Last updated on Feb 20, 2026

Get the free connecticut trust

Show details

AMENDMENT TO TRUST THIS Amendment, is being made on this the day of, 20, by of County, State of, as the Trust or of THE REVOCABLE TRUST dated. Trust or(s) do hereby amend the trust mentioned above

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is connecticut trust

A Connecticut trust is a legal arrangement where one party holds property for the benefit of another, often used for estate planning or asset protection.

pdfFiller scores top ratings on review platforms

like the fact I can fill and type.. but not easy to understand how to find forms, unless you pay for another part of service.>>??? is this correct

It is extremely useful, but a little awkward to use for a 67 year old like me.

I am happy that you have the forms I need. This is a lifesaver.

I love the program. It helps my clients read and sign documents from the comfort of their own homes

A bit early for my full response but so far, I Like...

It appears to be very simple but I would like a 'tutorial' on all of the features.

Who needs connecticut trust?

Explore how professionals across industries use pdfFiller.

How to fill out a connecticut trust form form

Understanding the Connecticut trust amendment process

A trust amendment is a legal modification made to an existing trust document. Understanding this process is crucial for estate planning, ensuring that your wishes are accurately reflected. The reasons for amending a trust can vary, including changes in assets, beneficiaries, or family circumstances.

-

A trust amendment alters the terms of an existing trust without revoking it.

-

Amending a trust maintains alignment with your current financial and familial circumstances, showcasing your intent.

-

Reasons may include birth or death of beneficiaries, changes in marital status, or new financial assets.

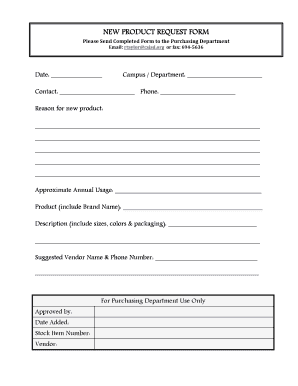

What are the key components of the amendment to trust form?

Filling out the Connecticut trust amendment form correctly requires understanding its key components. The form includes required fields that capture essential information pertaining to the trustor and details about the amendments being made.

-

Information such as the trust name, trustor's address, and effective date of the amendment must be included.

-

Sections include trustor information, the specific amendments being made, and any additional notes or instructions.

-

A notarized signature is often required to validate the authenticity of the amendment.

How do fill out the Connecticut trust amendment form?

Following a structured approach can help ensure your trust amendment form is filled out correctly. Make use of tools that streamline this process by providing templates and guidance.

-

Begin with filling in your trustor details, followed by the specific changes. Ensure clarity and accuracy throughout.

-

Double-check names and dates, and consider involving an attorney to review your entries.

-

Neglecting notarization or leaving sections incomplete can invalidate your amendment.

How to manage your trust documents with pdfFiller?

pdfFiller simplifies the trust document management process by allowing users to perform edits and eSignatures online. Learning how to utilize its features can enhance collaboration and document organization.

-

Use the upload feature to import your pre-existing trust amendment document.

-

Share the document with stakeholders for input and execute eSignatures seamlessly.

-

Utilize pdfFiller’s cloud storage to keep your documents safe and easily accessible.

What are the legal considerations when amending a trust in Connecticut?

Legal requirements for trust amendments in Connecticut can be complex. It’s vital to understand local laws and potentially seek legal counsel when making significant amendments.

-

State laws may dictate how amendments should be executed and documented.

-

A thorough legal review can prevent future disputes and ensure compliance with state regulations.

-

Consult local bar associations or utilize online legal platforms for guidance.

How do finalize my trust amendment?

Finalizing your trust amendment involves several key steps to ensure that all required actions have been completed. Proper record-keeping helps track all modifications.

-

Ensure all signatures are collected, and the amendment is notarized before filing.

-

Store the amendment alongside your original trust documents in a secure location.

-

Regular reviews, at least every few years or after significant life events, are recommended to maintain accuracy.

Where can access additional resources on trusts and estate planning?

Understanding estate planning can be enhanced by utilizing resources that provide guidance and templates for related documents. pdfFiller offers a comprehensive resource library to support users.

-

Access a variety of templates and forms specifically designed for Connecticut residents.

-

Stay informed by reading articles that cover all aspects of estate planning and trust management.

-

Utilize tailored resources that cater to state-specific requirements, easing the amendment process.

How to fill out the connecticut trust

-

1.Start by gathering relevant information about the trust's purpose and the beneficiaries.

-

2.Open the PDF form for the Connecticut trust on pdfFiller.

-

3.Fill in the trust's name and date at the top of the form.

-

4.Enter the names and details of the grantor (the person creating the trust) and trustee (the person managing the trust).

-

5.List the beneficiaries who will receive assets from the trust, including their relationship to the grantor.

-

6.Detail the assets to be included in the trust, providing descriptions and estimated values.

-

7.Specify the terms of the trust, including any conditions under which assets should be distributed.

-

8.Review the information for accuracy before signing the document.

-

9.Submit the completed form as instructed on pdfFiller or consult with a legal professional for further guidance.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.