Get the free inter vivos

Show details

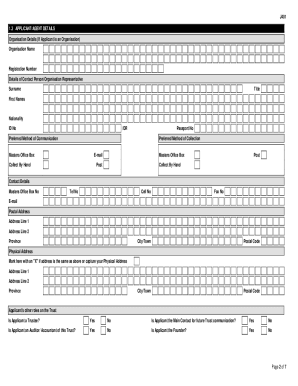

General Form of Inter Vivos Irrevocable Trust Agreement Trust Agreement made on the day of between of Name of Trustor Street Address City County State Zip Code hereinafter called Trustor and Whereas Trustor is presently the owner of the property the Property described in Exhibit A which is attached and incorporated by this reference and collection of the income from the Property and the disposition of both the income and the Property in the manner provided below. Now therefore for and in...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign inter vivos

Edit your inter vivos form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your inter vivos form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing inter vivos online

Follow the steps down below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit inter vivos. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can a revocable trust be made irrevocable?

If a trust is revocable it can generally be amended and turned into an irrevocable trust. This can also happen automatically when the person who created the trust dies. If the grantor or creator of a revocable trust dies, this can trigger the trust to become an irrevocable trust.

Can you make a revocable trust irrevocable?

If a trust is revocable it can generally be amended and turned into an irrevocable trust. This can also happen automatically when the person who created the trust dies. If the grantor or creator of a revocable trust dies, this can trigger the trust to become an irrevocable trust.

Can an irrevocable trust be changed by the grantor?

Modification or termination of a noncharitable irrevocable trust may be accomplished with a single consent modification document if the trust's grantor and all of its possible beneficiaries agree. Husband, Wife and their children may agree to change the successor Trustee to Wife's sister.

What is the difference between an irrevocable and revocable trust?

The simplest difference between the two is that assets remain in the grantor's estate in a revocable trust but move out of the estate in an irrevocable trust. The primary reasoning behind the irrevocable trust is that there are many good reasons for clients to want to move assets out of their estate.

Can the grantor of an irrevocable trust be a beneficiary?

The grantor (as an individual or couple) transfers their assets to an irrevocable trust. However, unlike other irrevocable trusts, the grantor can be the income beneficiary. The grantor can receive income from the trust to the maximum amount allowed by Medicaid.

Is a testamentary trust revocable or irrevocable?

A revocable living trust automatically becomes irrevocable when its grantor dies because he/she is no longer alive and available to amend it or dissolve it. A testamentary trust is revocable during the testator's lifetime because it doesn't actually exist yet. It won't come into being until after his/her death.

Which is better revocable or irrevocable trust?

The simplest difference between the two is that assets remain in the grantor's estate in a revocable trust but move out of the estate in an irrevocable trust. The primary reasoning behind the irrevocable trust is that there are many good reasons for clients to want to move assets out of their estate.

Is a testamentary trust irrevocable?

Irrevocable trusts are trusts in which the trustor cannot change or revoke the trust. Testamentary trusts are classified as irrevocable because testamentary trusts only come into effect after the trustor dies.

What is a trust under will testamentary?

A testamentary trust (sometimes referred to as a will trust or trust under will) is a trust which arises upon the death of the testator, and which is specified in his or her will. A will may contain more than one testamentary trust, and may address all or any portion of the estate.

Is a testamentary trust included in gross estate?

The trust's assets are included in your taxable estate at the time of death. It is generally set up to retain control over assets rather than for estate tax reasons. You may enjoy certain estate tax advantages because the assets held by the trust may be considered a gift and not subject to estate tax.

How can I send inter vivos to be eSigned by others?

Once you are ready to share your inter vivos, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit inter vivos in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your inter vivos, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I edit inter vivos straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing inter vivos, you can start right away.

Fill out your inter vivos online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Inter Vivos is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.