Get the free Wrap Around Mortgage template

Show details

This is a sample Purchase and Sale agreement for the interest and rights to oil, gas and minerals, and related equipment, owned by one of the parties. The Agreement contains many detailed provisions

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

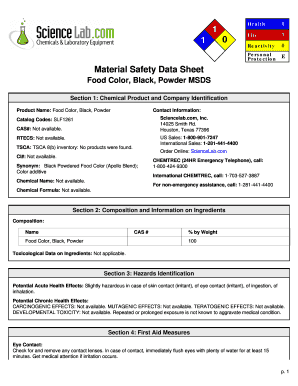

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is wrap around mortgage

A wrap around mortgage is a type of secondary mortgage that encompasses an existing mortgage and allows the borrower to make one payment that wraps around the older loan.

pdfFiller scores top ratings on review platforms

I like it so far but I know their is a lot to learn.

Easy to use and never have issue recovering documents

Overall, PDFfiller has served as a great resource for me I enjoy it's simple and easy to use functions.

It's easier to use than .the other apps I've tried

PDFfiller is making filling out forms much more streamlined. As a non-profit organization we try to look for things make the running of it more efficient. PDFfiller has made this possible. No more trying to create the forms and fill in the tiny blocks. Just create, insert, and print.

I am finding it helpful indeed. I haven't utilized all of the options yet. So far I like it. The mobile app is far more difficult to use than the website. Doesn't quite sync with the different cloud websites for transfers into the app.

Who needs wrap around mortgage template?

Explore how professionals across industries use pdfFiller.

Complete Guide to Wrap Around Mortgage Forms

How do wrap around mortgages work?

A wrap around mortgage is a type of financing arrangement where a new mortgage wraps around an existing mortgage. This allows a buyer to make payments directly to the seller, who continues to pay the original lender. This arrangement can simplify the process of acquiring property, especially when traditional financing options are not available.

-

Wrap around mortgages facilitate the transfer of property without needing the buyer to directly engage with traditional lenders.

-

These mortgages can be more flexible and provide easier qualification criteria for buyers, saving both time and hassle in the purchasing process.

-

Buyers assume the risk if the seller defaults on the original mortgage, potentially causing legal complications.

What are the key components of a wrap around mortgage form?

A wrap around mortgage form needs to capture essential information for both parties involved. Ensuring all critical fields are covered can help streamline the transaction and avoid misunderstandings.

-

Include details such as property address, buyer and seller identification, and the amounts involved in the wrap around financing.

-

Critical clauses should outline payment terms, interest rates, and responsibilities of each party to avoid future disputes.

-

It's essential to ensure compliance with local laws and regulations to validate the agreement.

How to fill out your wrap around mortgage form?

Filling out a wrap around mortgage form requires attention to detail and precision. Proper completion ensures that all legal obligations are met effectively.

-

Follow instructions carefully, starting from basic information to more complex fields, ensuring all data is accurate.

-

Avoid incomplete fields or unclear terms; these can lead to legal issues later.

-

Double-check all entries against provided documentation to uphold the form's integrity.

What are common terms in wrap around mortgages?

Understanding common terms in wrap around mortgages can help parties navigate the agreement with confidence. Familiarity with terminology ensures smooth transactions and avoids potential conflicts.

-

The mortgagee is the lender, while the mortgagor is the borrower; both roles must be clearly defined in legal agreements.

-

Secured indebtedness means the amounts secured against the property, crucial for assessing exposure and obligations.

-

Future advances are additional funds that may be drawn from the wrap-around mortgage, contingent on terms predefined.

What steps are involved in legal recording and compliance?

Legal recording of the wrap around mortgage form is critical in ensuring that the transaction is legally binding and publicly acknowledged.

-

Typically, forms should be submitted to county or state offices responsible for property records.

-

The date of recording establishes priority and serves as the official record of the mortgage.

-

Ensure compliance with Alabama’s specific regulations regarding wrap around mortgages to avoid potential legal issues.

How can you manage your mortgage post-filing?

Effective management of a wrap around mortgage after filing ensures timely payments, compliance, and resolution of potential issues.

-

Regularly monitor payment schedules to maintain financial health and uphold terms of the agreement.

-

Act promptly to address any discrepancies or disputes that may arise during the mortgage term.

-

Be informed about your rights and obligations to prevent exploitation and ensure compliance with the mortgage terms.

What are common troubleshooting steps for mortgage issues?

Addressing issues related to a wrap around mortgage promptly is essential for maintaining financial stability and avoiding default.

-

Explore options such as renegotiating terms or seeking financial assistance to avoid foreclosure.

-

Consult a legal professional to understand your options if a dispute arises regarding the mortgage.

-

Engaging with real estate advisors can provide valuable guidance in navigating complex mortgage matters.

How can pdfFiller assist with mortgage document management?

pdfFiller offers an array of tools designed to simplify document preparation and management, ensuring an efficient process.

-

With pdfFiller, users can easily edit, sign, and finalize their mortgage documents online.

-

Teams can work together seamlessly, making adjustments and finalizing documents collaboratively.

-

Access documents from anywhere, ensuring you have what you need, when you need it.

How should wrap around mortgages be incorporated into financial planning?

Integrating wrap around mortgages into your financial plan is essential for long-term viability and success.

-

Make informed decisions regarding mortgage terms to align with your overall financial strategy.

-

Evaluate the long-term sustainability of the mortgage to ensure it fits your future financial goals.

-

Consulting with financial advisors can provide tailored advice on managing wrap around mortgages effectively.

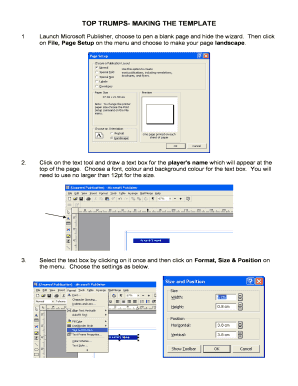

How to fill out the wrap around mortgage template

-

1.Start by gathering all necessary documentation, including details about the existing mortgage and property information.

-

2.Access pdfFiller and log in to your account or create a new one if you don't have one.

-

3.Use the search feature to find the wrap around mortgage template.

-

4.Click on the template and select 'Fill' to open the form for editing.

-

5.Begin by entering the borrower's details, including their name and contact information.

-

6.In the appropriate section, input the existing mortgage details, including the balance and monthly payment.

-

7.Add the terms of the wrap around mortgage, such as interest rate and payment schedule.

-

8.Include any additional terms and conditions relevant to the agreement.

-

9.Review all the information for accuracy and clarity before finalizing.

-

10.Once satisfied, save your work and either download the document or send it directly for signing.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.