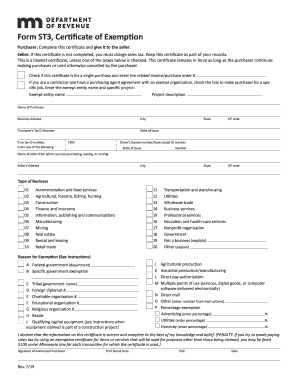

MN DoR ST3 2013 free printable template

Show details

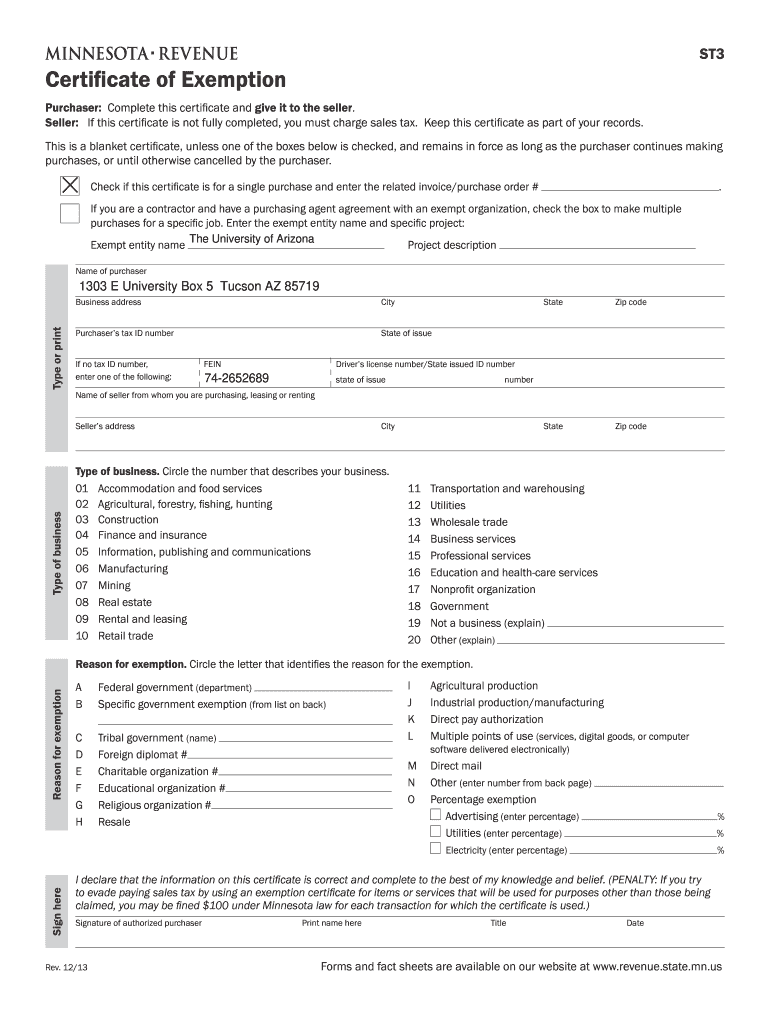

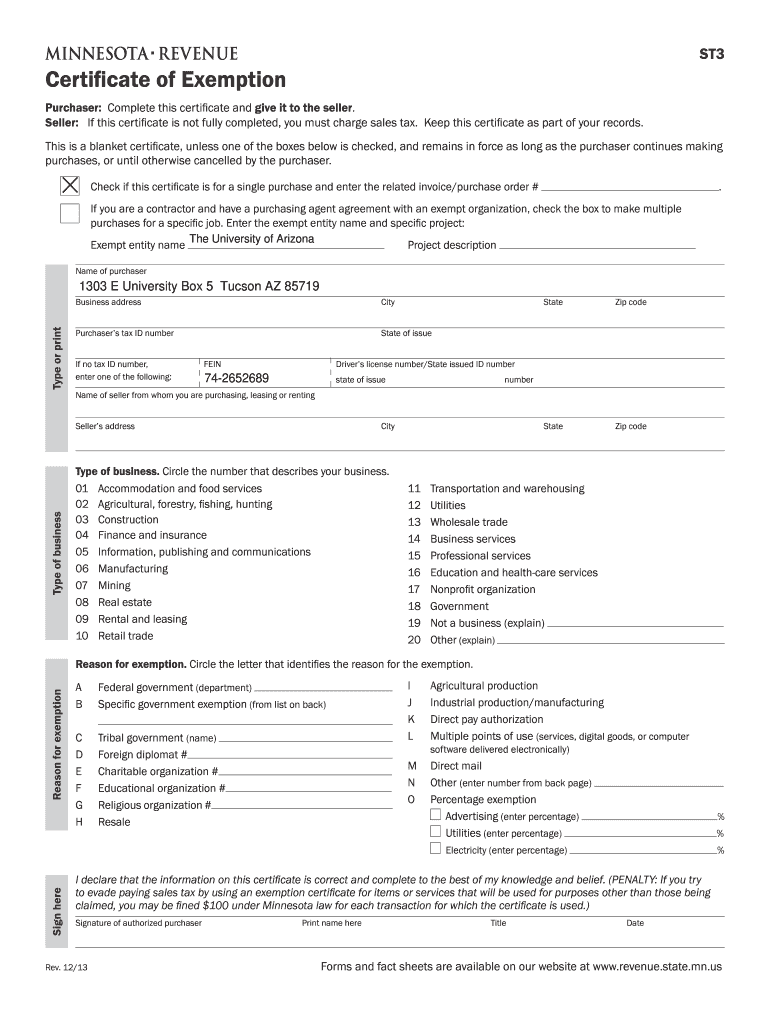

Form ST3 instructions and exemption descriptions website at www. revenue. state. mn.us. Purchasers Complete this certificate and give it to the seller. Revenue. state. mn.us Exemption descriptions See the Form ST3 instructions and information about the following exemptions. Purchaser must enter exempt percentage on Form ST3. Revenue Notice 12-11 Sales Tax Exemptions Qualified Data Centers. Forms and information Website www. revenue. state. mn.u...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MN DoR ST3

Edit your MN DoR ST3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MN DoR ST3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MN DoR ST3 online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit MN DoR ST3. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MN DoR ST3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MN DoR ST3

How to fill out MN DoR ST3

01

Obtain the MN DoR ST3 form from the Minnesota Department of Revenue website or your local office.

02

Fill out your personal information at the top of the form, including name, address, and Social Security number.

03

Indicate the tax period for which you are filing.

04

Provide information regarding the type of sale and the nature of the transaction.

05

List the total sales amount and the amount of sales tax collected.

06

Include any applicable exemptions or deductions.

07

Sign and date the form at the bottom.

08

Submit the completed form to the Minnesota Department of Revenue by the established deadline.

Who needs MN DoR ST3?

01

Businesses operating in Minnesota that make taxable sales.

02

Sellers who are registered for sales tax collection in Minnesota.

03

Individuals or entities required to report sales tax for transactions conducted in Minnesota.

Fill

form

: Try Risk Free

People Also Ask about

How do I change my name on my Land Registry title?

On a name change You'll need to download and complete Form ID1, which proves your identity when applying for a name change on the title register. Send ID1 with evidence of your change of name (for example, the deed poll document, your marriage certificate or your decree absolute) and AP1 to the Land Registry.

What is a statutory declaration for land?

A statutory declaration is a formal statement made affirming that something is true to the best knowledge of the person making the declaration. It has to be signed in the presence of a solicitor, commissioner for oaths or notary public.

How long does it take to change your name on the Land Registry?

Over half of the remaining applications to update the register, such as changing a name or transferring a property title, take 4 weeks to complete, with most completed in just over 3 months.

What is an ST3 Land Registry?

Form ST3: Statement of truth in support of an application for registration of land based upon lost or destroyed deeds.

What is a statutory declaration use of land?

The statutory declaration sets out the information that must be included to comply with Land Registry requirements when an application is being made to register the benefit of a prescriptive right of way. For more information, see Land Registry Practice Guide 52: Easements claimed by prescription.

How long does it take to change name on property deeds?

It usually takes four to six weeks to complete the legal processes involved in the transfer of title.

What is an ST1 form?

Form ST1: Statement of truth in support of an application for registration based upon adverse possession.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify MN DoR ST3 without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your MN DoR ST3 into a dynamic fillable form that you can manage and eSign from anywhere.

How do I execute MN DoR ST3 online?

pdfFiller has made it easy to fill out and sign MN DoR ST3. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an electronic signature for the MN DoR ST3 in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your MN DoR ST3 in minutes.

What is MN DoR ST3?

MN DoR ST3 is a seller's exemption certificate used in Minnesota to claim sales tax exemption on purchases made for resale or certain other exempt purposes.

Who is required to file MN DoR ST3?

Businesses and individuals who are purchasing items for resale, or qualifying for specific exemptions under Minnesota sales tax law, are required to file MN DoR ST3.

How to fill out MN DoR ST3?

To fill out MN DoR ST3, provide the seller's name, address, and tax ID number, the purchaser's information, and specify the reason for the exemption along with the items being purchased.

What is the purpose of MN DoR ST3?

The purpose of MN DoR ST3 is to allow purchasers to claim exempt status from sales tax for qualifying purchases, ensuring compliance with Minnesota tax regulations.

What information must be reported on MN DoR ST3?

MN DoR ST3 must report the purchaser's name, address, reason for exemption, the type of goods or services being purchased, and the seller's details.

Fill out your MN DoR ST3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MN DoR st3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.