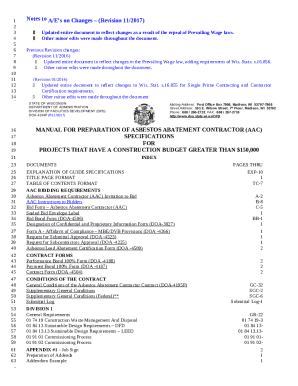

US-01038BG free printable template

Show details

Bill of Sale for a Golf Cart For and in consideration of Dollars ($), cash in hand paid, and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is US-01038BG

US-01038BG is a form used for reporting specific tax-related information to the IRS.

pdfFiller scores top ratings on review platforms

so far so good. Not the easiest to find document while logged in. I find I have to do a search on the document from a web browser to get to it. PFDfiller couldn't find the doc from within the app.

Very professional solution for everyday usage

Who needs US-01038BG?

Explore how professionals across industries use pdfFiller.

US-01038BG form how-to guide

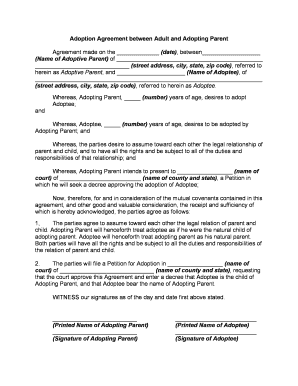

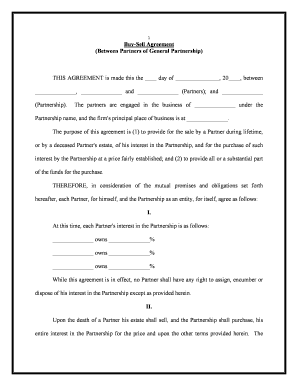

The US-01038BG form is essential for creating a legal Bill of Sale specifically for golf carts. This guide will walk you through understanding the form, its components, and how to complete it accurately.

Understanding the Bill of Sale for a Golf Cart

A Bill of Sale serves as a legal document that records the sale of a vehicle, in this case, a golf cart. It is crucial to have this document because it provides proof of transaction between the seller and buyer, safeguarding both parties' interests.

-

A Bill of Sale defines the terms of the sale and officially transfers ownership of the golf cart.

-

Proper documentation not only protects buyers and sellers but also aids in legal compliance during ownership transfer.

-

Golf carts often have unique selling regulations that must be addressed in the Bill of Sale.

Key components of the Bill of Sale

Certain elements must be included for the Bill of Sale to be valid. These details ensure that both the seller and the buyer have clear, recorded information about the transaction.

-

Names and addresses of both parties are crucial for establishing the identities involved in the transaction.

-

This information uniquely identifies the vehicle, reducing the chance of disputes over the cart being sold.

-

Including these specifications helps in accurately identifying the golf cart and verifying its registration status.

-

This clause indicates that the buyer accepts responsibility for the cart's condition upon purchase, limiting the seller's liability.

Filling out the Bill of Sale

Completing the Bill of Sale accurately is critical for legal validation. Mistakes can lead to disputes or complications later on.

-

Follow each field's requirements and ensure all information is accurate and current.

-

Double-checking names and vehicle details can prevent administrative errors that could jeopardize the sale.

-

Consider consulting with a legal professional if you're unsure about any part of the Bill of Sale.

Editing and customizing your document

Editing tools like pdfFiller allow you to customize your Bill of Sale to fit your needs. Customization can help with maintaining a professional appearance and ensuring that all relevant information is correctly presented.

-

These tools provide functionalities like text editing and rearranging sections to enhance clarity and presentation.

-

Ensuring the details reflect the particular transaction can enhance the Bill of Sale's effectiveness.

-

Creating templates can expedite future transactions that require similar documentation.

Signing your Bill of Sale

The signing process is essential for validating the sale. Electronic signatures are widely accepted and can make the procedure more manageable.

-

E-signatures facilitate the signing process, allowing documents to be signed remotely.

-

Many jurisdictions recognize electronic signatures as legally binding, similar to traditional handwritten signatures.

-

pdfFiller offers secure signing options, ensuring the integrity and authenticity of your documents.

Notary requirements for the Bill of Sale

Notarization may be required for certain sales, providing an additional layer of verification.

-

Notarization often helps to prevent fraud and guarantees that the signatures on the document are legitimate.

-

Notaries can be found in various places, including banks, law offices, and online platforms.

-

A notarized Bill of Sale can have significant legal advantages if disputes arise in the future.

Managing your documents with pdfFiller

Efficient document management is crucial for handling important forms like the Bill of Sale. pdfFiller provides tools to keep your documents organized.

-

With pdfFiller, you can categorize documents for easy retrieval when needed.

-

The platform allows for collaboration, enabling multiple stakeholders to review and edit documents.

-

Cloud-based access means you can work on your documents from anywhere, at any time.

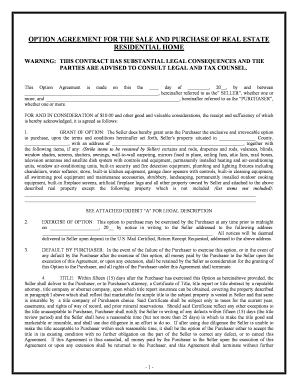

Compliance and legal considerations

It's vital to stay informed about local regulations concerning golf cart sales to ensure compliance. Failure to follow these regulations can lead to legal repercussions.

-

Always check with local authorities on specific legal requirements for golf cart sales in your area.

-

Regularly reviewing and updating your knowledge of state laws can help maintain compliance and avoid issues.

-

Keeping abreast of any changes in legislation ensures your transactions are always legally sound.

How to fill out the US-01038BG

-

1.Open pdfFiller and upload the US-01038BG form to your documents.

-

2.Review the form layout to familiarize yourself with the required fields.

-

3.Start filling out your personal or business information in the designated sections.

-

4.Enter your tax identification number accurately in the corresponding box.

-

5.If applicable, provide details about income, deductions, or credits related to your tax situation.

-

6.Double-check all entered information for accuracy to avoid potential issues with the IRS.

-

7.Utilize pdfFiller's validation features to ensure all required fields are completed.

-

8.Save your progress regularly while filling out the form to prevent data loss.

-

9.Once completed, review the form one last time to ensure correctness and completeness.

-

10.Use the ‘Save’ or ‘Download’ option to save a copy of the filled form to your device or cloud storage.

-

11.Print and sign the completed form if a physical submission is required, or prepare it for electronic submission, following IRS guidelines.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.