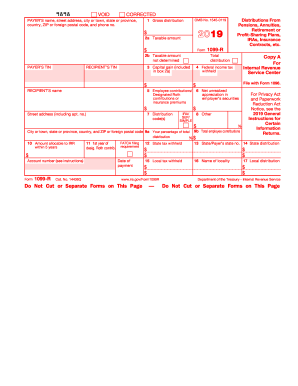

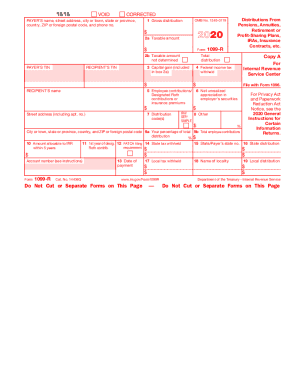

NY DTF IT-1099-R 2019 free printable template

Show details

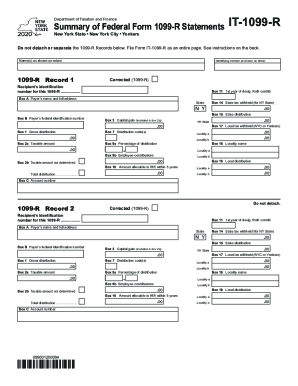

Department of Taxation and FinanceSummary of Federal Form 1099R StatementsIT1099RNew York State New York City Yonkers not detach or separate the 1099R Records below. File Form IT1099R as an entire

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF IT-1099-R

Edit your NY DTF IT-1099-R form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF IT-1099-R form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY DTF IT-1099-R online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NY DTF IT-1099-R. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF IT-1099-R Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF IT-1099-R

How to fill out NY DTF IT-1099-R

01

Obtain the NY DTF IT-1099-R form, which can be downloaded from the New York Department of Taxation and Finance website.

02

Fill in your payer information, including the name, address, and employer identification number (EIN).

03

Enter the recipient's information, including their name, address, and Social Security number (SSN).

04

Indicate the type of distribution being reported (e.g., retirement distribution, regular distribution).

05

Fill in the amount of distribution received by the recipient.

06

If applicable, report any federal income tax withheld.

07

Complete any additional boxes as necessary, following the instructions provided with the form.

08

Review all information for accuracy, and sign and date the form if required.

09

Submit the form to the appropriate state authorities by the specified deadline, either by mail or electronically.

Who needs NY DTF IT-1099-R?

01

Any individual who has received a distribution from a retirement plan, pension, or annuity should receive a NY DTF IT-1099-R form from the payer.

02

Payers, such as employers or financial institutions, are also required to file this form if they have made distributions subject to reporting.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to pay taxes on my 1099-R?

These distributions are deemed taxable income, and may be subject to early distribution penalties.

What is Form 1099-R used for?

IRS Form 1099-R provides information on benefits paid and amounts withheld for federal income tax. A copy of the form should be included with federal income tax filings if any federal tax is withheld. PERS will report the same information to the IRS for each retiree who is sent a form.

What is the unknown taxable amount on a 1099-R?

If a taxable amount was provided on previous 1099R statements, but changed to UNKNOWN this year, you have likely recovered an amount equal to your contributions as tax-free.

Who needs to fill out 1099-R?

File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of $10 or more from: Profit-sharing or retirement plans. Any individual retirement arrangements (IRAs). Annuities, pensions, insurance contracts, survivor income benefit plans.

Is 1099-R required?

The IRS requires issuers to file a 1099-R whenever they make an eligible distribution of $10 or more from … This means that your retired grandparents who regularly make withdrawals from their IRAs or 401(k)s to fund their lifestyle in retirement should get a 1099-R for every plan they draw on.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NY DTF IT-1099-R for eSignature?

When you're ready to share your NY DTF IT-1099-R, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How can I edit NY DTF IT-1099-R on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing NY DTF IT-1099-R right away.

How do I fill out NY DTF IT-1099-R on an Android device?

Use the pdfFiller app for Android to finish your NY DTF IT-1099-R. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is NY DTF IT-1099-R?

NY DTF IT-1099-R is a tax form used in New York State to report distributions from retirement plans, pensions, annuities, and other similar sources of income.

Who is required to file NY DTF IT-1099-R?

Entities that make qualifying distributions to individuals, such as pension administrators, retirement plan custodians, and other financial institutions, are required to file NY DTF IT-1099-R.

How to fill out NY DTF IT-1099-R?

To fill out NY DTF IT-1099-R, report the recipient's information, including name and Social Security number, the payer's details, the amount distributed, and any taxes withheld. Follow the specific instructions provided by the New York State Department of Taxation and Finance.

What is the purpose of NY DTF IT-1099-R?

The purpose of NY DTF IT-1099-R is to provide taxpayers and the state tax authorities with information about taxable distributions from retirement accounts, ensuring proper tax reporting and compliance.

What information must be reported on NY DTF IT-1099-R?

The information that must be reported on NY DTF IT-1099-R includes the recipient's name, address, Social Security number, the payer's information, the total amount distributed, the federal and state tax withholdings, and any applicable codes relevant to the distribution.

Fill out your NY DTF IT-1099-R online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF IT-1099-R is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.