Get the free Living Trust Property Record template

Show details

This is a Living Trust Property Inventory form. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is living trust property record

A living trust property record is a legal document that outlines the assets placed in a living trust and their management.

pdfFiller scores top ratings on review platforms

REVIEW

Everything worked out fine.

great site

great site great site

VERY GOOD SOFT

Excellent customer service

Excellent customer service. The request was attended to at a very high speed and got it done. Kudos to the customer service team!

I'm not very savy with technology, I wanted to upgrade...

I'm not very savy with technology, I wanted to upgrade my abilities and ease my work. I encounter PDFfilled easy to use the most imporatnt live help! I will keep learning. I'm very satisfied.

What do you like best?

I like that I can fax documents without having to have an actual fax number

What do you dislike?

There isn’t much to dislike about PDFfiller. I like everything it has to offer.

Recommendations to others considering the product:

It’s easy to use

What problems are you solving with the product? What benefits have you realized?

N/A. I don’t have any problems.

Who needs living trust property record?

Explore how professionals across industries use pdfFiller.

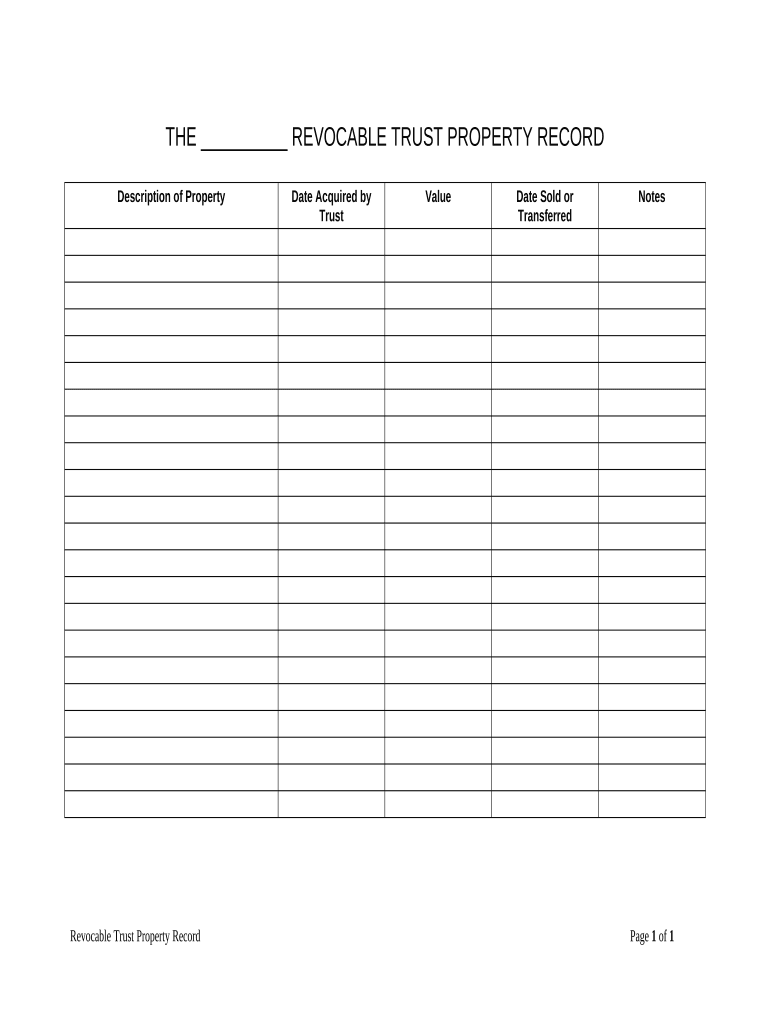

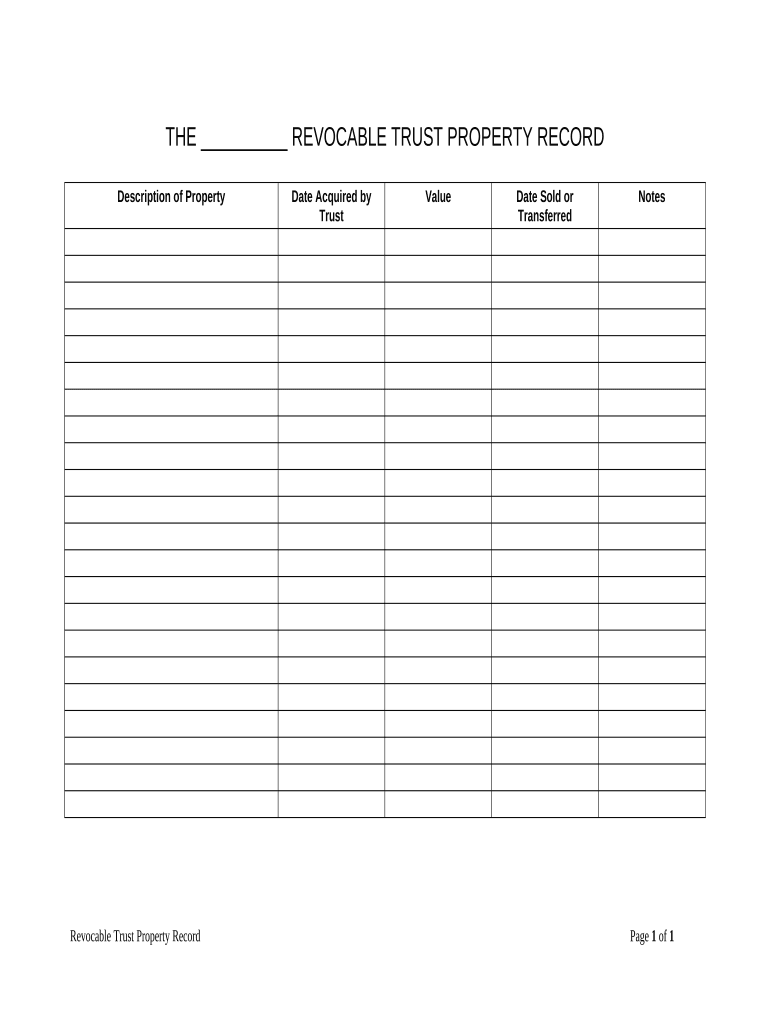

How to Fill Out a Living Trust Property Record Form

Understanding revocable trusts and their importance

A revocable trust is a legal document allowing you to place assets into a trust during your lifetime, which can be altered or revoked as needed. One significant advantage of using a revocable trust for property management is that it helps avoid probate, making the transition of assets smoother for your beneficiaries. Additionally, revocable trusts provide privacy, as they do not become public records like wills. It is essential to understand the differences between revocable trusts and other estate planning tools, such as irrevocable trusts or wills, to determine the best option for your estate plan.

Components of the revocable trust property record

-

Detailing each asset is crucial for clarity and organization.

-

Accurate record-keeping helps track property ownership and valuation over time.

-

Evaluating trust assets is important for both financial management and potential future tax implications.

-

This record is necessary for transparency during audits and to inform beneficiaries.

-

Utilizing this section allows you to include any additional details, maintenance issues, or considerations.

Step-by-step guide to filling out the revocable trust property record

-

Collect documents related to the property you are adding to the trust before starting.

-

Write a detailed description of each asset, including its address and legal description.

-

Ensure you record the accurate date you transferred the property into the trust.

-

Conduct an appraisal if necessary to reflect the property's current market value.

-

Maintain an accurate record by noting the date if the property is sold or transferred.

-

Input any particular conditions, maintenance issues, or special instructions relevant to the property.

Utilizing pdfFiller for document management and collaboration

pdfFiller provides an easy-to-use platform for editing PDFs directly, allowing for seamless modifications to your living trust property record form. You can electronically sign documents, eliminating the need for printing and scanning, which streamlines the process. Additionally, you can collaborate with team members in real-time, ensuring everyone has access to the most current information, and securely manage all your trust documents in the cloud.

Legal compliance and important considerations

-

It's essential to be aware of the requirements that vary by state for revocable trusts.

-

Engage with an estate planning attorney to ensure compliance and optimal structure for your trust.

-

Obtain the necessary consents and validations from involved parties to avoid disputes.

Next steps after completing the property record

-

This vital step adds legal validity to your documentation, especially for trust transactions.

-

Visit your County Recorder’s Office to file the documents as part of your public records.

-

Post-recording, ensure you and your beneficiaries are aware of the trust's terms and any implications.

Understanding what happens next

-

Regularly review and update your records to reflect any changes in property ownership or value.

-

Keep the record current so that it accurately represents the trust’s assets at all times.

-

Inform your beneficiaries about changes to the trust or its assets to promote transparency and trust.

How to fill out the living trust property record

-

1.Download the living trust property record template from pdfFiller.

-

2.Open the template in pdfFiller.

-

3.Begin by entering the name of the trust at the top of the document.

-

4.Fill in the date the trust was established.

-

5.List the names of the trustees responsible for managing the assets.

-

6.Provide detailed descriptions of each property or asset included in the trust, including addresses and ownership details.

-

7.Document any specific instructions for managing or distributing the assets, if applicable.

-

8.Review all entered information for accuracy and completeness.

-

9.Save the completed living trust property record.

-

10.Print or share the document as needed for legal purposes.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.