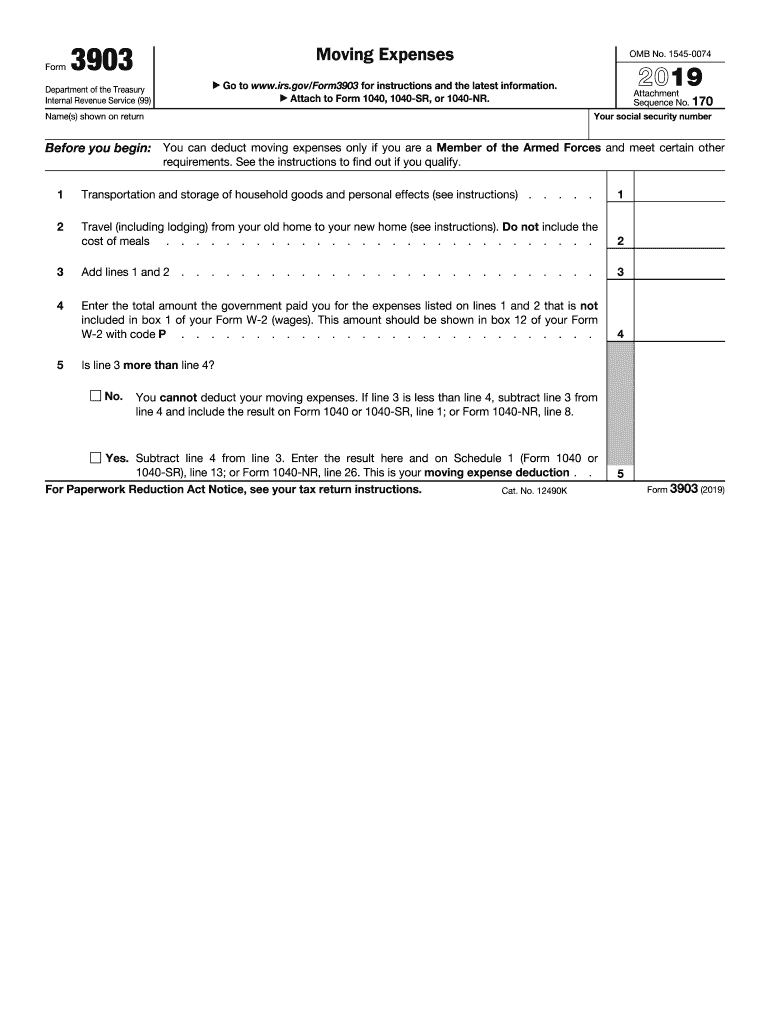

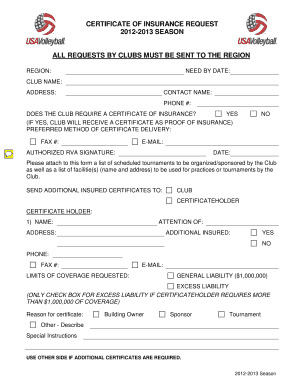

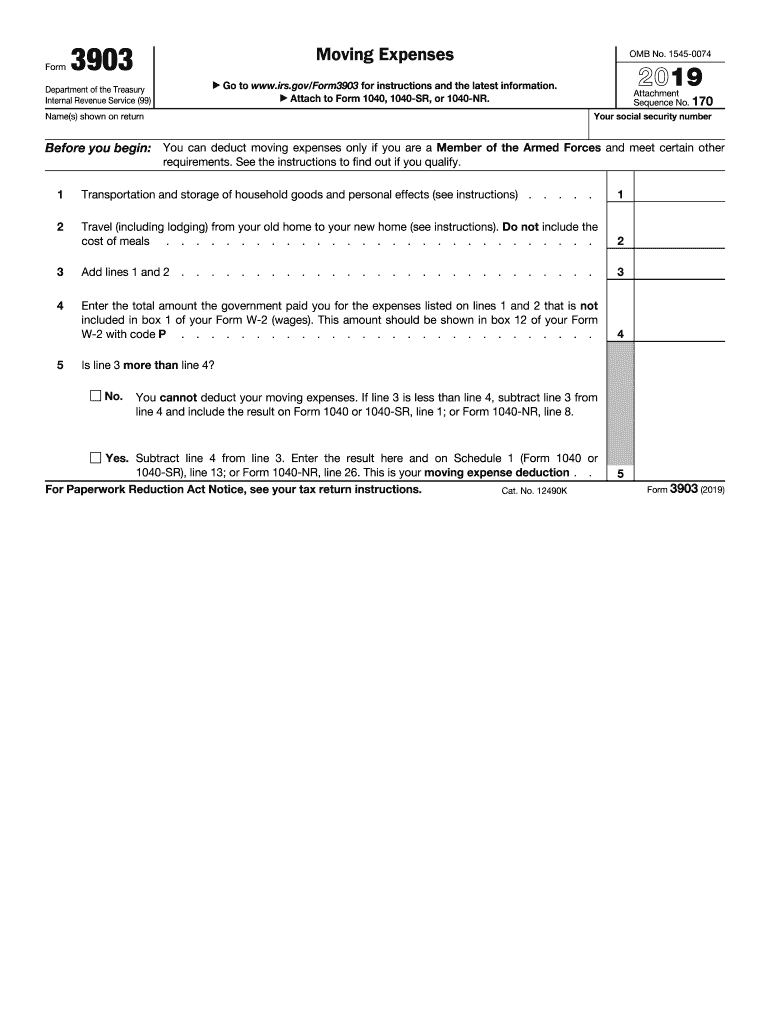

IRS 3903 2019 free printable template

Get, Create, Make and Sign IRS 3903

How to edit IRS 3903 online

Uncompromising security for your PDF editing and eSignature needs

IRS 3903 Form Versions

How to fill out IRS 3903

How to fill out IRS 3903

Who needs IRS 3903?

Instructions and Help about IRS 3903

Welcome to simple tax one two three deduct moving expense using form 3903 first create a tax return select form 3903 for moving expenses then click edit' button to enter expense you must meet distance and time test for moving expense deduction enter transport and storage costs and travel costs if you use your own vehicle you can deduct either actual out-of-pocket expense or use mileage cost enter the amount reimbursed by your employer in line three clicks Save when done then using import to enter w-2 income now click view to see the tax return form 3903 is prepared and your deduction is $1,500 the amount is also entered in form 1040 adjusted gross income section thanks for watching

People Also Ask about

What is form 3903?

Who qualifies for moving expense deduction?

What deductions can I claim without receipts?

What is not considered a deductible moving expense?

What is the IRS form for moving?

What moving expenses are covered?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit IRS 3903 online?

How do I edit IRS 3903 in Chrome?

Can I edit IRS 3903 on an iOS device?

What is IRS 3903?

Who is required to file IRS 3903?

How to fill out IRS 3903?

What is the purpose of IRS 3903?

What information must be reported on IRS 3903?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.