KS TR-212a 2018 free printable template

Show details

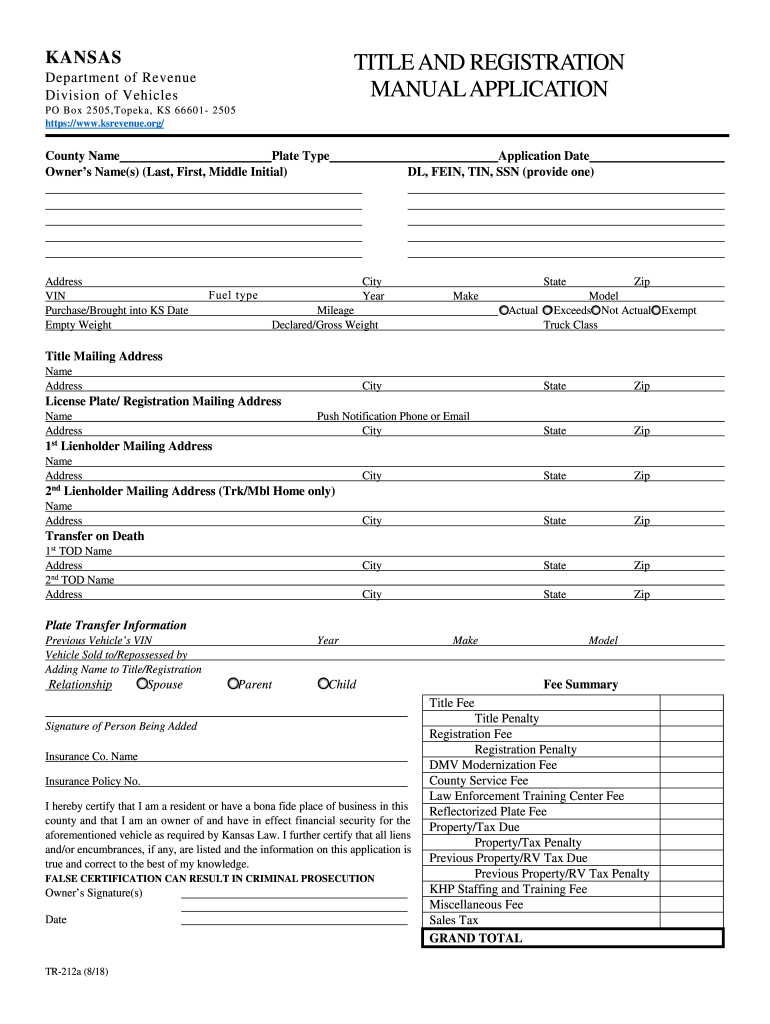

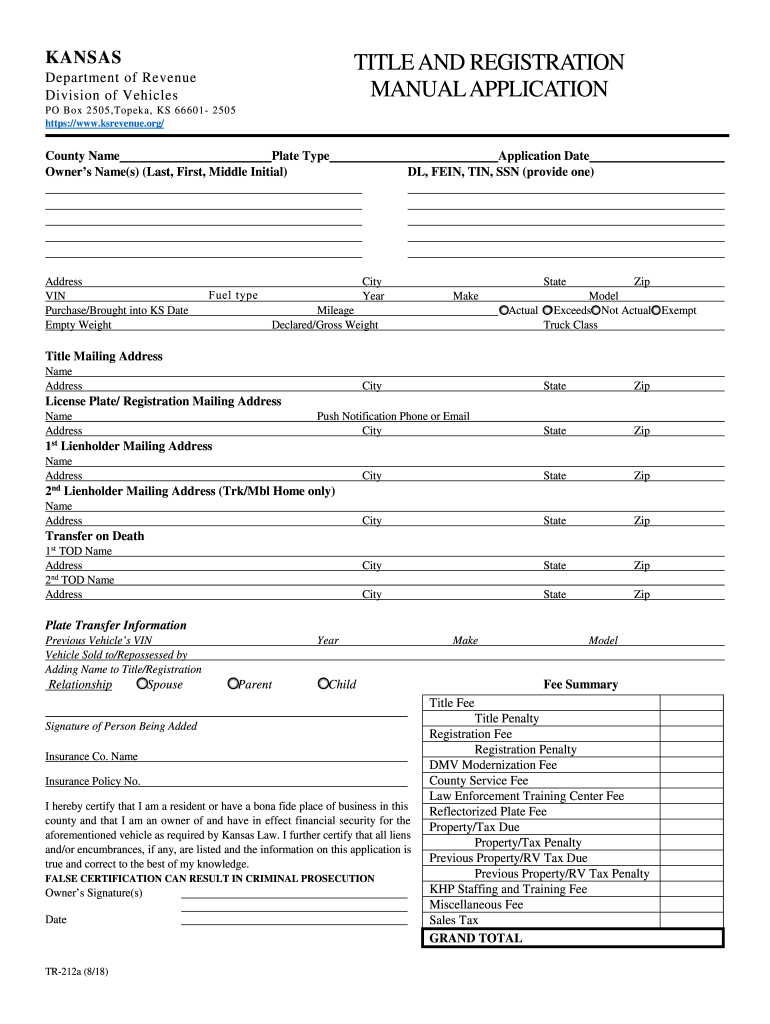

KANSASTITLE AND REGISTRATION

MANUAL APPLICATIONDepartment of Revenue

Division of VehiclesClear Form PO Box 2505, Topeka, KS 666012505

https://www.ksrevenue.org/County Name

Plate Type

Owners Name(s)

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KS TR-212a

Edit your KS TR-212a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KS TR-212a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit KS TR-212a online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit KS TR-212a. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS TR-212a Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KS TR-212a

How to fill out KS TR-212a

01

Begin by downloading the KS TR-212a form from the official website.

02

Enter your name and contact information in the designated fields.

03

Provide your social security number or taxpayer identification number.

04

Indicate the purpose of the form in the relevant section.

05

Fill out any required financial information accurately.

06

Review all the information to ensure it is complete and accurate.

07

Sign and date the form at the bottom.

08

Submit the completed form according to the instructions provided.

Who needs KS TR-212a?

01

Individuals who are initiating a specific tax-related process in Kansas.

02

Tax professionals acting on behalf of clients to handle tax matters.

03

Businesses required to report certain types of income or deductions.

Fill

form

: Try Risk Free

People Also Ask about

How do I request a title from Kansas DMV?

You will need to complete the Application for Secured/Duplicate/Reissue Title, form VCO/TR-720B that includes the following information: vehicle year, make and identification number, owner's name(s) the current odometer reading and your signature. Include appropriate title fee.

Do I need a bill of sale to title a car in Kansas?

You will need a bill of sale if there is no price listed on your title for a private party sale, you are registering an out-of-state vehicle, or you purchased your vehicle from a dealer. Bill of sale documents in Kansas are not required to be notarized.

What do I need to title a new car in Kansas?

Titling a New Vehicle Properly signed manufacturer's statement/certificate of origin (MSO/MCO). Current proof of insurance. Sales Tax receipt. Property tax must be paid at the time of registration unless applying for a temporary plate.

Where do I send my Kansas manual title application?

Mail or take completed application to the County Treasurer's Motor Vehicle Office. DO NOT send cash.

What documents do I need to title a car in Kansas?

What to Bring Proof of Ownership. If you are a new resident to Kansas who is licensing a vehicle that you have brought in from another state a VIN inspection by the Kansas Highway Patrol will be required to register the vehicle in Kansas. Proof of Insurance. Odometer Disclosure Statement. Sales Tax Receipt. Payment.

How do I file for a title in Kansas?

You will need to complete the Application for Secured/Duplicate/Reissue Title, form TR-720B that includes the following information: vehicle year, make and identification number, owner's name(s) and the current odometer reading. Include appropriate title fee. The title fee in Kansas is $10.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get KS TR-212a?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the KS TR-212a in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I fill out the KS TR-212a form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign KS TR-212a and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I complete KS TR-212a on an Android device?

Complete your KS TR-212a and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is KS TR-212a?

KS TR-212a is a tax form used for reporting certain tax-related information to the state of Kansas.

Who is required to file KS TR-212a?

Entities and individuals who meet specific reporting criteria set by the Kansas Department of Revenue are required to file KS TR-212a.

How to fill out KS TR-212a?

To fill out KS TR-212a, complete all required fields with accurate information regarding your tax situation, and ensure all necessary documentation is attached before submission.

What is the purpose of KS TR-212a?

The purpose of KS TR-212a is to collect relevant tax information to ensure compliance with Kansas state tax laws.

What information must be reported on KS TR-212a?

KS TR-212a requires reporting information such as taxpayer identification, income details, deductions, and other relevant tax data.

Fill out your KS TR-212a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KS TR-212a is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.