ZA ABSA 3740 EX 2009 free printable template

Show details

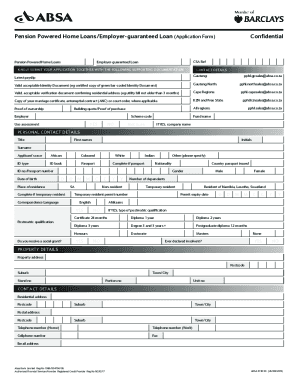

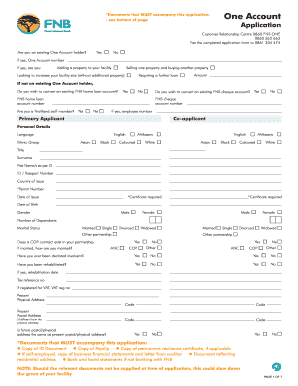

Absa Bank Limited Reg No 1986/004794/06 Pension-supported Housing Loan/Employee-guaranteed Housing Loan Application Form CSA Ref Employee-guaranteed Housing Loan KINDLY SUBMIT YOUR APPLICATION TOGETHER WITH THE FOLLOWING SUPPORTING DOCUMENTATION CONTACT DETAILS Gauteng Latest Payslip 011 350 1705/1747/6354 pshl.gsales absa.co. za 012 303 2270 or 012 310 7664/698 pshl*northsales absa*co. za 021 405 7878/7783/7935 pshl*capesales absa*co. za 031 366 9277/9198 pshl*kznsales absa*co. za Gauteng...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ZA ABSA 3740 EX

Edit your ZA ABSA 3740 EX form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ZA ABSA 3740 EX form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ZA ABSA 3740 EX online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ZA ABSA 3740 EX. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ZA ABSA 3740 EX Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ZA ABSA 3740 EX

How to fill out ZA ABSA 3740 EX

01

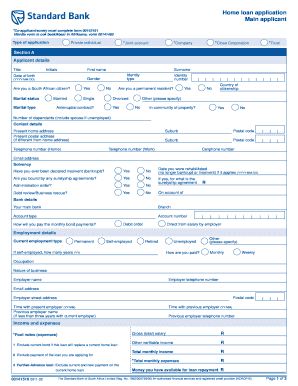

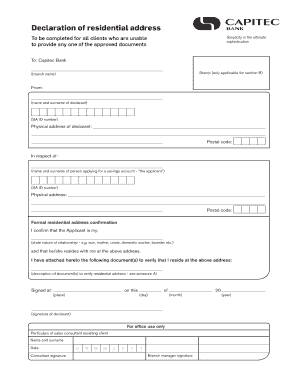

Begin by gathering all required personal and financial information.

02

Obtain the ZA ABSA 3740 EX form from the relevant authority or website.

03

Fill in your name, address, and contact details in the designated fields.

04

Provide accurate financial information, including your income, expenses, and assets.

05

Ensure to complete all sections of the form to avoid delays.

06

Review the form for any errors or missing information.

07

Sign and date the form at the bottom.

08

Submit the form through the specified method, either online or by mail.

Who needs ZA ABSA 3740 EX?

01

Individuals applying for financial assistance or loan products from ABSA.

02

Clients who wish to provide a detailed account of their financial status for credit evaluation.

03

Businesses seeking financing options or line of credit from ABSA.

Fill

form

: Try Risk Free

People Also Ask about

How long does SA home loan Approval take?

How long does it take for the bank to approve a home loan in South Africa? Home loan approval usually takes around one week, although it can take longer if certain requirements haven't been met. You can use our Bond Calculator to determine what home loan you would qualify for.

What credit score do you need to qualify for a home?

The minimum credit score needed for most mortgages is typically around 620. However, government-backed mortgages like Federal Housing Administration (FHA) loans typically have lower credit requirements than conventional fixed-rate loans and adjustable rate mortgages (ARMs).

How fast can a bank approve a home loan?

With some lenders that have an automated preapproval process, you can get preapproved in just a few seconds online. Others might take a day or two. Once you're preapproved, you'll submit an official loan application. That's when the process might begin to inch toward that 51-day average.

How do I make sure I get approved for a loan?

Here are five tips to boost your chances of qualifying for a personal loan. Clean up your credit. Credit scores are major considerations on personal loan applications. Rebalance your debts and income. Don't ask for too much cash. Consider a co-signer. Find the right lender.

How long does Absa bank take to process a loan?

How long does a loan application take? #OwnIt It normally takes 48 hours to get approval once all the documents have been provided .

What are basic documents required for home loan?

Home Loan applicants need to furnish personal documents, such as Pan Card and Aadhar Card, among others; income-related documents, such as bank account statements; employment/ business-related documents, such as salary slips or profit and loss statements; and property-related documents.

How long does it take to get an approval letter for a mortgage?

On average, it takes 7-10 days to get a pre-approval, although in some cases it may take less time. To speed up the home loan pre-approval time, you should gather your financial documents that the lender will require (e.g., W2s, proof of income, tax returns, etc.).

How do I check if I qualify for a home loan?

Applying for a Home Loan Review your income and expenses, including the reliability of your income. Authenticate your income and employment. Assess your past financial track-record. Check and assess your credit score and creditworthiness. Verify your identity. Determine your age in relation to the period of the loan.

What do I put on a loan application?

This initial application will often ask for your personal information, such as your name, address, phone number, date of birth, and Social Security Number. You may also be required to state your desired loan amount and purpose, as well as additional financial details like your gross monthly income or mortgage payment.

What documents do I need to buy a house in South Africa?

For all applications A copy of your ID document. A copy of the offer to purchase containing both the seller and purchaser's details (not necessary for a pre-approval) Proof of income. Six months' worth of bank statements.

How long does Absa take to approve?

It takes two to three weeks for the documents to be inspected. The whole process (from start to registration) can take up to 3 months.

How long does Absa mortgage Approval take?

The whole process can take up to 3 months (in some cases longer) after which you can start the move into your new home.

What is the easiest home loan to qualify for?

An FHA loan will typically be the easiest mortgage to qualify for because it offers the lowest credit score requirement — far lower than for a conventional loan — and requires only a 3.5% down payment. However, if you have special circumstances, do research tailored to your situation.

How do I write a loan application form?

Things To Remember in Writing a Loan Application Letter Observe the proper rules for writing formal letters. State your intent to borrow a specific amount of money. Explain in detail the reason for borrowing money. Enumerate your assets and liabilities.

How do you start a loan application letter?

Heading and Greeting Your name and contact information. The date of your letter. The name, title and contact information of your loan agent. A subject line stating that you're writing about a loan and specifying the dollar amount you're requesting. A greeting.

What are 3 items needed to be approved for a mortgage loan?

Requirements for Pre-Approval Proof of Income. Potential homebuyers must provide W-2 wage statements and tax returns from the past two years, current pay stubs that show income and year-to-date income, and proof of additional income sources such as alimony or bonuses. Proof of Assets. Good Credit.

How to write a loan?

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

What documents do I need to apply for a home loan in South Africa?

When applying for a home loan you will need documents such as your valid South African identity card or document, proof of your income, a list of your expenses, an offer to purchase (also known as a sales agreement), as well as your banking details. Use this checklist to help you get your ducks in a row.

How do I figure out if I qualify for a home loan?

Using a percentage of your income can help determine how much house you can afford. For example, the 28/36 rule may help you decide how much to spend on a home. The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt.

How much can I borrow for a house based on my income?

Most future homeowners can afford to mortgage a property even if it costs between 2 and 2.5 times the gross of their income. Under this particular formula, a person that is earning $200,000 each year can afford a mortgage up to $500,000.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the ZA ABSA 3740 EX in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your ZA ABSA 3740 EX and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I fill out the ZA ABSA 3740 EX form on my smartphone?

Use the pdfFiller mobile app to complete and sign ZA ABSA 3740 EX on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit ZA ABSA 3740 EX on an iOS device?

Use the pdfFiller mobile app to create, edit, and share ZA ABSA 3740 EX from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

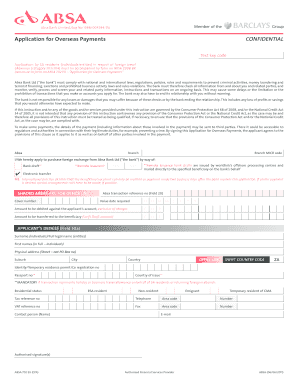

What is ZA ABSA 3740 EX?

ZA ABSA 3740 EX is a specific form used in South Africa for the reporting of certain financial transactions, typically related to banking or financial institutions.

Who is required to file ZA ABSA 3740 EX?

Entities and individuals who engage in financial transactions that require disclosure under South African regulations are typically required to file ZA ABSA 3740 EX.

How to fill out ZA ABSA 3740 EX?

To fill out ZA ABSA 3740 EX, one generally needs to provide accurate details regarding the financial transactions, including amounts, parties involved, and dates, ensuring all required fields are completed as per the guidelines.

What is the purpose of ZA ABSA 3740 EX?

The purpose of ZA ABSA 3740 EX is to ensure compliance with financial regulatory requirements, facilitate tracking of financial transactions, and enhance transparency in the financial system.

What information must be reported on ZA ABSA 3740 EX?

Information that must be reported on ZA ABSA 3740 EX typically includes transaction details, parties involved, amounts, dates of transactions, and any other relevant identifiers as specified by regulatory authorities.

Fill out your ZA ABSA 3740 EX online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ZA ABSA 3740 EX is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.