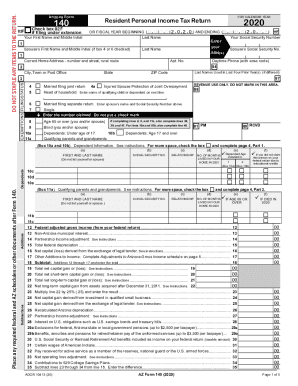

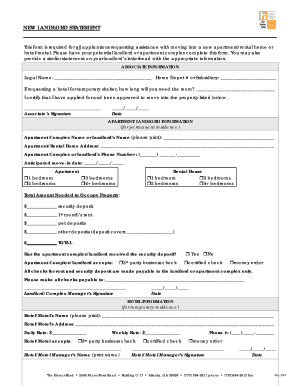

IRS 712 2006 free printable template

Show details

2 TLS, have you transmitted all R text files for this cycle update? Date. R.S. SPECIFICATIONS TO BE REMOVED BEFORE PRINTING INSTRUCTIONS TO PRINTERS FORM 712, PAGE 1 of 4 PRINTS: HEAD-to-HEAD MARGINS:

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign pdffiller form

Edit your irs form 712 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 712 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 712 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 712. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 712 Form Versions

Version

Form Popularity

Fillable & printabley

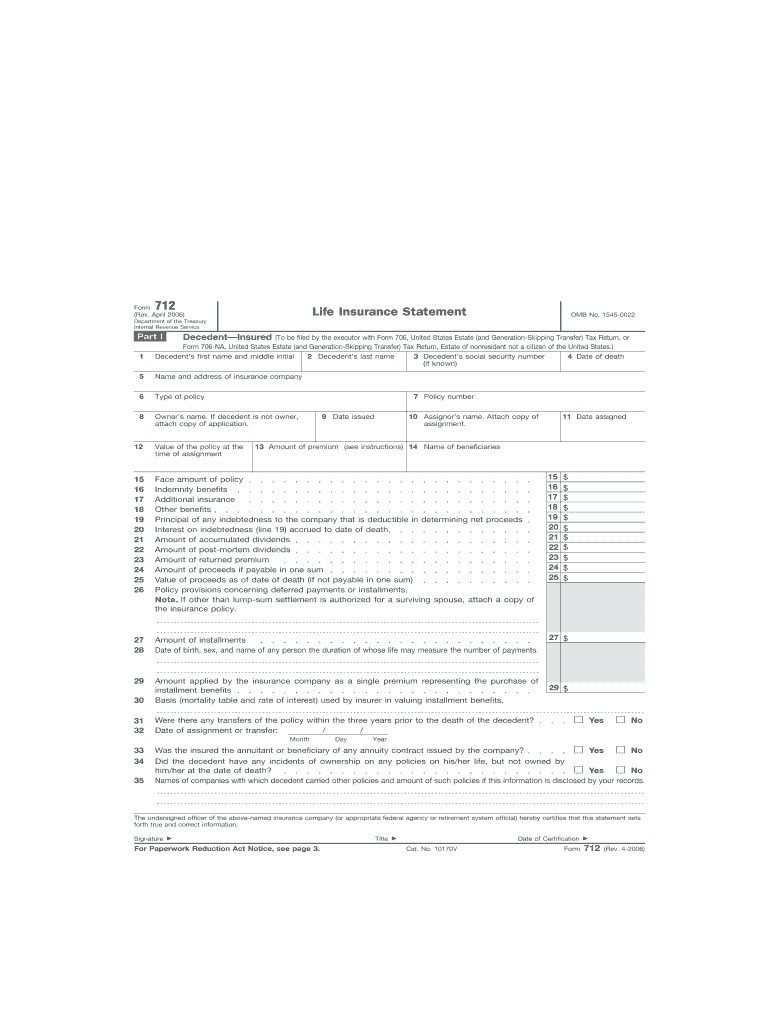

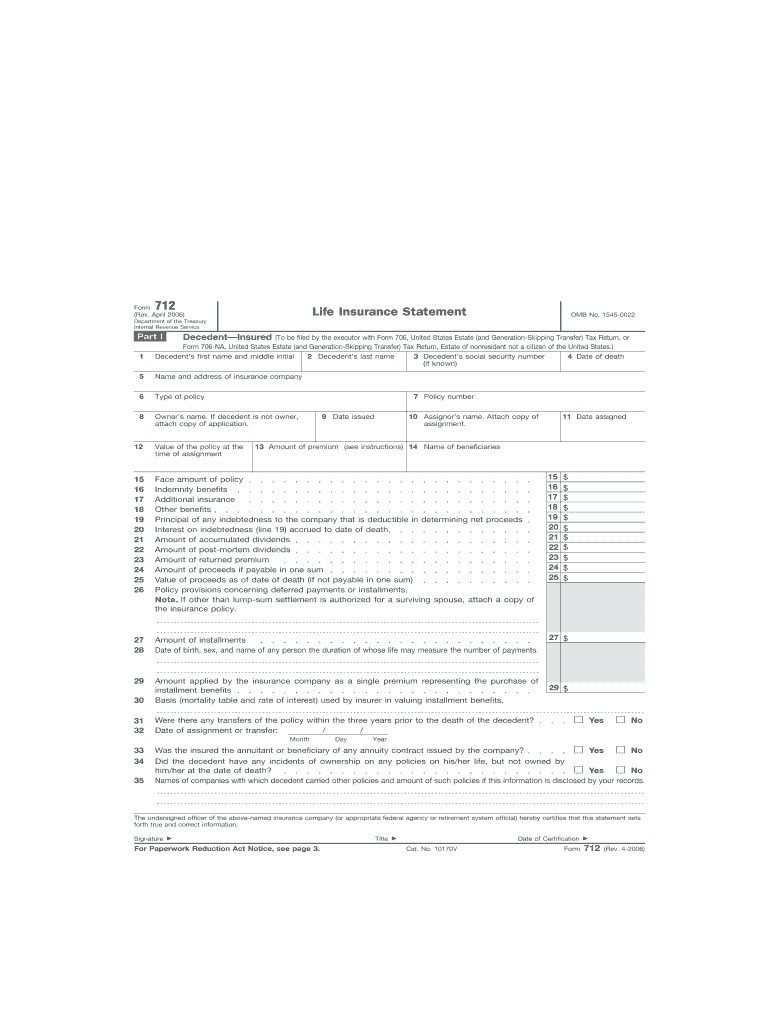

How to fill out IRS 712

How to fill out IRS 712

01

Obtain a copy of IRS Form 712 from the IRS website or a tax professional.

02

Identify the decedent's date of death and enter it in the designated section on the form.

03

Fill out the value of the life insurance policy at the time of the decedent's death.

04

Include any additional relevant information, such as the name of the insurance company and the policy number.

05

Review the completed form for accuracy and ensure all necessary attachments are included.

06

Sign and date the form before submission.

07

Mail the completed form to the appropriate IRS address or file electronically, if applicable.

Who needs IRS 712?

01

Executors or administrators of a decedent's estate.

02

Beneficiaries of a life insurance policy who need to report its value for tax purposes.

03

Individuals who are settling an estate that includes life insurance proceeds.

Fill

form

: Try Risk Free

People Also Ask about

Who prepares IRS Form 712?

Form 712 is filed by executors with Form 706, 706-NA, or 709 for insurance policy or premium amounts.

How do I get a Form 712?

If you have a life insurance policy claim and need to obtain a copy of the IRS Federal Form 712, you can download a copy on the IRS website.

Do insurance companies provide Form 712?

After the death of the insured, estates that need to file an estate tax return will need to ask the insurance company to provide a Form 712 for each policy insuring the decedent.

What is the purpose of Form 712?

The IRS Federal Form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. Because it's typically the executor who manages the financial affairs of the deceased, it's the executor's responsibility to file the form - along with an estate tax return if needed.

Do you get a tax form for life insurance payments?

Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them. However, any interest you receive is taxable and you should report it as interest received.

Who must file Form 712?

More In Forms and Instructions Form 712 is filed by executors with Form 706, 706-NA, or 709 for insurance policy or premium amounts.

What is a 712 letter?

Form 712 (“Life Insurance Statement”) is a supplemental form the IRS requests whenever a life insurance policy must be valued for gift tax purposes on the Form 709 (Gift Tax return) or for estate tax purposes on the Form 706 (Estate Tax return).

Do you need a Form 712 for an annuity?

While life insurance is usually income tax free, it is not always estate tax free. That is why the Form 712 is necessary. Failure to file a Form 712 when one is necessary greatly increases the likelihood of an IRS audit on the Federal Estate Tax Return and the assessment of additional taxes, interest, and penalties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IRS 712 directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your IRS 712 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I edit IRS 712 in Chrome?

Install the pdfFiller Google Chrome Extension to edit IRS 712 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I sign the IRS 712 electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your IRS 712 and you'll be done in minutes.

What is IRS 712?

IRS Form 712 is a form used to report the value of life insurance policies and annuities for estate tax purposes.

Who is required to file IRS 712?

The estate executor or administrator is required to file IRS Form 712 if there are life insurance policies or annuities involved in the estate.

How to fill out IRS 712?

To fill out IRS Form 712, gather information regarding the insured, the policy details, and the beneficiary. Complete the required sections, sign, and date the form.

What is the purpose of IRS 712?

The purpose of IRS Form 712 is to provide the IRS with information about the value of life insurance policies and annuities for determining estate tax liabilities.

What information must be reported on IRS 712?

The information reported on IRS Form 712 includes the insured's details, the policy number, the type of insurance, the face value, cash surrender value, and the name of the beneficiary.

Fill out your IRS 712 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 712 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.