IRS Instructions 1040 Schedule C 2019 free printable template

Show details

If you are the sole member of a domestic LLC file Schedule C or C-EZ or Schedule E or F if applicable unless you have elected to treat the domestic LLC as a corporation. See Form 8832 for details on making this election and for information about the tax treatment of a foreign LLC. For details on reforestation expenses see chapters 7 and 8 of Pub. 535. Paperwork Reduction Act Notice. We ask for the information on Schedule C Form 1040 and Schedule C-EZ Form 1040 to carry out the Internal...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Instructions 1040 Schedule C

Edit your IRS Instructions 1040 Schedule C form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Instructions 1040 Schedule C form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS Instructions 1040 Schedule C online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS Instructions 1040 Schedule C. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Instructions 1040 Schedule C Form Versions

Version

Form Popularity

Fillable & printabley

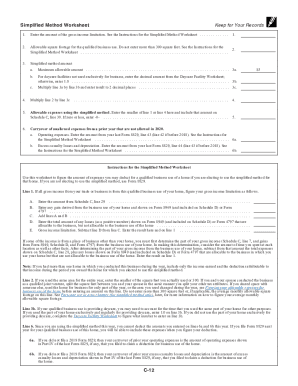

How to fill out IRS Instructions 1040 Schedule C

How to fill out IRS Instructions 1040 Schedule C

01

Obtain a copy of IRS Form 1040 Schedule C and the instructions from the IRS website.

02

Fill in your name and Social Security number at the top of the form.

03

Indicate the principal business activity and provide a brief description of your business.

04

Enter your business income on line 1, including all income earned from sales or services.

05

List your business expenses in the designated sections, including cost of goods sold, advertising, and other deductions.

06

Calculate your net profit or loss by subtracting total expenses from total income.

07

Complete the rest of the form as required, including any applicable deductions and credits.

08

Review the completed form for accuracy and completeness before submission.

Who needs IRS Instructions 1040 Schedule C?

01

Self-employed individuals who report income or loss from their business on their personal income tax returns.

02

Freelancers and independent contractors who receive 1099 forms for their services.

03

Small business owners who operate as sole proprietors.

Fill

form

: Try Risk Free

People Also Ask about

Where does depreciation show on tax return?

Use Form 4562 to: Claim your deduction for depreciation and amortization. Make the election under section 179 to expense certain property. Provide information on the business/investment use of automobiles and other listed property.

What is Schedule B?

More In Forms and Instructions Use Schedule B (Form 1040) if any of the following applies: You had over $1,500 of taxable interest or ordinary dividends. You received interest from a seller-financed mortgage and the buyer used the property as a personal residence. You have accrued interest from a bond.

What schedule is depreciation on income tax return?

What Is a Tax Depreciation Schedule? By creating a tax depreciation schedule, you can maximize the cash return from your business or investment property each financial year. The schedule can also be used to claim any missed deductions from the past year.

Does depreciation go on Schedule C?

In most cases, your depreciation deductions will be entered on IRS Form 4562, Depreciation and Amortization, and then the total amount will be carried over to Line 13 of your Schedule C if you are a sole proprietor, or to Form 1120 for a C corporation, Form 1120S for an S corporation, or to Form 1065 for a partnership

Is a depreciation schedule part of a tax return?

Depreciation is the act of writing off a tangible asset over multiple tax years. Depending on your business structure, you list your depreciation deduction each year on Form 1040 (Schedule C), Form 1120/1120S, or Form 1065.

What does C schedule mean?

Schedule C is a tax form used to report business-related income and expenses. This schedule is filled out by self-employed individuals, sole proprietors, or single-member LLCs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the IRS Instructions 1040 Schedule C in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your IRS Instructions 1040 Schedule C in seconds.

Can I edit IRS Instructions 1040 Schedule C on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign IRS Instructions 1040 Schedule C. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I edit IRS Instructions 1040 Schedule C on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share IRS Instructions 1040 Schedule C on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is IRS Instructions 1040 Schedule C?

IRS Instructions 1040 Schedule C is a form used by sole proprietors to report income and expenses associated with their business activities as part of their individual income tax return.

Who is required to file IRS Instructions 1040 Schedule C?

Individuals who are self-employed or who have earned income from a sole proprietorship are required to file IRS Instructions 1040 Schedule C.

How to fill out IRS Instructions 1040 Schedule C?

To fill out IRS Instructions 1040 Schedule C, gather your income and expense records, complete the sections detailing your business income, deduct allowable expenses, and calculate your net profit or loss.

What is the purpose of IRS Instructions 1040 Schedule C?

The purpose of IRS Instructions 1040 Schedule C is to report the income and expenses of a sole proprietorship, allowing the IRS to assess how much tax is owed on the business income.

What information must be reported on IRS Instructions 1040 Schedule C?

Information that must be reported on IRS Instructions 1040 Schedule C includes gross income from sales, cost of goods sold, and various business expenses such as rent, utilities, and supplies.

Fill out your IRS Instructions 1040 Schedule C online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Instructions 1040 Schedule C is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.