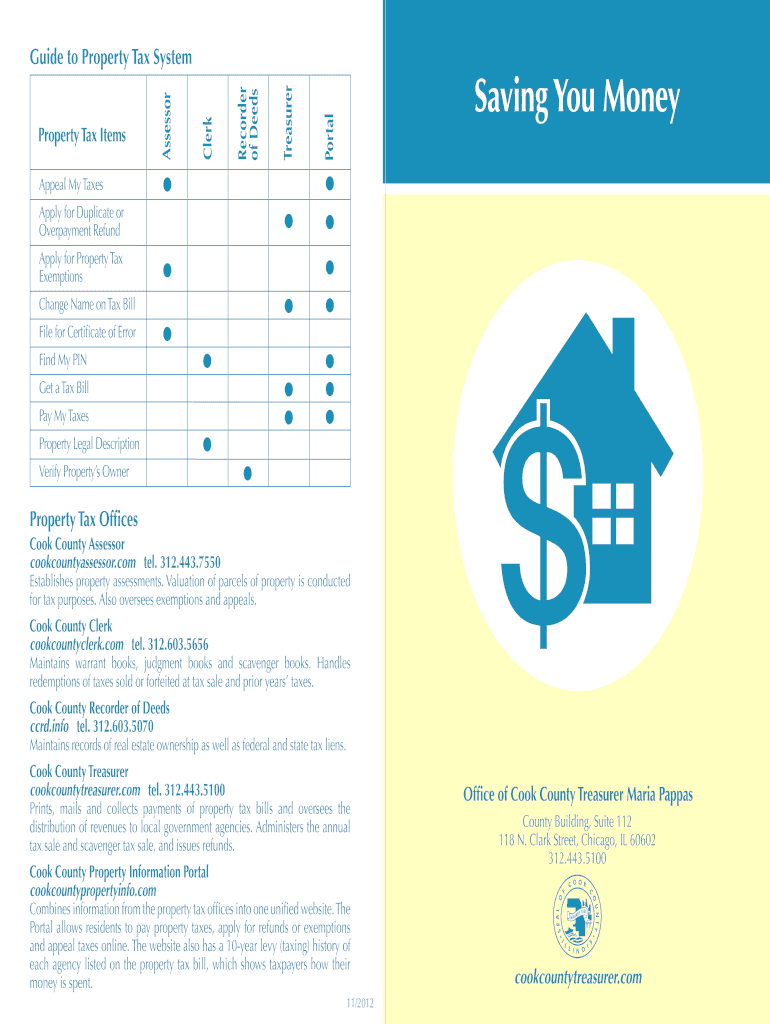

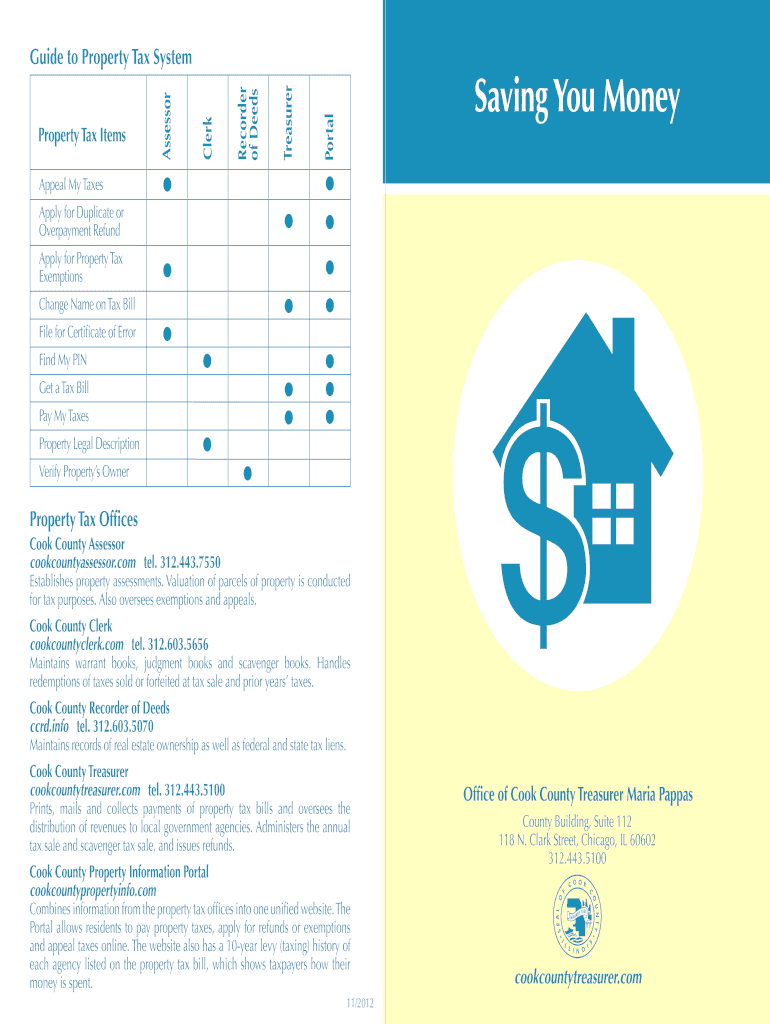

Get the free Appeal My Taxes

Show details

Appeal My TaxesvFind My Informal

v

change Name on Tax Bill

File for Certificate of Error

get a Tax BillvvPay My TaxesvvProperty Legal Description

Verify Properties OwnerSaving You MoneyvvApply for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign appeal my taxes

Edit your appeal my taxes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your appeal my taxes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing appeal my taxes online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit appeal my taxes. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out appeal my taxes

How to fill out an appeal for my taxes?

01

Gather all relevant documentation: Before you start the process, ensure that you have all the necessary documents such as tax returns, income statements, and any supporting evidence for your appeal.

02

Understand the reasons for appealing: Familiarize yourself with the specific reasons why you believe your taxes were assessed incorrectly or unfairly. It could be due to errors in calculation, overlooked deductions, or changes in your financial situation.

03

Review the appeals process: Research and understand the specific guidelines and procedures for filing an appeal with your local tax authority. Each jurisdiction may have different requirements, deadlines, and forms to be filled out.

04

Fill out the necessary forms: Complete the required appeal forms accurately and thoroughly. Provide all the essential information, including your contact details, tax year(s) in question, specific reasons for the appeal, and any supporting documentation.

05

Attach supporting evidence: Gather any additional documentation that supports your case, such as receipts, bank statements, or other relevant records. Make copies and include them with your appeal to strengthen your argument.

06

Submit your appeal: Follow the instructions provided by your local tax authority to submit your completed appeal forms and supporting documentation. Keep copies of everything you submit for your records.

07

Await a response: After submitting your appeal, be patient and wait for a response from the tax authority. This can take some time, so it's important to follow up and check the status of your appeal if necessary.

08

Prepare for an appeal hearing: In some cases, you may be required to present your case in an appeal hearing. If this happens, prepare your arguments, gather any additional evidence, and be ready to articulate your position clearly and convincingly.

09

Consider professional assistance: If you find the appeals process complex or overwhelming, you may want to consult with a tax professional or a tax attorney who can guide you and provide expert advice throughout the appeal.

10

Keep records and track the outcome: Maintain copies of all documents and correspondence related to your appeal. In case of any future disputes or questions about your taxes, having a comprehensive record of your appeal can be beneficial.

Who needs to appeal their taxes?

01

Individuals who believe their taxes were incorrectly assessed: If you feel that your tax liability was calculated incorrectly, you may need to appeal your taxes to rectify any errors or discrepancies.

02

Taxpayers who have experienced changes in their financial situation: If significant changes such as job loss, medical expenses, or other financial hardships have occurred since filing your taxes, you might want to appeal to update your tax assessment to reflect your current situation.

03

Individuals who believe they qualify for additional deductions or exemptions: If you discovered overlooked deductions, credits, or exemptions that can reduce your tax liability, appealing your taxes can help you claim those benefits.

04

Anyone who believes their property's assessed value is incorrect: If you are a property owner and believe that your property's value was inaccurately assessed for tax purposes, appealing your property taxes can be a way to challenge the assessment and potentially lower your tax burden.

05

Business owners with complex tax situations: Business owners facing complex tax situations and dealing with issues such as business deductions, depreciation, or payroll taxes might need to appeal their taxes to ensure accurate calculations and fair assessments.

Remember, it is important to consult with a tax professional or seek legal advice specific to your situation to ensure you follow the correct process and meet all the necessary requirements when appealing your taxes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute appeal my taxes online?

pdfFiller has made it simple to fill out and eSign appeal my taxes. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit appeal my taxes in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your appeal my taxes, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out the appeal my taxes form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign appeal my taxes. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is appeal my taxes?

Appealing your taxes is the process of formally challenging the assessed value of your property for tax purposes.

Who is required to file appeal my taxes?

Property owners who believe their property taxes are too high are required to file an appeal.

How to fill out appeal my taxes?

You can fill out an appeal by submitting the necessary forms to your local tax assessor's office.

What is the purpose of appeal my taxes?

The purpose of appealing your taxes is to potentially lower the assessed value of your property, which can result in lower property tax payments.

What information must be reported on appeal my taxes?

You must provide evidence supporting your claim that the assessed value of your property is too high, such as recent appraisals or comparable property sales.

Fill out your appeal my taxes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Appeal My Taxes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.