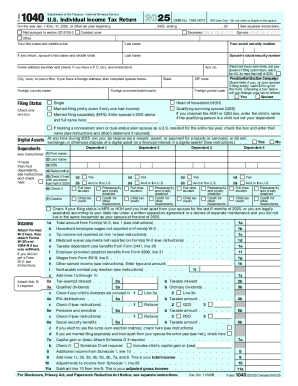

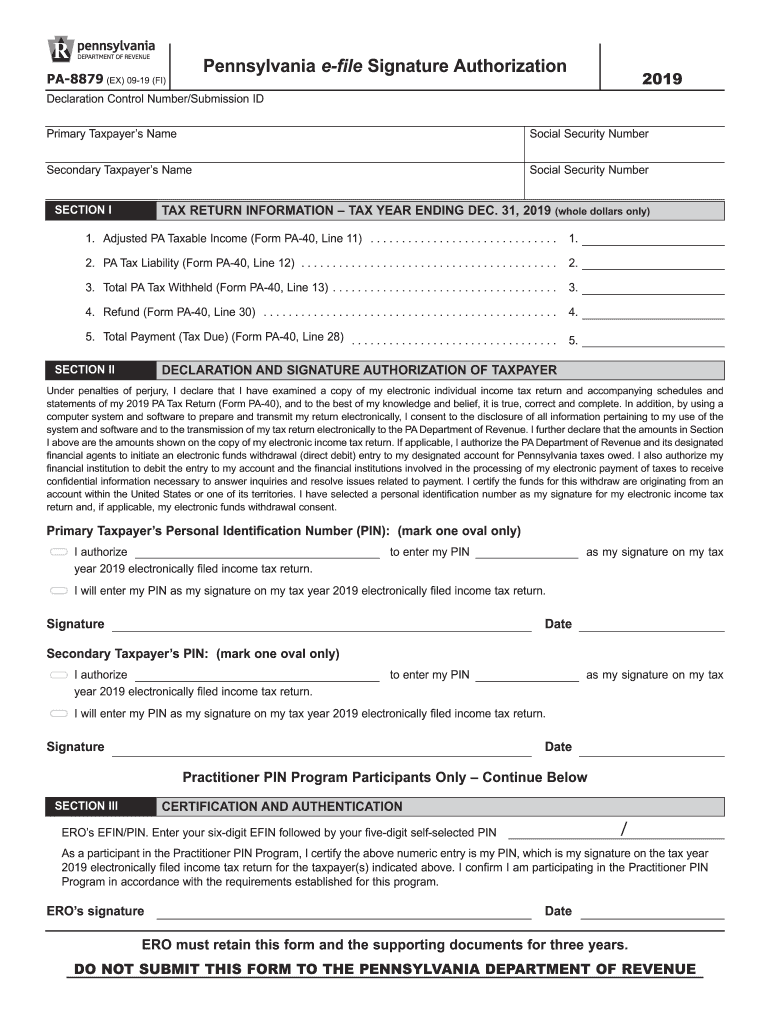

PA PA-8879 2019 free printable template

Show details

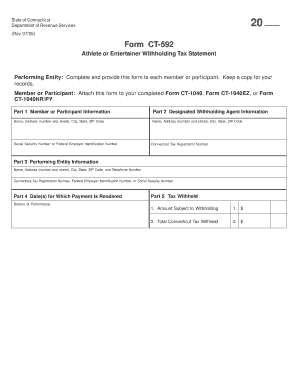

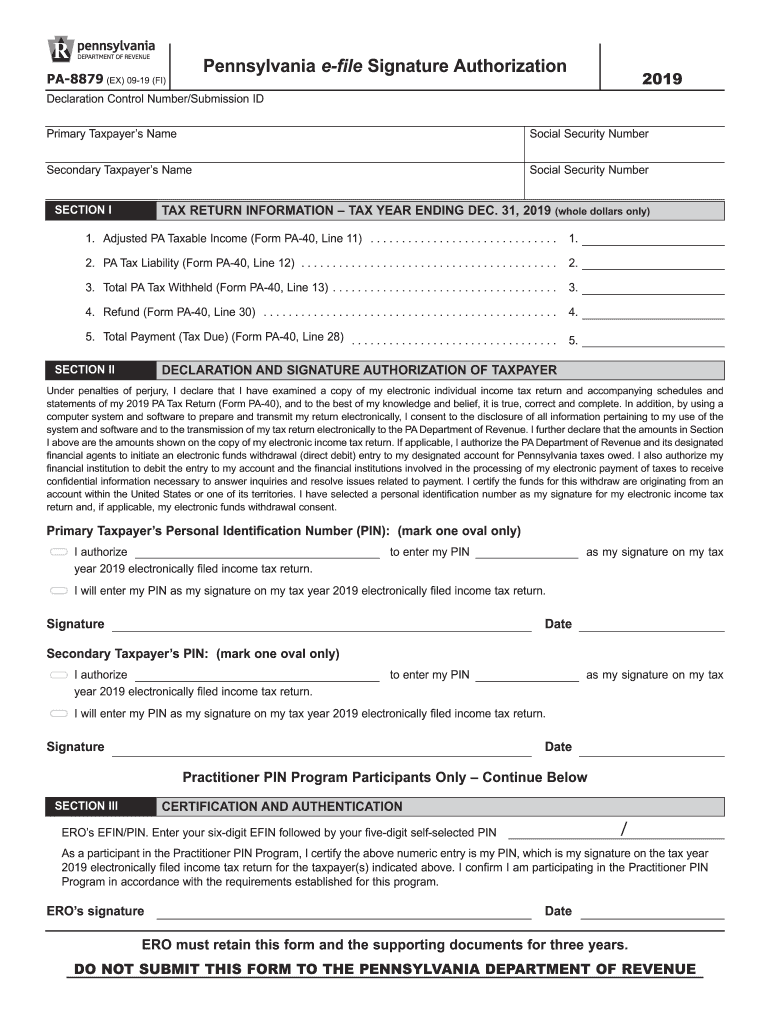

PA-8879 EX 04-18 FI Pennsylvania e-file Signature Authorization START Declaration Control Number/Submission ID Primary Taxpayer s Name Social Security Number Secondary Taxpayer s Name PARt i tax Return information tax year Ending Dec. 31 2018 Whole dollars only 1. Adjusted PA Taxable Income Form PA-40 Line 11. 2. PA Tax Liability Form PA-40 Line 12. 3. Total PA Tax Withheld Form PA-40 Line 13. 4. Refund Form PA-40 Line 30. 5. Total Payment Tax Due Form PA-40 Line 28. PARt ii Declaration and...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA PA-8879

Edit your PA PA-8879 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA PA-8879 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PA PA-8879 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit PA PA-8879. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA PA-8879 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA PA-8879

How to fill out PA PA-8879

01

Obtain Form PA PA-8879 from the Pennsylvania Department of Revenue website.

02

Enter the taxpayer's name and address in the appropriate fields.

03

Provide the Social Security Number (or EIN) of the taxpayer.

04

Indicate the tax year for which the return is being filed.

05

Review the information for accuracy.

06

Sign and date the form in the designated areas.

07

Submit the completed PA PA-8879 form to your tax preparer.

Who needs PA PA-8879?

01

Anyone filing a Pennsylvania tax return with a tax preparer needs to complete PA PA-8879.

02

Taxpayers who choose to e-file their Pennsylvania tax returns must also provide this form.

Fill

form

: Try Risk Free

People Also Ask about

What is pa form?

Prior authorization (prior auth, or PA) is a management process used by insurance companies to determine if a prescribed product or service will be covered. This means if the product or service will be paid for in full or in part.

How long does the PA authorization take?

The patient and the prescribing/rendering provider should receive a written response to a request for Prior Authorization/Program Exception (for a patient under 21 years of age) within 21 days.

What is a pre authorization form?

Prior authorization—sometimes called precertification or prior approval—is a health plan cost-control process by which physicians and other health care providers must obtain advance approval from a health plan before a specific service is delivered to the patient to qualify for payment coverage.

What is the purpose of pre-authorization?

The prior authorization process gives your health insurance company a chance to review how necessary a medical treatment or medication may be in treating your condition. For example, some brand-name medications are very costly.

What is an example of pre-authorization?

For example, your health plan may require prior authorization for an MRI, so that they can make sure that a lower-cost x-ray wouldn't be sufficient. The service isn't being duplicated: This is a concern when multiple specialists are involved in your care.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute PA PA-8879 online?

Filling out and eSigning PA PA-8879 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit PA PA-8879 in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your PA PA-8879, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How can I edit PA PA-8879 on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing PA PA-8879.

What is PA PA-8879?

PA PA-8879 is the Pennsylvania e-file Signature Authorization form used to authorize an electronic submission of a Pennsylvania personal income tax return.

Who is required to file PA PA-8879?

Taxpayers who choose to file their Pennsylvania personal income tax returns electronically through a tax preparer are required to file PA PA-8879.

How to fill out PA PA-8879?

To fill out PA PA-8879, the taxpayer must provide their personal information, including name, address, and Social Security number, and then sign the form to authorize their tax preparer to file the return electronically.

What is the purpose of PA PA-8879?

The purpose of PA PA-8879 is to serve as an authorization document that allows tax preparers to electronically file a taxpayer's personal income tax return on their behalf.

What information must be reported on PA PA-8879?

The PA PA-8879 must report the taxpayer's name, address, Social Security number, and consent to electronically file their tax return, along with the tax preparer's information.

Fill out your PA PA-8879 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA PA-8879 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.