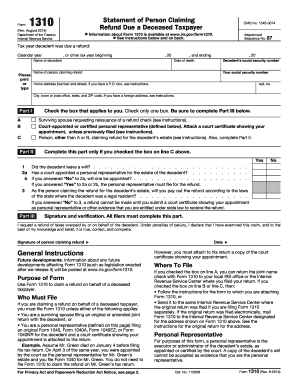

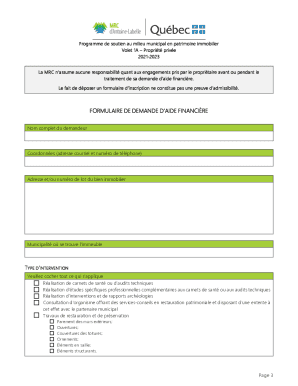

IRS 1310 2019 free printable template

Show details

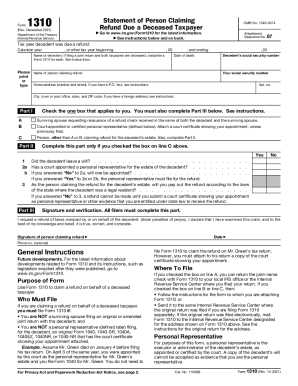

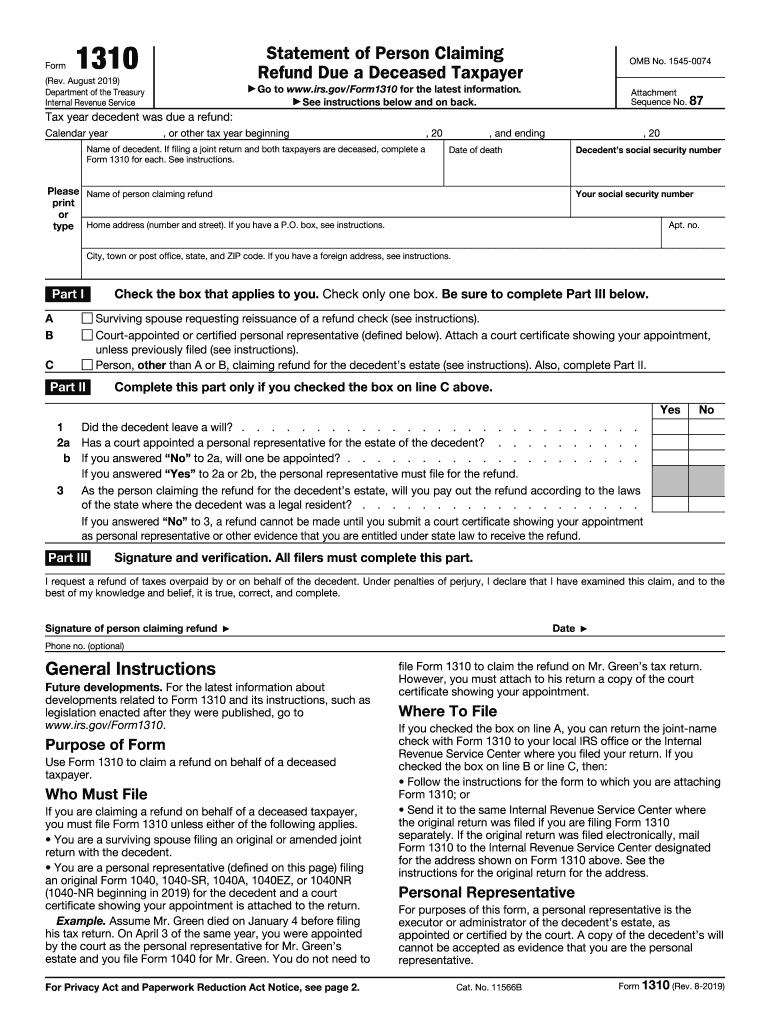

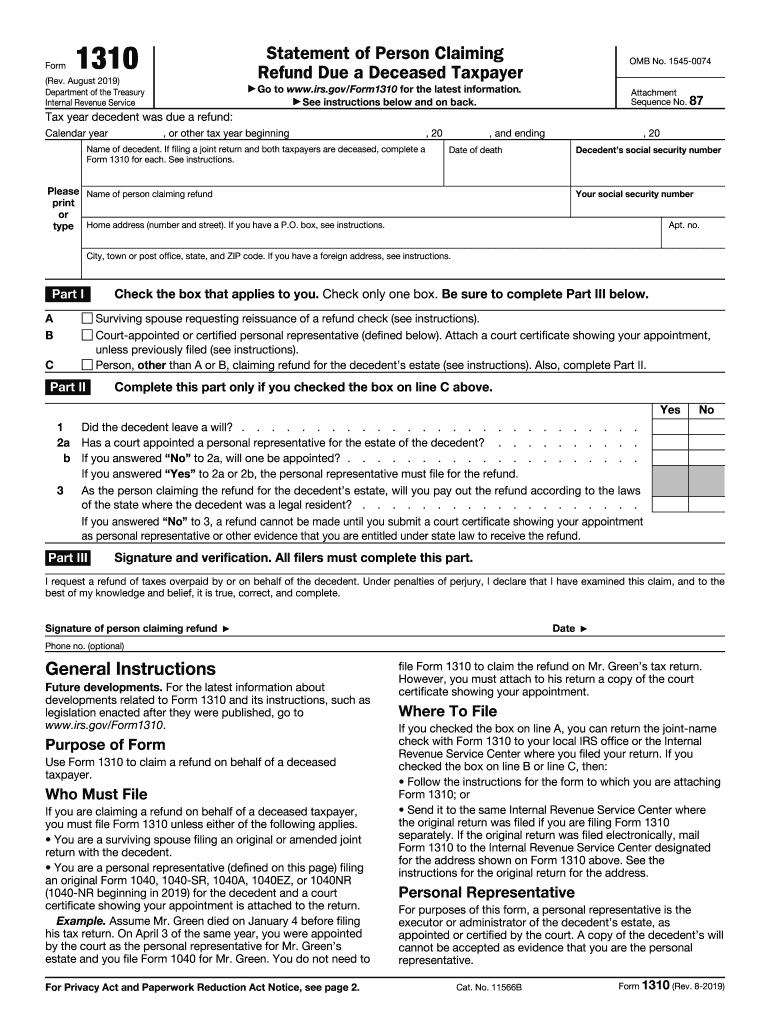

You can return the joint-name check with Form 1310 to your local IRS office or the Internal Revenue Service Center where you filed your return. A new check will be issued in your name and mailed to you. If the original return was filed electronically mail Form 1310 to the Internal Revenue Service Center designated for the address shown on Form 1310 above. Where To File If you checked the box on line A you can return the joint-name check with Form 1310 to your local IRS office or the Internal...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 1310

Edit your IRS 1310 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 1310 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 1310 online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IRS 1310. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 1310 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 1310

How to fill out IRS 1310

01

Obtain a copy of IRS Form 1310 from the IRS website or your local IRS office.

02

Fill in the decedent's information including their name, Social Security number, and the date of death.

03

Provide your information as the claimant (your name, Social Security number, and address).

04

Indicate your relationship to the deceased in the appropriate section.

05

If filing with a tax return, ensure you attach Form 1310 to the tax return.

06

If filing Form 1310 separately, include all required documentation and mail it to the appropriate IRS address.

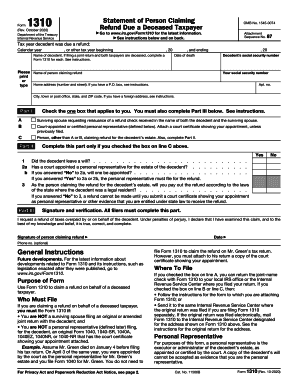

Who needs IRS 1310?

01

Form 1310 is needed by individuals who are claiming a refund on behalf of a deceased taxpayer.

Fill

form

: Try Risk Free

People Also Ask about

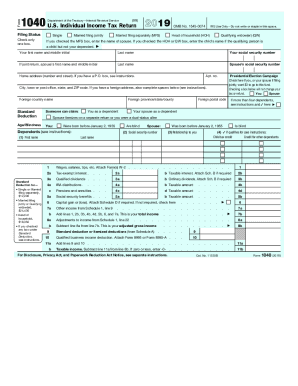

How does a surviving spouse file a tax return?

As long as you don't remarry, you have a choice to file as married filing jointly with your deceased spouse in the year of your spouse's death. You also can file married filing separately. If there is an executor, you will need to discuss these options with the executor as the executor must agree to a joint return.

Can IRS form 1310 be filed electronically?

You cannot include this document in the electronic file or as an attachment. As a result, you must paper file the return.

Do you need to report death of spouse to IRS?

When someone dies, their surviving spouse or representative files the deceased person's final tax return. On the final tax return, the surviving spouse or representative will note that the person has died. The IRS doesn't need any other notification of the death.

Who is not required to file form 1310?

If a court-appointed personal representative is specified, they are not a surviving spouse, and the return results in a refund, Form 1310 isn't needed.

Does 1310 need to be signed?

Form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund that was due to the taxpayer at the time of death. If a personal representative has been appointed, they must sign the tax return.

Does a surviving spouse need to file form 1310?

If you're a surviving spouse filing a joint return, or a court-appointed or court-certified personal representative filing an original return for the decedent, you don't have to file Form 1310.

Where do I file IRS form 1310?

Where do I mail Form 1310? If you're a surviving spouse, you'll mail Form 1310 to the same Internal Revenue Service Center where you filed your return. If you aren't the surviving spouse, then you'll mail the form to the same Internal Revenue Service Center where the original return was filed.

Do I have to paper file form 1310?

You cannot include this document in the electronic file or as an attachment. As a result, you must paper file the return.

Does form 1310 have to be mailed?

If filing a Form 1310 along with a Form 1041, the IRS will issue the refund to the estate rather than to any individual. Form 1310 must be mailed to the IRS. It cannot be efiled.

Can I file form 1310 online?

You cannot include this document in the electronic file or as an attachment. As a result, you must paper file the return.

Does form 1310 have to be mailed?

How do I file Form 1310? Unfortunately, Form 1310 cannot be e-filed. It must be mailed.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IRS 1310 from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including IRS 1310, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I fill out IRS 1310 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your IRS 1310, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I fill out IRS 1310 on an Android device?

Use the pdfFiller app for Android to finish your IRS 1310. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is IRS 1310?

IRS 1310 is a tax form used to claim a refund on behalf of a deceased taxpayer.

Who is required to file IRS 1310?

An executor, administrator, or other authorized representative of a deceased taxpayer is required to file IRS 1310 to claim any tax refunds due.

How to fill out IRS 1310?

To fill out IRS 1310, you need to provide information such as the deceased's name, Social Security number, and details of the claimant, including their relationship to the deceased.

What is the purpose of IRS 1310?

The purpose of IRS 1310 is to allow eligible individuals to claim tax refunds for a deceased taxpayer.

What information must be reported on IRS 1310?

Information required on IRS 1310 includes the deceased taxpayer's name, Social Security number, the type of refund being claimed, and the claimant's details and relationship to the deceased.

Fill out your IRS 1310 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 1310 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.