Last updated on Feb 17, 2026

Get the free notice default form

Show details

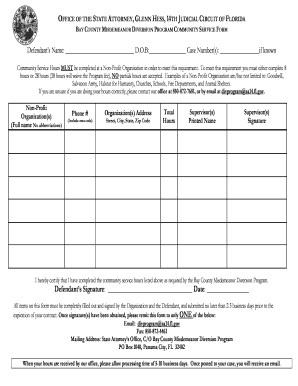

NOTICE OF DEFAULT TO: YOU ARE NOT COMPLYING WITH THE TERMS OF THE CONTRACT FOR DEED DATED REGARDING THE PROPERTY LOCATED AT, AND YOU ARE IN DEFAULT. IF THE DEFAULT IS NOT CORRECTED WITHIN DAYS FROM

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is notice default form

A notice default form is a legal document used to inform a borrower that they have defaulted on a loan or mortgage agreement.

pdfFiller scores top ratings on review platforms

love it

love it would reccommend

I always receive excellent customer…

I always receive excellent customer service! any issues or questions I have are always resolved in a professional and timely manner.

Thank you!

easy to use

I like the free trial lol

I was surprised I still have to hand…

I was surprised I still have to hand write a form to send to IRS - I thought this would take care of it for me. Or did I miss something.

Great to edit my PDF for work

Great to edit my PDF for work

excellent site in every way

excellent site in every way

Who needs notice default form?

Explore how professionals across industries use pdfFiller.

Understanding the Notice of Default Form

A Notice of Default form is a critical document in real estate transactions that signals a borrower has defaulted on their mortgage obligations. Knowing how to fill out this form accurately is essential for both lenders and borrowers.

What is a Notice of Default?

A Notice of Default officially communicates to a borrower that they have failed to meet the terms of their loan agreement, typically due to missed payments. This document starts the process of potential foreclosure if the borrower does not rectify the default within a specified timeframe.

Importance of a Notice of Default in Property Transactions

Understanding the Notice of Default is vital, as it plays a significant role in protecting lenders' interests. It ensures that borrowers are made aware of their shortcomings, thus allowing them the opportunity to resolve the issue before further legal action occurs.

Legal requirements for sending a Notice of Default

The process for sending a Notice of Default includes specific legal requirements that vary by state. Generally, it must be sent via certified mail to ensure delivery and should include detailed information about the default.

Key Components of a Notice of Default

A well-crafted Notice of Default should include several critical components that make it effective.

-

This includes accurate details regarding who is receiving the Notice, ensuring that it reaches the correct party.

-

It is essential to outline what constitutes the default, specifying any delinquent payments and the time frame involved.

-

Incorporating contract dates and property locations is important for context in the Notice.

What information should be included in the recipient information?

The recipient information must include the name and full address of the person or entity receiving the Notice. Accuracy is crucial; any misspelled names or wrong addresses can lead to significant delays.

What details should be included about the default?

Providing a detailed account of the default is important. This includes specifying the type of default, like missed payments, along with the corresponding amounts owed and how long the payments have been overdue.

Why are property details critical in the Notice of Default?

Including property details ensures that the Notice is tied to a specific location and contract. This aids in clarification, preventing confusion around multiple properties or agreements.

Consequences of Ignoring a Notice of Default

Ignoring a Notice of Default can lead to severe repercussions, including potential legal actions from the seller to reclaim their interest in the property. As defaults escalate, property rights may be lost, and eviction could follow.

-

Sellers may seek to initiate foreclosure proceedings if defaults are not addressed.

-

Failing to comply may result in the loss of home ownership and eviction.

-

Awareness of these processes is crucial to navigate defaults effectively.

Correcting Default: Steps to Compliance

Addressing a default involves specific corrective actions. It's crucial to take action within stated deadlines to rectify the situation.

-

Identify the problem and take appropriate measures to resolve it, such as making overdue payments.

-

Meeting deadlines is essential to avoid further complications or legal actions.

-

Local laws may dictate how defaults should be managed and corrected.

What are the steps for remedying payment defaults?

To remedy payment defaults, start by assessing the total owed and calculating a payment plan to catch up. Payment methods can vary; be sure to clarify acceptable options with the lender.

How to address other types of defaults?

Non-monetary defaults require clear communication with the seller to explore potential remedies. Negotiation may provide unique solutions tailored to both parties' needs.

How to Use the pdfFiller Platform for Notice of Default

pdfFiller offers useful features that streamline the process of completing a Notice of Default form. With tools designed for easy editing, signing, and sharing of documents, users can efficiently manage their paperwork.

-

The platform provides an intuitive interface for filling out the form accurately.

-

Users can seamlessly eSign and distribute the document to relevant parties.

-

Access to cloud features enables tracking and document management from anywhere.

What are the best practices for filling out a Notice of Default using pdfFiller?

When using pdfFiller, start by thoroughly reviewing the form's fields. Ensure all information is correct and complete to avoid potential delays during processing.

PDF Best Practices for Notice of Default

After completion, ensure the document is stored securely to maintain compliance and privacy. Employ effective storage solutions to ensure easy retrieval when necessary.

-

Confirm that all sections are correctly filled in before sending.

-

Establish a reliable method for storing signed documents.

-

Stay updated with local laws to ensure ongoing document compliance.

How to fill out the notice default form

-

1.Open the notice default form template on pdfFiller.

-

2.Begin by entering the date at the top of the form.

-

3.Fill in the borrower's name and contact information in the designated fields.

-

4.Provide the loan or mortgage account number for reference.

-

5.Indicate the specific default reason, such as missed payments or non-compliance with loan terms.

-

6.Include the total amount past due in the appropriate section.

-

7.Add any required jurisdiction or legal citation if applicable.

-

8.Review the completed information for accuracy and completeness.

-

9.Sign the form digitally using pdfFiller's e-signature tool.

-

10.Save the filled-out form to your account or download it for distribution.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.