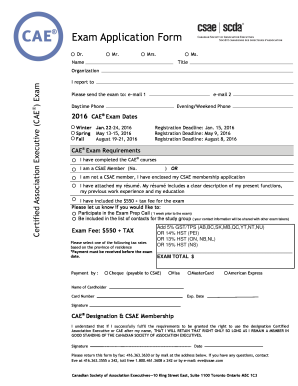

Get the free Georgia Subordination Agreement of Mortgage

Show details

AFTER FILING PLEASE RETURN TO: SUBORDINATION AGREEMENT STATE OF GEORGIA COUNTY OF (hereinafter the “Mortgagee “) is the holder and owner of a deed to secure debt (hereinafter the “security deed

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is georgia subordination agreement of

A Georgia subordination agreement is a legal document that establishes the priority of claims against a property, typically between loans or lienholders.

pdfFiller scores top ratings on review platforms

Very helpful and accessible content of use.

easy to use and takes the hassle out of trying to sort documents

The Best !, I did not expect this to be par excellence, It meet my expectations and even more - I will recommend, the engine, design and it covers the Business requirements and needs.

P.Patrick

MUY PRACTICO, NO ENCUENTRO LA HERRAMIENTA PARA AMPLIAR EL ESPACIO DE ESCRITURA

Actually, quite a good system. Disappointed that USPS does not actually do this for free of course.

It is a huge help for me as a teacher, I'm doing all of my marking on it and then using the email function. A huge time saver.

Who needs georgia subordination agreement of?

Explore how professionals across industries use pdfFiller.

Understanding the Georgia Subordination Agreement of Form Form

The Georgia subordination agreement of form form is an essential document for those involved in real estate transactions or financing. It outlines the terms by which a higher-priority loan can take precedence over existing liens or claims on a property. In this guide, we'll explore its significance, components, and processes surrounding filling out this important document.

What is a subordination agreement?

A subordination agreement is a legal document that establishes the hierarchy of claims against a property. It's mainly used in real estate to ensure that a new lender’s interest takes precedence over existing loans. This is crucial for borrowers when seeking additional financing since it makes the new loan less risky for lenders.

-

The purpose is to prioritize loan claims, allowing for better access to financing.

-

Helps secure loans for construction, refinancing, or other purposes while mitigating risk for lenders.

-

The key parties include the Mortgagee (the lender), the Borrower (the homeowner), and the Lender (the one providing the new loan).

Key components of the Georgia subordination agreement

Understanding the essential components of the Georgia subordination agreement is pivotal for all parties involved. It contains specific information that must be accurately filled out to avoid potential legal issues.

-

These include party names, loan details, and the property’s legal description.

-

Identifies who the Mortgagee is and their role in the subordination process.

-

Must include the Borrower's legal name and property details to validate the agreement.

-

Specific amounts and legal descriptions ensure clarity on the loan terms.

Filling out the Georgia subordination agreement

Filling out the Georgia subordination agreement accurately is essential for a valid contract. Utilizing modern tools can simplify this process greatly.

-

Follow our intuitive steps using pdfFiller's interactive tools to fill out forms accurately.

-

Leverage editing tools in pdfFiller to input relevant information effortlessly.

-

Make use of pdfFiller's eSign functionalities to ensure secure and legal signing.

Compliance and legal considerations

Compliance is crucial for the legality of the agreement. Each state, including Georgia, has specific requirements that must be executed properly.

-

Ensure adherence to Georgia's laws regarding mortgage and lien rights.

-

All parties must comprehend the legal ramifications of signing a subordination agreement.

-

Missteps in execution can lead to disputes and financial loss, requiring legal advice for rectification.

Common use cases for subordination agreements

Subordination agreements are frequently utilized in various real estate scenarios that require clear prioritization of debts. Understanding these situations can help you assess your need for such a document.

-

Commonly needed when a borrower requires additional funding for improvements or refinancing.

-

Allows Borrowers to take additional loans against properties even while existing mortgages are in place.

-

Improper handling can lead to loss of priority and potential financial ruin if claims are disputed.

Post-execution steps for the subordination agreement

Once the Georgia subordination agreement is executed, there are crucial subsequent steps to ensure its validity and enforceability.

-

Confirm all parties retain copies of the signed agreement for their records.

-

File the signed document in the appropriate county office to make it part of the public record.

-

Utilize pdfFiller to securely store and manage the agreement electronically, ensuring easy access.

Learning more: Explore related forms and templates

There are numerous other forms and templates related to subordination and real estate transactions that you may find useful. pdfFiller offers a wide array of resources to aid in your documentation.

-

Explore other essential documents available on pdfFiller that complement the subordination agreement.

-

Learn how to easily find related forms tailored to Georgia's legal requirements.

-

Utilize pdfFiller’s features to evaluate various forms that may meet your needs.

How to fill out the georgia subordination agreement of

-

1.Begin by downloading the Georgia subordination agreement template from pdfFiller.

-

2.Open the document in the pdfFiller platform.

-

3.Fill in the names of all parties involved, including the borrower and lender.

-

4.Specify the property address that the agreement pertains to.

-

5.Indicate the loan amounts and any existing liens that need to be subordinated.

-

6.Include the date of the agreement in the designated section.

-

7.Check for accuracy in all information filled out to ensure it reflects current agreements.

-

8.Review the terms of the agreement to confirm understanding by all parties.

-

9.If applicable, attach any additional documents needed for the agreement.

-

10.Once complete, save the document and choose to either print or email it to all parties for signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.