Get the free Estate Planning Questionnaire and Worksheets template

Show details

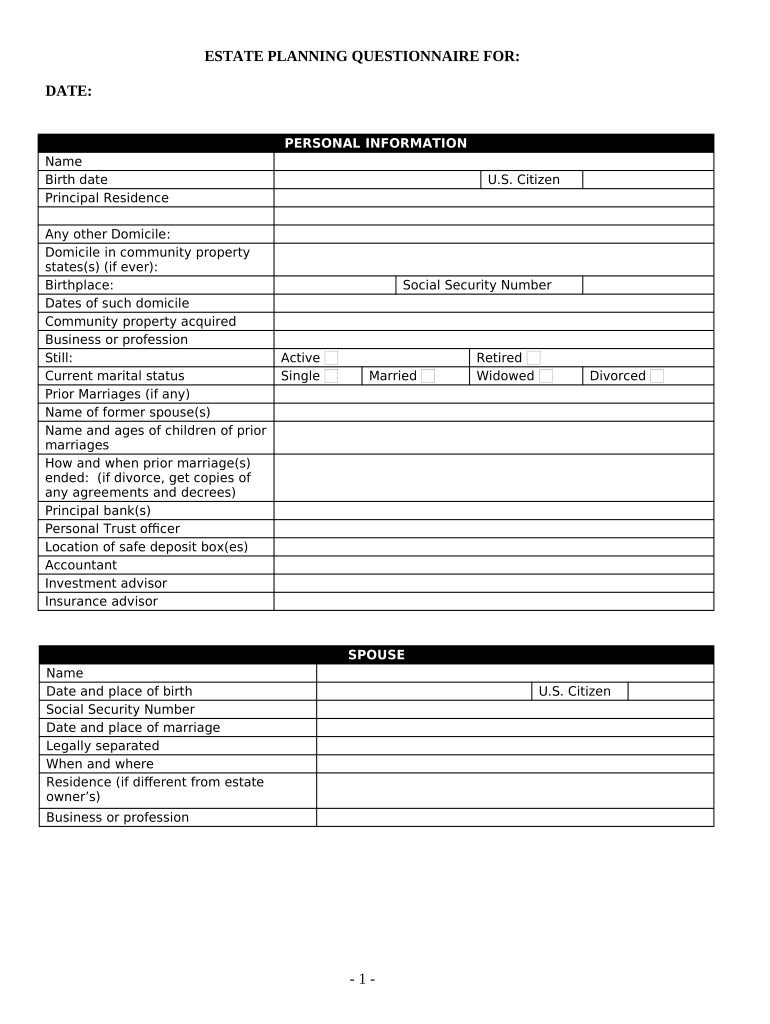

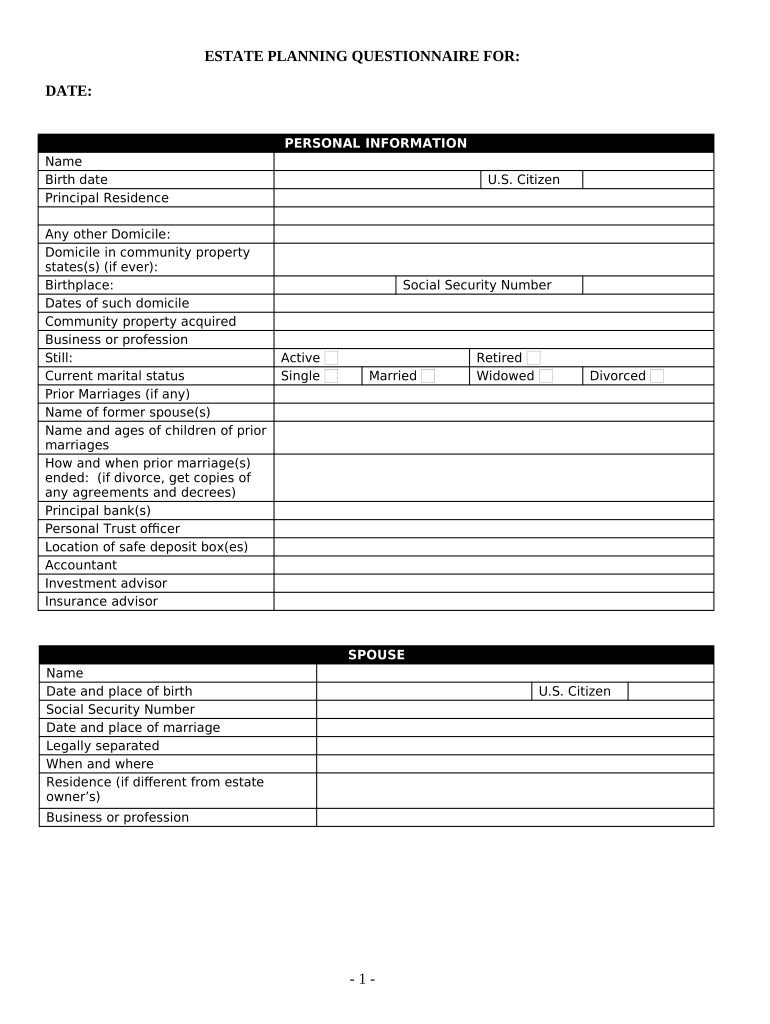

This Estate Planning Questionnaire and Worksheet form is for completing information relevant to an estate. It contains questions for personal and financial information. You may use this form for client

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is estate planning questionnaire and

An estate planning questionnaire is a document used to gather important information about an individual's assets, beneficiaries, and wishes for distribution upon death.

pdfFiller scores top ratings on review platforms

This is the easiest program for completing PDF forms.

I've tried others and had very frustrating results. Yours has been sooooo easy and user friendly.

It has been very helfull and easy to use, very friendly!

I'm new and learning but PDF filler is simple enuff even I can do things

good experience, user friendly, very useful tool to have and easy to use

I had an issue with a purchase for PDFfiller.com. I called customer service to get a refund, they were kind enough to honor my request. I would use them again.

Who needs estate planning questionnaire and?

Explore how professionals across industries use pdfFiller.

Estate Planning Questionnaire and Form Guide

What is estate planning and why is it essential?

Estate planning is the process of organizing the distribution of an individual's assets after their death. It is crucial for ensuring that your wishes are honored and that your loved ones are provided for. Without a proper estate plan, the state may decide how your assets are distributed, which may not align with your intentions.

Common components of estate planning include wills, which outline how your assets will be distributed; trusts, which manage assets on behalf of beneficiaries; and powers of attorney, which designate someone to make decisions on your behalf if you become incapacitated.

-

Legal documents that specify how your assets will be distributed after your passing.

-

Arrangements that hold assets for the benefit of another, often offering tax advantages.

-

Documents that grant another individual authority to make financial or health decisions on your behalf.

Additionally, many myths surrounding estate planning can create confusion. For instance, some believe that estate planning is only for the wealthy, but in reality, everyone can benefit from having a plan in place.

How to prepare for your estate planning questionnaire?

Preparation is key to successfully completing your estate planning questionnaire. Start by gathering essential documents, including personal identification, financial statements, and property deeds. Having these documents readily available will save time and ensure that you provide accurate information.

-

Include driver's licenses, birth certificates, and Social Security numbers.

-

Gather bank statements, investment accounts, life insurance policies, and any debts.

-

Document all real estate you own, including homes, land, and rental properties.

Additionally, it's important to list possible heirs and beneficiaries. This ensures that your estate is distributed according to your wishes. If you have minor children, consider potential guardians to care for them in the event of your passing.

What to include in the personal information section?

When completing the personal information section, provide clear and accurate details about yourself and your family. Start with your name, date of birth, and residency information, ensuring that identifiers match your legal documents.

-

Include current marital status as well as information regarding any previous marriages.

-

List all children, including stepchildren and adopted children, providing relevant details for each.

This section sets the foundation for your estate plan, making it clear who your family members are and any relevant relationships that may impact your estate distribution.

How to identify beneficiaries and fiduciaries?

Choosing beneficiaries—the individuals who will benefit from your estate—is a critical step. Consider who you want to inherit your assets, and clearly define their roles as beneficiaries, executors, and trustees within your will.

-

Individuals or organizations you wish to allocate your assets to.

-

Trusted people tasked with executing the terms of your will.

-

Individuals or institutions responsible for managing your trusts according to your wishes.

If you have young children, it's essential to select suitable guardians. This decision should be made thoughtfully, considering who can provide the best care and support for your children.

What to detail about gifts made during life?

It's essential to document any gifts made during your lifetime. This may include outright gifts, which are freely given, versus gifts placed in a trust, which have specific conditions. Keeping a record is critical for both tax implications and ensuring equitable distribution of your estate.

-

Gifts given without conditions, which need to be reported for tax purposes.

-

Gifts given through a trust, often with specific conditions attached.

Understanding the tax implications of these gifts is vital. You may need to report significant gifts depending on local tax laws, ensuring you stay compliant with regulations.

What financial information is necessary?

An overview of your financial situation is essential for complete estate planning. Start with real estate, specifying each property you own along with relevant mortgages and their estimated values. Accurate assessments help clarify your financial picture.

-

List all properties, their mortgage details, and current market values.

-

Gather details on stocks, bonds, and other investment accounts, including current values.

-

Consider obtaining appraisals for significant assets to provide an accurate valuation.

This financial information will enable advisors to provide better planning guidance and create a clearer picture of your legacy.

How to utilize pdfFiller for your estate planning needs?

pdfFiller offers a seamless way to manage your estate planning questionnaire. With its user-friendly editing features, you can fill out and modify your document with ease, ensuring that all information is correct and up-to-date.

-

Easily modify your estate planning questionnaire using pdfFiller's tools.

-

Legally sign your documents electronically to ensure binding agreements.

-

Share your completed form with family members or advisors for feedback and input.

Using pdfFiller allows for a collaborative approach to your estate planning, empowering you to create the best possible outcomes for your loved ones.

How to avoid common pitfalls in estate planning?

Completing your estate planning questionnaire can present several pitfalls. Common mistakes include failing to update your plan regularly, which can lead to outdated information that no longer reflects your wishes or changes in your family situation.

-

Ensure that all information provided in the questionnaire is accurate and up-to-date.

-

Review and update your estate plan periodically, especially after major life events.

-

Engage with legal and financial professionals to ensure compliance and best practices.

Compliance with laws is essential, so consulting with professionals can significantly reduce the likelihood of errors. This proactive approach will not only help you avoid costly mistakes but will also ensure your estate is handled according to your wishes.

How to fill out the estate planning questionnaire and

-

1.Start by accessing the estate planning questionnaire on pdfFiller.

-

2.Review the introduction of the document to understand its purpose and importance.

-

3.Begin filling in your personal information, including your full name, address, and contact details.

-

4.List your assets, including real estate, bank accounts, investments, and personal property, providing as much detail as possible.

-

5.Identify your beneficiaries by naming individuals or organizations that will receive your assets.

-

6.Include any specific wishes regarding asset distribution or special conditions for beneficiaries.

-

7.Sign the questionnaire electronically, if required, and date the document to ensure it is current.

-

8.Review all entries for accuracy before final submission, and save a copy for your records.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.