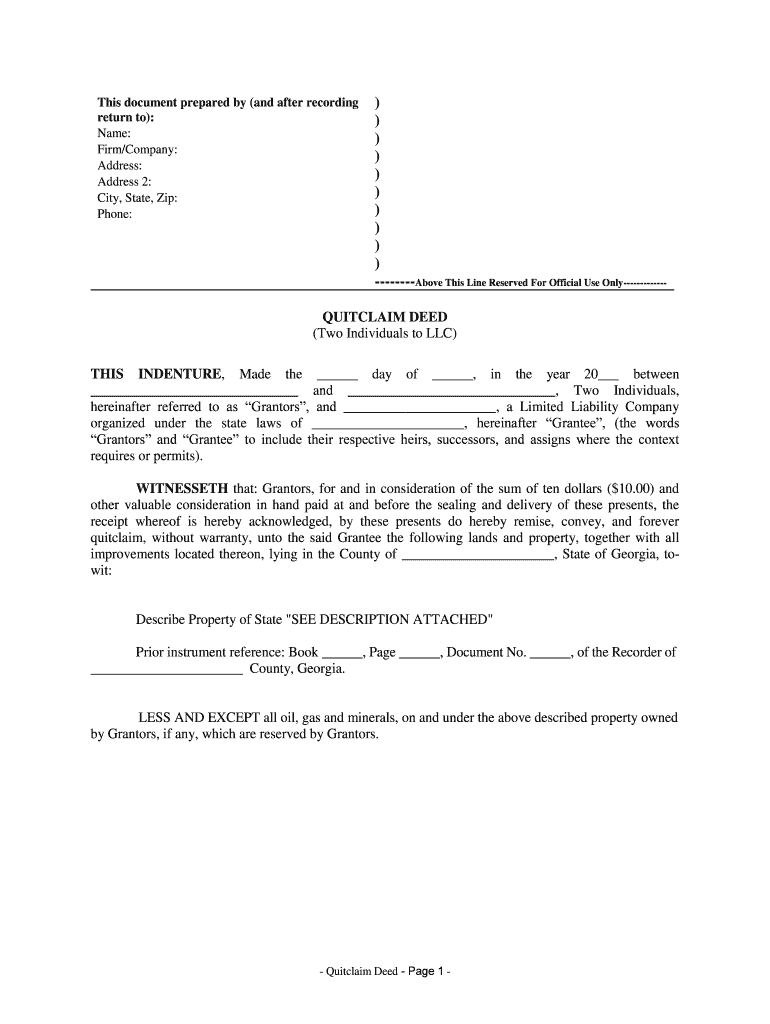

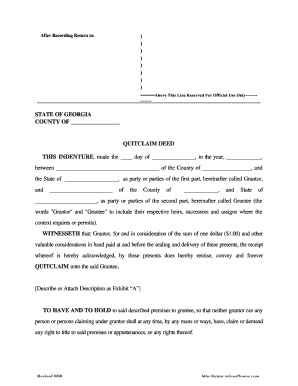

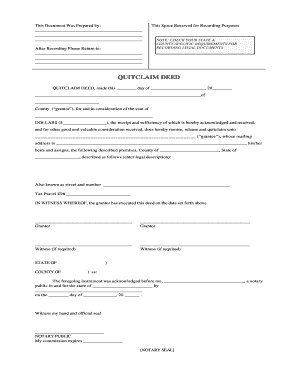

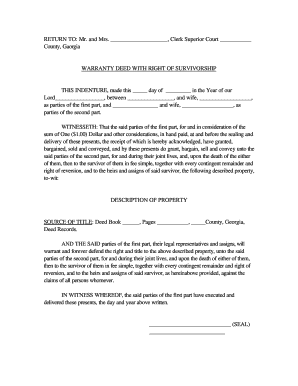

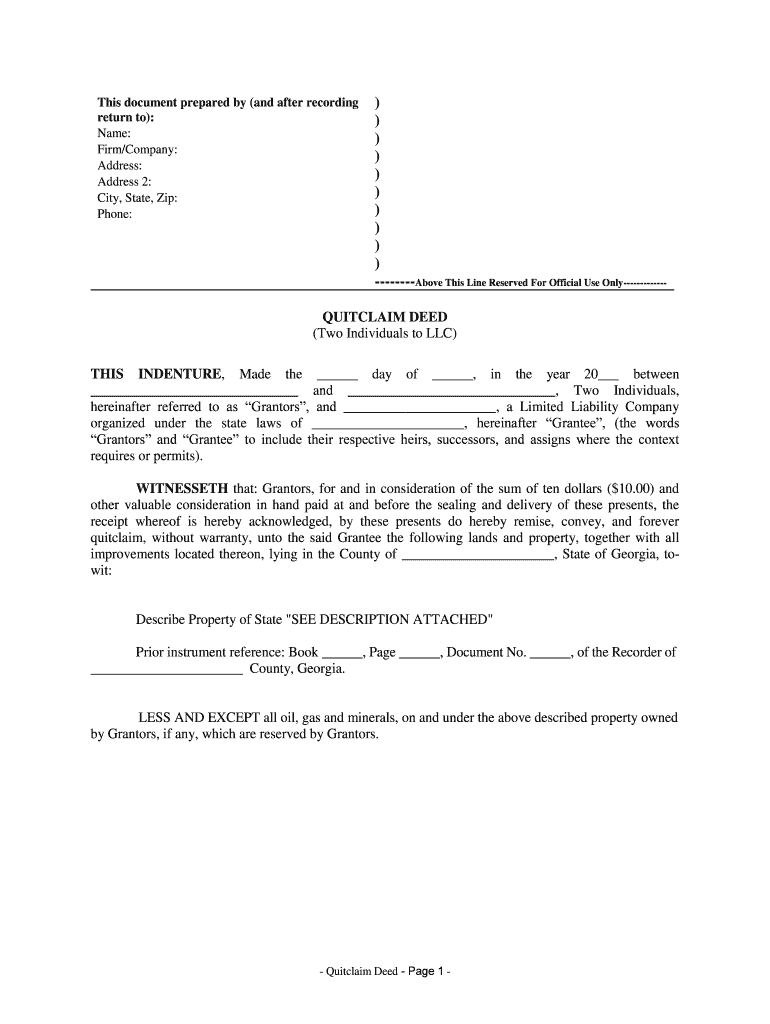

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Quitclaim Deed, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USAF control no. GA-A2002

GA Quitclaim Deed 2020-2025 free printable template

Get, Create, Make and Sign georgia quitclaim deed

How to edit georgia quitclaim deed online

Uncompromising security for your PDF editing and eSignature needs

GA Quitclaim Deed Form Versions

How to fill out georgia quitclaim deed

How to fill out GA Quitclaim Deed

Who needs GA Quitclaim Deed?

Instructions and Help about georgia quitclaim deed

Hi this is Lee Phillips I want to talk to you for two seconds about a concept called a quit claim deed You quit claiming your interest in the property, so it's called a quit claim deed Quit claim deeds are often used when you're transferring property in and out of a living revocable trust, and it works just fine because the living revocable trust is considered to be you are transferring your interest to you Now I have to talk about quit claim deeds for two seconds The quit claim deed only says that you quit claiming any interest that you have on the property I can give you a valid quit claim deed for my interests in the White House Perfectly valid deed I don't have much interest in the White House, so the deed isn't worth a lot, but you can give the quit claim deed to whatever interest you have in the piece of property Now if you're transferring assets to a company like an LLC that you've set up or corporation that you've set up you're not going to use a quit claim deed you're going to use a warranty deed because you want any warranties like the title insurance and stuff to go with the deed that you're removing over to your LLC or your corporation But the trust is different It's you still have the warranties you still have all the stuff so when you do a quit claim deed to a trust you're not losing any of the warranties and things that you would normally want to make sure that you'd send along with the property The quit claim deed has a couple of elements like six or so that you need One it needs to identify you Now you are you're the guy who owns the property if you're the seller or if you're the guy who's transferring it into the trust your trust So it identifies the guy who owns the property now It has to identify the guy who is to get the property If it's your living revocable trust remember that it is name of trust date of trust and the trustee those three elements have to be there And I saw a deed the other day thatdidnt have those three elements, and we've gone over those elements before, so it has your name now that would be husband and wife if you own the property as joint tenants, and you're putting it into the living revocable trust, so you'd both have to be identified If you're in a community property state and even if hubby or sweeties name isn't on the deed I'm still going to want their name to be there as a granter the guy who gives up the property So I want both names in a community property state independent of who owns it And normally you're in a joint tenancy situation or something so were going to have both of the spouses anyway We have to identify the property What are we sending over Now that could be a legal description Lot 6 Plat A know somebody's subdivision blah blah blah, or it could be what we call a metes and bounds description 38 feet north of the centerline of blah blah blah blah blah You've seen those So I've got to describe the property Then we have to have a date We have to have a signature of the guy who's...

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can LLC have one member?

Can a single member LLC own a single member LLC?

How do I add another member to my LLC?

How do I add a member to my LLC?

Can you add members to a single member LLC?

Do I need a new EIN if I add a member to my LLC?

Can two people have an LLC?

Can an LLC have more than one owner?

How do I set up an LLC with multiple owners?

Can you have multiple owners of an LLC?

Can I create an eSignature for the georgia quitclaim deed in Gmail?

How do I fill out the georgia quitclaim deed form on my smartphone?

How do I fill out georgia quitclaim deed on an Android device?

What is GA Quitclaim Deed?

Who is required to file GA Quitclaim Deed?

How to fill out GA Quitclaim Deed?

What is the purpose of GA Quitclaim Deed?

What information must be reported on GA Quitclaim Deed?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.