Last updated on Feb 20, 2026

Get the free Satisfaction, Release or Cancellation of Deed of Trust by Individual template

Show details

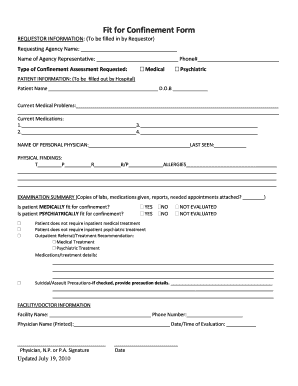

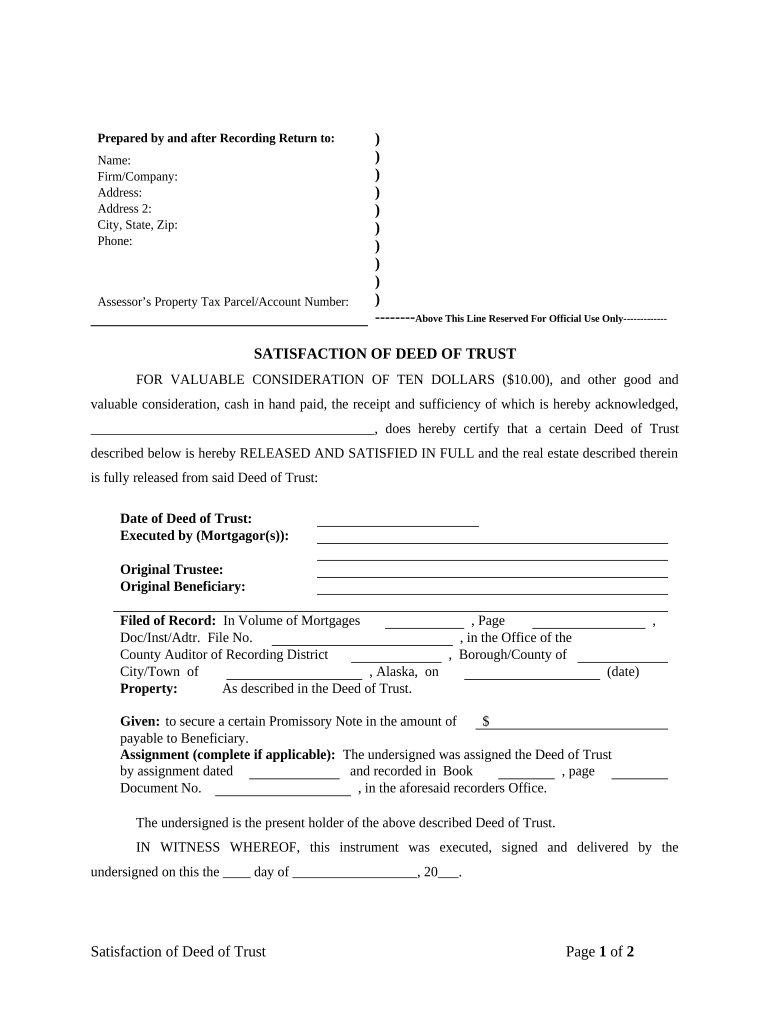

This Satisfaction or Release of a Deed of Trust is to be executed by the current individual holder of the Deed of Trust for the state of Alaska. This form complies with all state statutory laws and

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is satisfaction release or cancellation

A satisfaction release or cancellation is a legal document that formally acknowledges the fulfilling of obligations, thereby releasing a party from further liability under a specific agreement.

pdfFiller scores top ratings on review platforms

I know that most IRS forms are free and can be saved to my files, however sometimes trying to download the forms is difficult to do. PD Filler is much more user friendly and easy to follow.

Using the paid version and it works well. Love having the extra options over the free version. Worth the year subscription.

OIT was good but I still need more experience with it to get a higher rate,

Now it is a tool I use in my work. Has been very useful.

WOULD HAVE BEEN NICER TO BE ABLE TO PUT ALL MY 1099-MISC IN JUST 1 PDF THOUGH

I keep having trouble returning to my document in progress. Other than that I really like this form maker.

Outstandingly useful and so easy to use!

Who needs satisfaction release or cancellation?

Explore how professionals across industries use pdfFiller.

Satisfaction Release or Cancellation Form Guide

If you've successfully paid off your mortgage, the satisfaction release or cancellation form is essential. This document confirms that your mortgage obligation has been fulfilled and releases the lien on your property.

Understanding the satisfaction of mortgage form

A Satisfaction of Mortgage Form is a legal document filed with the county to indicate that a borrower has fully repaid their mortgage. It is crucial because it effectively releases the lien against the property, thereby clear title for the owner.

-

This form formally denotes that the mortgage debt has been paid off, clearing any claims of the lender against the property.

-

Filing the form prevents potential future financial complications by ensuring your property title is clear and free from the mortgage lien.

-

The satisfaction form is associated with previous mortgage agreements, serving as proof that all terms have been met and the loan is fully resolved.

Key components of the satisfaction of mortgage form

To successfully complete a satisfaction release or cancellation form, there are several critical components that need attention. Filling this out correctly ensures legality and accuracy.

-

The form should include information about who prepared it and detail the recording where the mortgage is filed.

-

Make sure to accurately provide the borrower's name, property address, and tax parcel number for proper identification.

-

Understanding these terms is vital; 'Valuable Consideration' refers to the payment made, while 'Release and Satisfaction' indicates the mortgage obligations have been met.

Step-by-step guide to completing the satisfaction of mortgage form

Completing the satisfaction release or cancellation form involves a clear set of steps to ensure all information is correctly filed. Here's a simple guide.

-

Compile all relevant documents and personal information needed to fill out the form.

-

Systematically work through the required fields in the form to ensure accuracy.

-

Double-check all entries to prevent errors that could delay processing.

-

A signature is required, and in many cases, notarization may be necessary to validate the document.

Where to submit your satisfaction of mortgage form

The location for submitting the satisfaction release or cancellation form varies by area but usually goes to local recording offices. Knowing where to submit is important for compliance.

-

Visiting your local county office is typically the first step for successful submission.

-

Check if your region allows online submissions; if in-person, know the required documents beforehand.

-

Be prepared to pay any associated fees, which can vary by county.

Understanding the legal implications of the satisfaction of mortgage

Filing the satisfaction release or cancellation form has several legal implications that homeowners should be aware of to protect their interests.

-

Once filed, there is typically a positive effect on the homeowner's credit score due to the removal of the mortgage debt.

-

The property owner will now have a clear title, which is essential for future property transactions.

-

After the satisfaction is recorded, ensure no further obligations to the lender exist to avoid legal issues.

Common mistakes to avoid when filling out the form

Filling out the satisfaction release or cancellation form may seem straightforward, but several common mistakes can lead to delays or issues.

-

Ensure each section is completely filled to prevent automatic rejection of the form.

-

Verify that signatures match those on official documents to avoid complications.

-

Attention to deadlines and payment is crucial to maintaining a clear property title.

Leveraging pdfFiller for your document needs

Using pdfFiller, you can efficiently manage your satisfaction release or cancellation form through an intuitive online platform. This can drastically simplify the process.

-

Easily modify your document from anywhere, avoiding printing issues.

-

Access your forms anytime and collaborate with others securely in the cloud.

-

Utilize pdfFiller's sharing capabilities for seamless collaboration with parties involved.

How to fill out the satisfaction release or cancellation

-

1.Open the pdfFiller website and log in to your account.

-

2.Click on 'Create New' to start a new document.

-

3.Search for 'satisfaction release or cancellation' template in the template library.

-

4.Select the appropriate template to edit.

-

5.Fill in the debtor's name and information in the designated fields.

-

6.Enter the creditor's name and address in the specified section.

-

7.Include the details of the obligation that has been satisfied, such as the amount paid and the date of payment.

-

8.Add any necessary legal descriptions or terms relevant to the agreement.

-

9.Review all entered information for accuracy and completeness.

-

10.Sign the document electronically or print it for manual signing if needed.

-

11.Save the completed document in the desired format, either PDF or another chosen format.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.