Irrevocable Generation Skipping (Dynasty) Trust Agreement For Benefit of Trustors Children and Grandchildren 2020-2026 free printable template

Show details

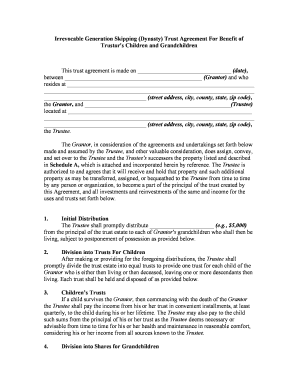

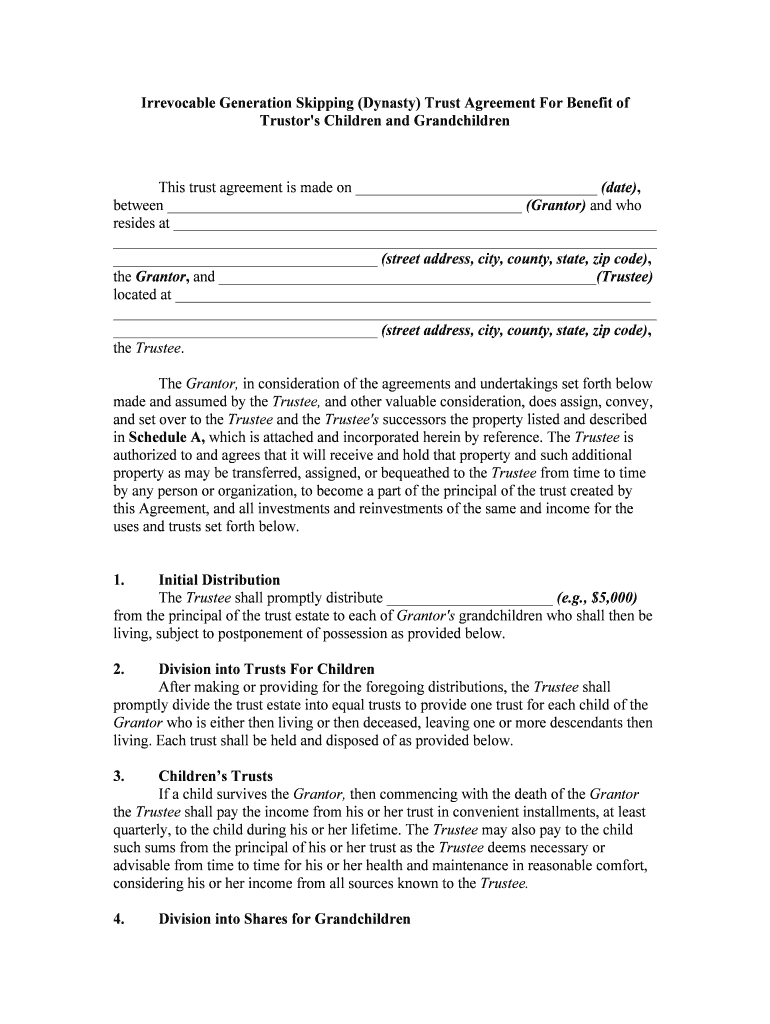

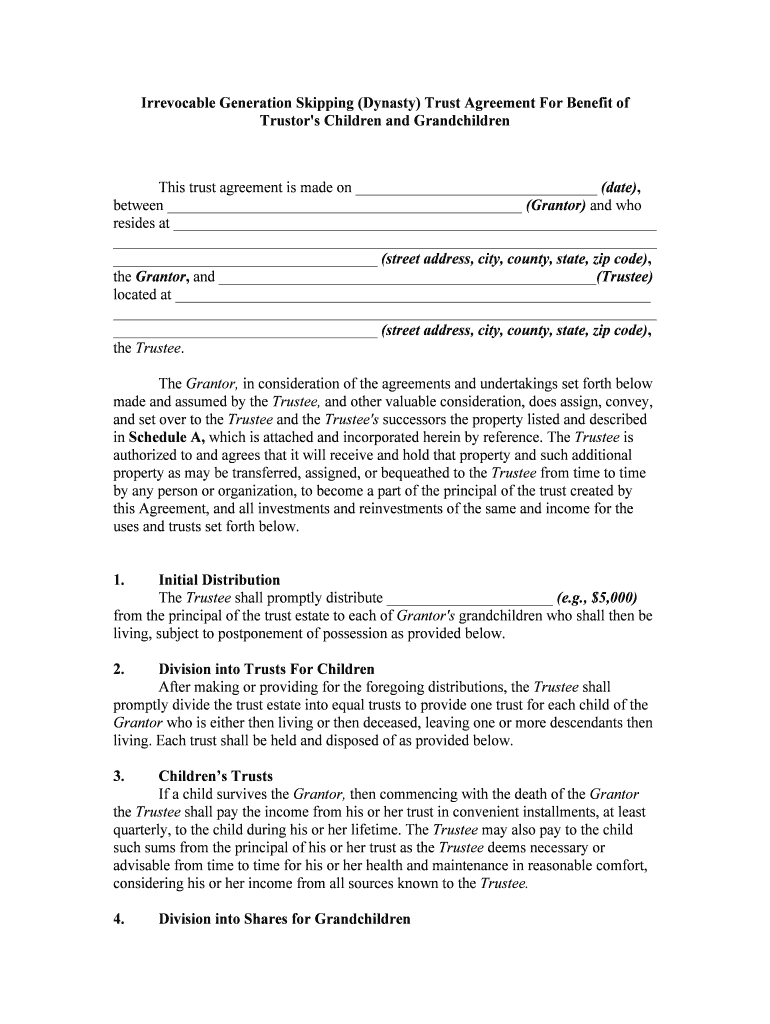

Irrevocable Generation Skipping Dynasty Trust Agreement For Benefit of Trustor s Children and Grandchildren This trust agreement is made on date between Grantor and who resides at the Grantor and Trustee located at the Trustee. The Grantor in consideration of the agreements and undertakings set forth below made and assumed by the Trustee and other valuable consideration does assign convey and set over to the Trustee and the Trustee s successors the property listed and described in Schedule A...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Irrevocable Generation Skipping Dynasty Trust Agreement

Edit your Irrevocable Generation Skipping Dynasty Trust Agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Irrevocable Generation Skipping Dynasty Trust Agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Irrevocable Generation Skipping Dynasty Trust Agreement online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit Irrevocable Generation Skipping Dynasty Trust Agreement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Irrevocable Generation Skipping Dynasty Trust Agreement

How to fill out Irrevocable Generation Skipping (Dynasty) Trust Agreement For Benefit

01

Identify the grantor of the trust and provide their personal information including name, address, and date of birth.

02

Select a trustee who will manage the trust assets and provide their details.

03

List the beneficiaries who will benefit from the trust, specifying their relationship to the grantor.

04

Detail the assets that will be transferred into the trust, including real estate, investments, and other property.

05

Include provisions that outline how and when the beneficiaries will receive distributions from the trust.

06

Specify any conditions or restrictions on the distributions to beneficiaries.

07

Include a section on management of the trust assets, detailing the trustee's responsibilities.

08

Ensure that clauses about tax implications and responsibilities are included.

09

Review the document for completeness and accuracy before signing.

10

Consult with a legal professional to ensure all state-specific laws are adhered to.

Who needs Irrevocable Generation Skipping (Dynasty) Trust Agreement For Benefit?

01

Individuals looking to pass wealth across generations while avoiding estate taxes.

02

Families aiming to preserve family wealth and control over distributions to future generations.

03

Those with substantial assets who want to ensure their wealth is managed according to their wishes after their passing.

04

Anyone concerned about the financial security of their descendants, including grandchildren and great-grandchildren.

05

Individuals interested in providing for their heirs without them facing immediate financial claims or liabilities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit Irrevocable Generation Skipping Dynasty Trust Agreement from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like Irrevocable Generation Skipping Dynasty Trust Agreement, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Where do I find Irrevocable Generation Skipping Dynasty Trust Agreement?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific Irrevocable Generation Skipping Dynasty Trust Agreement and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit Irrevocable Generation Skipping Dynasty Trust Agreement on an Android device?

The pdfFiller app for Android allows you to edit PDF files like Irrevocable Generation Skipping Dynasty Trust Agreement. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is Irrevocable Generation Skipping (Dynasty) Trust Agreement For Benefit?

An Irrevocable Generation Skipping (Dynasty) Trust Agreement is a legal arrangement that allows assets to be transferred to beneficiaries across multiple generations without incurring generation-skipping transfer taxes. This type of trust is designed to preserve wealth by bypassing the estate tax at each generation.

Who is required to file Irrevocable Generation Skipping (Dynasty) Trust Agreement For Benefit?

The trustee of the Irrevocable Generation Skipping Trust is typically responsible for filing any required documents related to the trust. Beneficiaries may also need to provide information for tax purposes, depending on their income and distributions from the trust.

How to fill out Irrevocable Generation Skipping (Dynasty) Trust Agreement For Benefit?

Filling out the Irrevocable Generation Skipping Trust Agreement involves providing essential information such as the trust's name, the trustee's details, beneficiaries, terms of the trust, and conditions under which the trust assets can be distributed. It is advisable to consult with a legal professional to ensure accuracy.

What is the purpose of Irrevocable Generation Skipping (Dynasty) Trust Agreement For Benefit?

The primary purpose of this trust is to allow wealth to be passed down through multiple generations while minimizing estate and gift taxes. It provides a mechanism for creating a lasting family legacy and protecting assets from creditors, divorce, or other financial risks.

What information must be reported on Irrevocable Generation Skipping (Dynasty) Trust Agreement For Benefit?

Information that must be reported typically includes the trust's name, trustee identification, a description of the trust assets, the names of the beneficiaries, any distributions made during the reporting period, and details of any income generated by the trust. Specific reporting requirements may vary based on jurisdiction.

Fill out your Irrevocable Generation Skipping Dynasty Trust Agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irrevocable Generation Skipping Dynasty Trust Agreement is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.