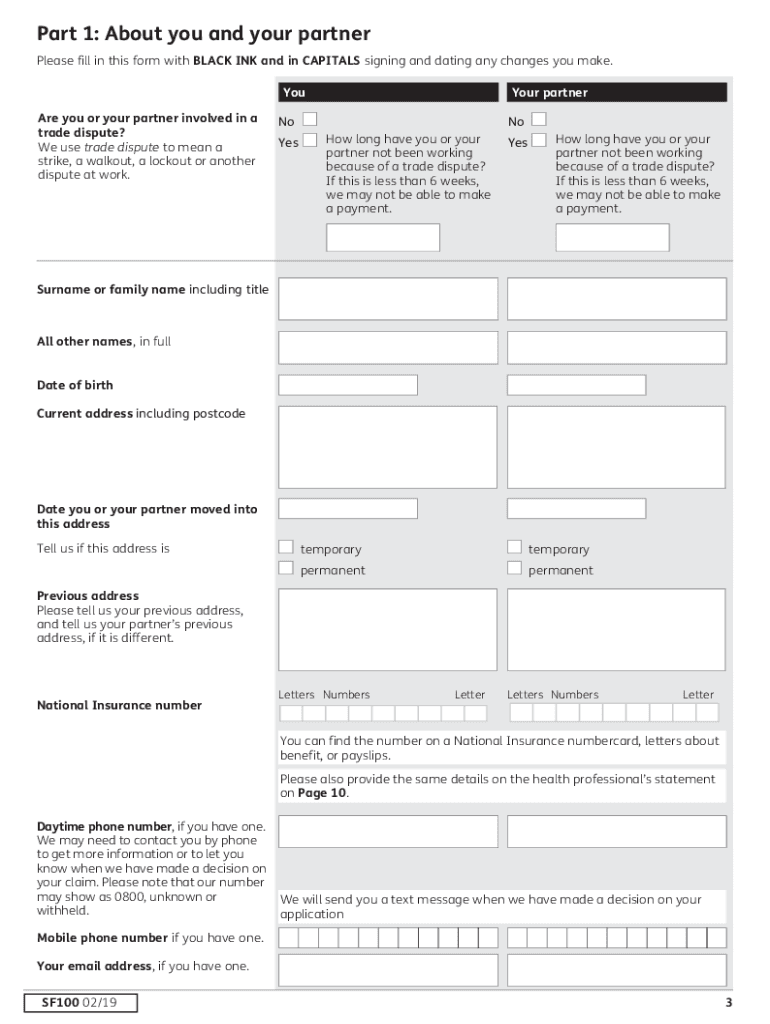

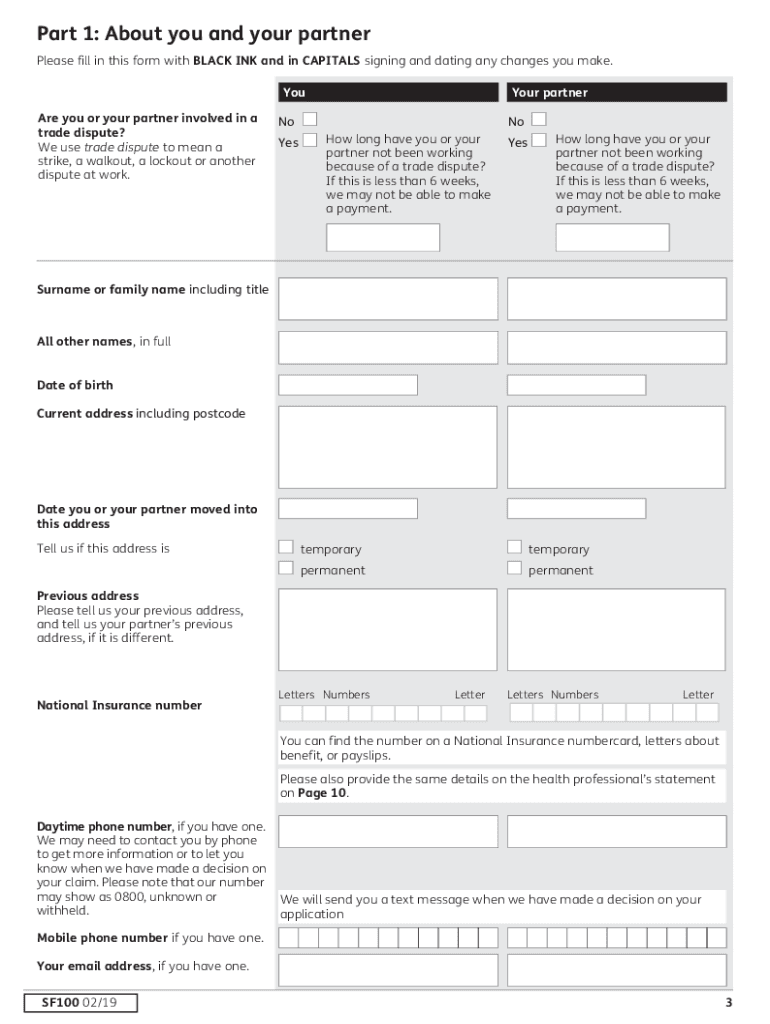

UK SF100 2019 free printable template

Show details

Sure Start

Maternity Grant

from the Social Fund

Important information

Before you fill in this claim form, please take a few minutes to read these notes.

They contain important information and help

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UK SF100

Edit your UK SF100 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK SF100 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UK SF100 online

Follow the steps below to use a professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit UK SF100. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK SF100 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK SF100

How to fill out UK SF100

01

Obtain the UK SF100 form from the relevant government website or office.

02

Fill in your personal details including your name, address, and contact information.

03

Provide details about your business, including its name, registration number, and type of business.

04

Specify the nature of the application you are submitting.

05

Complete any additional sections that are relevant to your application, such as financial information or supporting documents.

06

Review the form for accuracy and completeness.

07

Submit the form as per the instructions provided, whether online, by mail, or in person.

Who needs UK SF100?

01

Individuals or businesses applying for specific licenses, permits, or registrations in the UK.

02

Anyone who needs to declare certain information related to their business activities.

03

Those applying for funding or financial assistance from government programs.

Fill

form

: Try Risk Free

People Also Ask about

What benefits can I claim when pregnant and not working?

Income Support If you don't qualify for Maternity Allowance or Statutory Maternity Pay, are unemployed and can't look for work, or on a low income, you might be able to claim Universal Credit while you're pregnant.

What benefits can you get while pregnant?

Medicaid provides health coverage to low-income pregnant women during pregnancy and up to two months after the birth of the baby. CHIP Perinatal provides similar coverage for women who can't get Medicaid and don't have health insurance.

What grants can I claim when pregnant?

What is the Sure Start Maternity Grant? Pension Credit. Income Support. Universal Credit. Income-based Jobseeker's Allowance. Income-related Employment and Support Allowance. Child Tax Credit at a higher rate than the family element. Working Tax Credit which includes a disability or severe disability element.

What money can I get while pregnant?

There are benefits and financial help if you're pregnant, whether you're employed or not. Free prescriptions and dental care. Healthy Start. Tax credits. Statutory Maternity Pay. Maternity Allowance. Statutory Paternity Pay. Statutory Adoption Pay.

How can I make extra money while pregnant?

10 Ways to Earn Money While Pregnant Transcriptionist. Different companies require varying levels of expertise—this means there are a number of opportunities for beginners to transcribe audio content. Online Juror. Sell Clothes or Old Items. Translator. Online Tutor. Drive for a Food Delivery Service. Babysit. Housesit.

Can I get universal credit if I'm pregnant?

Income Support If you don't qualify for Maternity Allowance or Statutory Maternity Pay, are unemployed and can't look for work, or on a low income, you might be able to claim Universal Credit while you're pregnant.

Can I claim Universal Credit if I'm pregnant?

Income Support If you don't qualify for Maternity Allowance or Statutory Maternity Pay, are unemployed and can't look for work, or on a low income, you might be able to claim Universal Credit while you're pregnant.

How much money do you get from the government for having a baby UK?

You could get a one-off payment of £500 to help towards the costs of having a child. This is known as a Sure Start Maternity Grant.

What benefits can I claim when pregnant UK?

There are benefits and financial help if you're pregnant, whether you're employed or not. Free prescriptions and dental care. Healthy Start. Tax credits. Statutory Maternity Pay. Maternity Allowance. Statutory Paternity Pay. Statutory Adoption Pay.

Do you get extra Universal Credit when pregnant?

You can apply for help to pay for registered childcare from Universal Credit or Working Tax Credit. You may get this extra money when you return to work, depending on your income, but could also receive it while you are on maternity leave.

What benefits can I get when pregnant?

There are benefits and financial help if you're pregnant, whether you're employed or not. Free prescriptions and dental care. Healthy Start. Tax credits. Statutory Maternity Pay. Maternity Allowance. Statutory Paternity Pay. Statutory Adoption Pay.

What benefits can I claim when pregnant and unemployed UK?

1. Statutory Maternity Pay and Maternity Allowance. Pregnant working women and those recently employed can usually get Statutory Maternity Pay ( SMP ) from their employer or Maternity Allowance ( MA ) through Jobcentre Plus.

Do you still get the 500 pound grant when pregnant?

Yes. You can get the £500 maternity grant (or the Scottish equivalent) as long as you're claiming at least one of the benefits listed above and you're expecting your first child (or your second is twins or triplets).

What grants can I get when pregnant UK?

You could get a one-off payment of £500 to help towards the costs of having a child. This is known as a Sure Start Maternity Grant. If you live in Scotland you cannot get a Sure Start Maternity Grant. You can apply for a Pregnancy and Baby Payment instead.

Can you get maternity pay if unemployed UK?

You can get MA if you have changed jobs during pregnancy or you do not earn enough to get SMP or you are unemployed or self-employed during pregnancy. You do not need to be currently employed to claim MA, you may qualify for it on the basis of previous employment.

Do I get any money from the government when pregnant?

The Best Start Grant Pregnancy and Baby Payment is a cash payment to help eligible parents and carers when they're pregnant or have a new baby. You may be able to get this payment if: you're under 18. you're aged 18 or 19 and someone is getting benefits for you or.

What are you entitled to when pregnant UK?

You'll get £156.66 a week or 90% of your average weekly earnings (whichever is less) for 39 weeks if you're employed or have recently stopped working. You can get Maternity Allowance for up to 39 weeks. This means if you take the full 52 weeks Statutory Maternity Leave, your final 13 weeks will be unpaid.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit UK SF100 from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including UK SF100, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I create an eSignature for the UK SF100 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your UK SF100 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How can I edit UK SF100 on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing UK SF100.

What is UK SF100?

UK SF100 is a specific form used in the United Kingdom for reporting certain types of financial information, particularly for foreign companies operating in the UK.

Who is required to file UK SF100?

Foreign companies that have a presence in the UK and are required to report financial information, as per UK regulations, must file the UK SF100.

How to fill out UK SF100?

To fill out UK SF100, companies must gather accurate financial data, follow the guidelines provided by the relevant authorities, and ensure all sections of the form are completed before submission.

What is the purpose of UK SF100?

The purpose of UK SF100 is to ensure foreign companies comply with UK financial regulations by providing a clear and standardized report on their financial activities within the country.

What information must be reported on UK SF100?

The UK SF100 requires reporting on various financial metrics, including revenue, expenses, profit, and other relevant financial data as specified in the reporting guidelines.

Fill out your UK SF100 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK sf100 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.