Doe, hereby revoke the John Doe Revocable Living Trust, created by the Declaration of Trust signed MONTH, DAY, YEAR, ing to the power reserved to me. All property held in the trust shall be returned to the settlor. ”

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify california living trust form without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your california living trust form into a dynamic fillable form that you can manage and eSign from anywhere.

Can I create an electronic signature for signing my california living trust form in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your california living trust form right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I complete california living trust form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your california living trust form. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

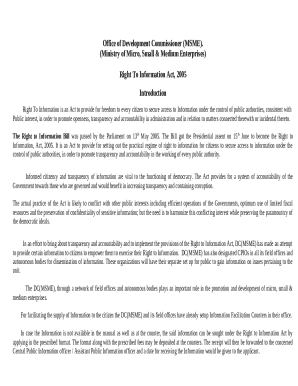

What is revocation living trust?

A revocation living trust is a legal document that allows the creator (grantor) to place their assets into a trust during their lifetime and retain the right to revoke or change the trust as desired.

Who is required to file revocation living trust?

The grantor or creator of the revocation living trust is typically the one required to execute the revocation document if they wish to terminate the trust.

How to fill out revocation living trust?

To fill out a revocation living trust, one must draft a formal document identifying the original trust being revoked, state the grantor's intent to revoke, and sign it in accordance with state laws.

What is the purpose of revocation living trust?

The purpose of a revocation living trust is to allow the grantor to manage their assets during their lifetime while retaining the flexibility to change or dissolve the trust as their circumstances or wishes change.

What information must be reported on revocation living trust?

The information that must be reported on a revocation living trust includes the name of the original trust, details about the assets involved, the grantor's personal information, and a statement indicating the intent to revoke the trust.

Fill out your california living trust form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

California Living Trust Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.