IRS Instruction 843 2019 free printable template

Show details

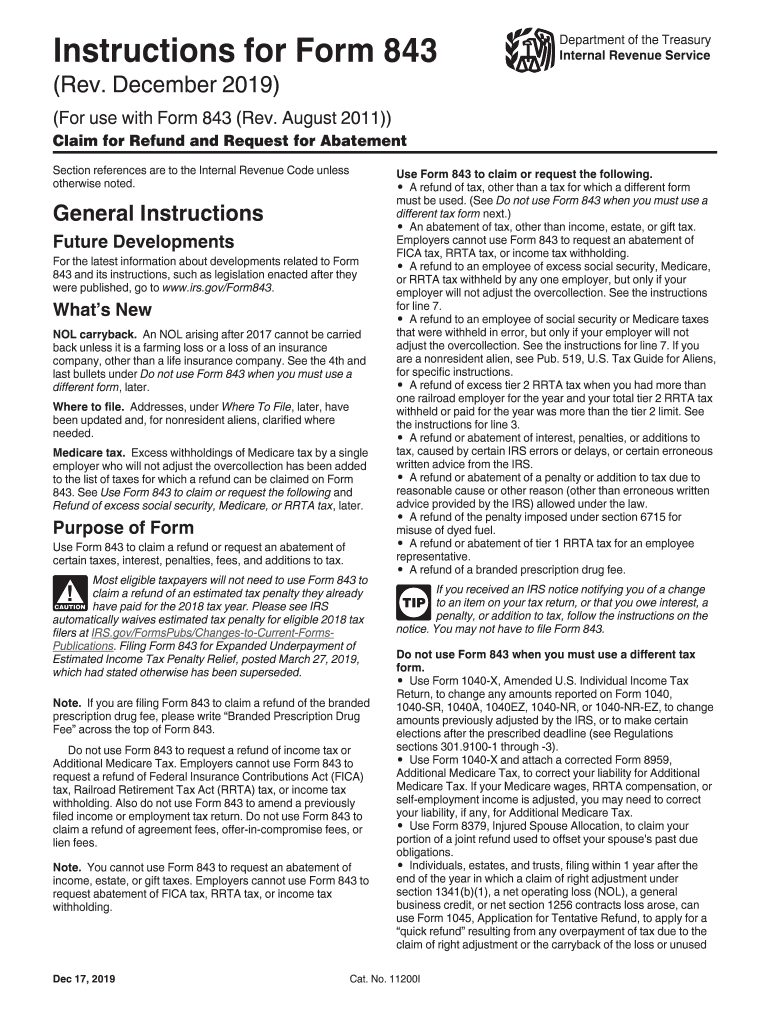

926 Household Employer s Tax Guide for how to correct that form. For more information see Treasury Decision 9405 at www.irs.gov/irb/2008-32IRB/ar13. html. Return to correct Form 1120 or 1120-A as originally filed or as Cat. No. 11200I later adjusted by an amended return a claim for refund or an examination or to make certain elections after the prescribed deadline see Regulations sections 301. 9100-1 through -3. Use Form 720X Amended Quarterly Federal Excise Tax Return to make adjustments to...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Instruction 843

Edit your IRS Instruction 843 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Instruction 843 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS Instruction 843 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IRS Instruction 843. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Instruction 843 Form Versions

Version

Form Popularity

Fillable & printabley

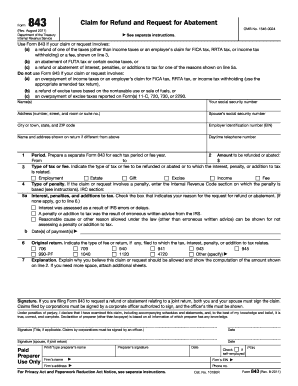

How to fill out IRS Instruction 843

How to fill out IRS Instruction 843

01

Obtain IRS Form 843 and its instructions from the IRS website or local IRS office.

02

Provide your name, address, and taxpayer identification number (TIN) at the top of the form.

03

Indicate the reason for filing the form in the appropriate section, such as requesting a refund or abatement of tax.

04

Fill out the details of the tax period for which the request is being made.

05

Include the specific amounts related to the request, ensuring accuracy.

06

Attach any supporting documentation that substantiates your claim.

07

Sign and date the form to certify that the information provided is accurate.

08

Submit the completed form to the appropriate address listed in the IRS instructions.

Who needs IRS Instruction 843?

01

Taxpayers who have overpaid taxes and wish to request a refund.

02

Individuals seeking to abate (eliminate) certain tax penalties due to reasonable cause.

03

Anyone who needs to correct an error or request adjustments related to their tax liability.

Fill

form

: Try Risk Free

People Also Ask about

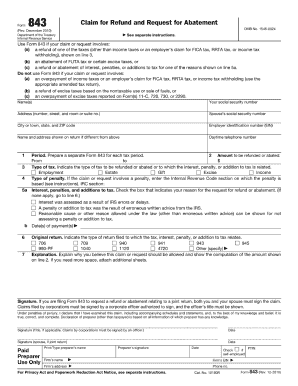

What is form 843 claim for refund and request for abatement?

Form 843 is used to claim a refund of certain assessed taxes or to request abatement of interest or penalties applied in error by the IRS. The form must be filed within two years from the date when taxes were paid or three years from the date when the return was filed, whichever is later.

What is the best explanation for form 843?

Use Form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax.

Can you file form 843 online?

Note that Form 843 cannot be e-filed. Check the instructions for Form 843 for where to mail.

What is the 843 form used for?

Use Form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax.

What is a good reasonable cause for penalty abatement?

Failure to File or Pay Penalties Examples of valid reasons for failing to file or pay on time may include: Fires, natural disasters or civil disturbances. Inability to get records. Death, serious illness or unavoidable absence of the taxpayer or immediate family.

What is reasonable cause for IRS form 843?

Reasonable cause: A death in the family, inability to obtain records, natural disasters, and other related instances. It's important to note that the IRS will not consider a lack of funds a reasonable cause.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IRS Instruction 843 in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your IRS Instruction 843 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I send IRS Instruction 843 to be eSigned by others?

When your IRS Instruction 843 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I complete IRS Instruction 843 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your IRS Instruction 843. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is IRS Instruction 843?

IRS Instruction 843 is a guideline that provides instructions for taxpayers to request a refund of certain overpayments, specifically related to tax payments.

Who is required to file IRS Instruction 843?

Taxpayers who believe they have overpaid their taxes and wish to request a refund are required to file IRS Instruction 843.

How to fill out IRS Instruction 843?

To fill out IRS Instruction 843, taxpayers should provide their personal information, details of the tax payment in question, and the reason for the refund request, ensuring all required fields are completed accurately.

What is the purpose of IRS Instruction 843?

The purpose of IRS Instruction 843 is to guide taxpayers through the process of requesting a refund of overpaid taxes.

What information must be reported on IRS Instruction 843?

The information that must be reported on IRS Instruction 843 includes the taxpayer's identification details, the amounts and dates of the overpayments, and the justification for the refund request.

Fill out your IRS Instruction 843 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Instruction 843 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.