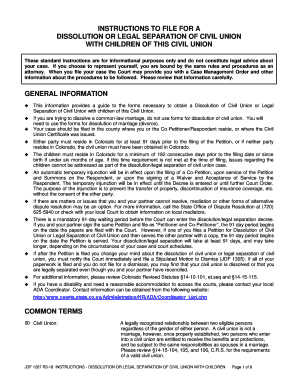

Get the free Salary Verification for Potential Lease template

Show details

This Salary Verification form for Potential Lease is a form to be sent to a potential tenant's employer, in order for the Landlord to verify the lease applicant's income as reported on an application

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is salary verification form for

A salary verification form is a document used to confirm an individual's income and employment status, usually required by lenders or landlords.

pdfFiller scores top ratings on review platforms

Very easy to work with and essential for completing our work and contracts!

I still find some of the features not very intuitive but maybe some training will help.

Don't like the fact it auto renews and cant work out how to undo work you have done in erro

I have used it in the past and it is very user friendly. I love it.

This works great. I would like to see if you can draw boxes and smaller circles.

In a crunch for 1099s. The help desk was a bit rude. But the program did get the job done.

Who needs salary verification for potential?

Explore how professionals across industries use pdfFiller.

How to complete a salary verification form for form

What is the salary verification process?

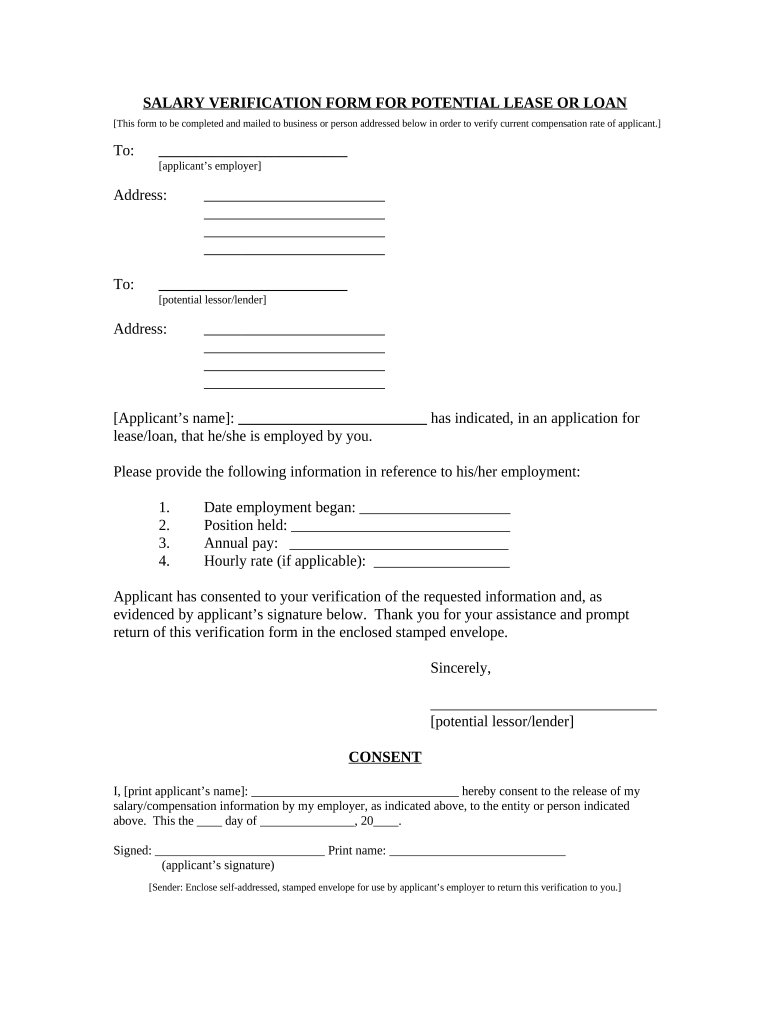

A salary verification form is a critical document used to authenticate an individual’s income and employment details. This verification process is vital for lease and loan applications, as it assures lessors and lenders of the applicant's financial reliability. It typically involves three key parties: the applicant, the employer, and the lessor or lender.

What are the key components of the salary verification form?

-

This section captures details about the employer, ensuring that the verifying party can reach out for additional information if necessary.

-

This area provides the details of the lender or lessor, ensuring that the verification gets to the right place.

-

Here, the applicant lists their personal information, creating a clear connection between the applicant and the verification request.

-

This includes essential information like employment date, job position, annual salary, and hourly rate, which are critical for accurate financial assessments.

How do you complete the salary verification form?

Completing a salary verification form involves several crucial steps. Start by accurately filling out each section and ensuring that you have the applicant's consent to share their information. You should be aware of the requirements for clarity and legal compliance. Tools like pdfFiller can make this process smoother, allowing for easy form completion and editing.

-

Fill in the employer's details, including name and contact information.

-

Provide the lender's or lessor's information, specifying where the verification should be directed.

-

Complete the applicant’s section, noting employment history and salary details.

-

Ensure all information fields are complete to avoid delays.

-

Use pdfFiller’s tools to verify all data before submission.

What are employer responsibilities in the verification process?

Employers play a significant role in the salary verification process. They must accurately complete the verification form while adhering to legal regulations regarding privacy. It's important to submit the verification promptly, considering the applicant's timelines for loan or lease applications, and manage multiple requests systematically.

-

Employers must comply with laws protecting employee information, ensuring that only required data is shared.

-

Timely responses to verification requests can influence whether the applicant secures their loan or lease.

-

Efficient practices in handling verification forms can prevent potential bottlenecks and service delays.

What common mistakes should be avoided in salary verification forms?

-

Leaving sections blank can cause delays or rejections, so ensure all fields are filled.

-

Without an applicant's permission, the verification may not be legally valid.

-

Accurately representing employment dates and financial figures is crucial for transparency.

-

Supporting documents can substantiate claims made in the verification and play a vital role in the process.

How can pdfFiller assist with salary verification forms?

pdfFiller offers numerous benefits when handling salary verification forms. The platform provides tools for secure editing and electronic signing, ensuring both employers and lenders maintain control over the documents. Additionally, its cloud-based features allow for easy collaboration and tracking of submission statuses.

-

Easily modify forms while protecting sensitive information from unauthorized access.

-

Sign documents electronically to expedite the verification process.

-

Facilitate communication among employers and lenders, enhancing transparency.

-

Keep all verification documents organized and accessible, avoiding lost paperwork.

What resources can help with effective verification?

-

Access pre-designed templates for salary verification forms to streamline the completion process.

-

Utilize links to understand legal requirements and best practices surrounding salary verification.

-

Explore insights on efficient document management tools available through pdfFiller.

What are the concluding thoughts on salary verification?

In conclusion, understanding how to navigate the salary verification process is essential for both applicants and employers. Engaging with pdfFiller’s tools can significantly help in simplifying the document handling process. Accurate verification is inherently important, equipping applicants with the necessary advantages for loan or lease applications.

How to fill out the salary verification for potential

-

1.Open the salary verification form on pdfFiller.

-

2.Enter the employee's full name in the designated field.

-

3.Fill in the employee's job title and department accurately.

-

4.Input the employee's start date and current employment status.

-

5.Provide the employee's annual salary or hourly wage as required.

-

6.Include any bonuses or additional compensation if relevant.

-

7.Add the employer's information, including name and contact details.

-

8.Double-check all entered information for accuracy.

-

9.Once completed, review the form for any missing fields or errors.

-

10.Save the document and choose the option to print or send it directly.

-

11.If necessary, reach out to the employee for additional verification details.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.