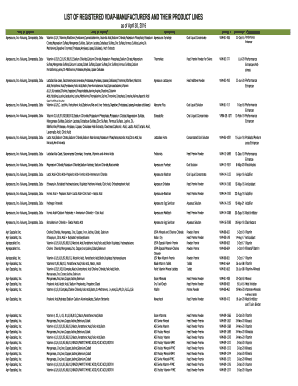

Get the free Estate Planning Questionnaire and Worksheets template

Show details

This Estate Planning Questionnaire and Worksheet is for completing information relevant to an estate. It contains questions for personal and financial information. You may use this form for client

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is estate planning questionnaire and

An estate planning questionnaire is a document designed to help individuals organize their personal and financial information for effective estate planning.

pdfFiller scores top ratings on review platforms

All good, except that the fee is a bit expensive.

I am a new user and just learning how to use all of the tools. I am excited about being able to do everything on my computer.

Recently I needed to fill out several forms from my mortgage servicer. They emailed the forms in pdf format and wanted them signed and returned same day. I don't have a scanner available so I googled and found PDFfiller. I was able to get my forms filled out, signed, and sent back in a very short time. PDFfiller is very easy to use. It really saved my day!

I cannot get this to print correctly; all I am getting aare dots on form.

11/16 Don't remember how, but finally got it to work and enjoyed it day I bought. Recently had more PDF forms to fill in and enjoyed it again. I will be cancelling sub in az few days, but will keep it in mind should I need it in future.

very good ! works like it said on the tin

Excellent. Faster and easier than a pdf filler program that I had previously run from my local drive. The signing feature us saving me tons of time.

Who needs estate planning questionnaire and?

Explore how professionals across industries use pdfFiller.

Estate Planning Questionnaire and Form Guide

How to fill out an estate planning questionnaire form

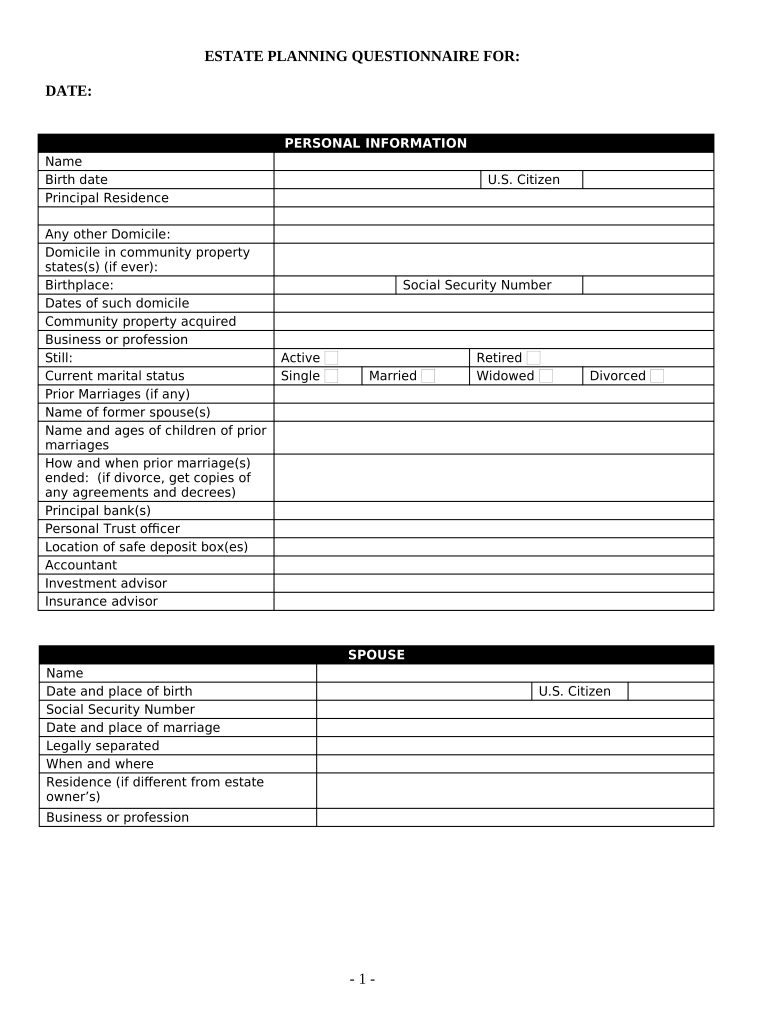

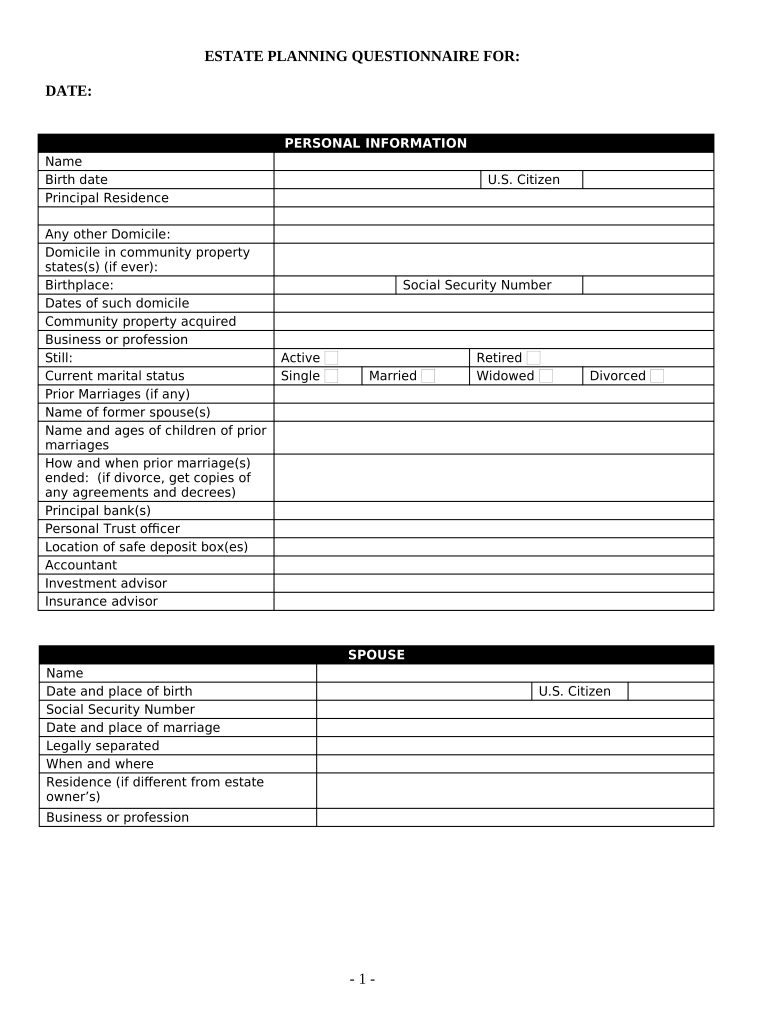

Filling out an estate planning questionnaire form is a crucial step in organizing your financial and personal matters. Begin by gathering all necessary personal and financial information, and carefully follow the instructions to ensure accurate completion. This guide will simplify the process and enhance your understanding of what is required in your estate planning efforts.

What is estate planning?

Estate planning is the process of arranging the management and disposal of a person's estate during their life and after death. This typically involves creating legal documents like wills and trusts that dictate how assets are distributed. Understanding the significance of this process can help individuals protect their loved ones and manage their wealth.

-

Establishing plans and directives for asset distribution and care for dependents.

-

Many think estate planning is only for the wealthy, but it's essential for everyone.

-

Wills, trusts, powers of attorney, and living wills are key documents.

Why should you navigate the estate planning questionnaire?

The estate planning questionnaire serves as a vital tool that guides you through the information needed to draft your estate documents. Having a structured approach can lead to more effective planning, ensuring you don’t miss critical information that could affect your estate.

-

To systematically collect information required for estate planning.

-

Take your time and provide detailed and accurate answers.

-

Inaccurate information can lead to legal challenges or unintended consequences.

What personal information is required?

Collecting complete personal information is crucial for accurately filling out your estate planning forms. This section typically includes details about your marital status, family connections, and other relevant personal data.

-

Include your full name, date of birth, and address.

-

State your current marital status and any prior marriages.

-

List children and their relationships or any dependents requiring consideration.

How do you identify beneficiaries and fiduciaries?

Choosing beneficiaries and fiduciaries is one of the most critical aspects of estate planning. Beneficiaries are individuals who will inherit your assets, while fiduciaries manage your estate according to your wishes. This section guides you through making informed choices.

-

Decide who you want to inherit specific assets outlined in your will.

-

Select trusted individuals to administer your estate and handle financial matters.

-

Consider your choices carefully and discuss with potential guardians beforehand.

How do gifts impact your estate?

Gift-giving during your lifetime can significantly affect your estate and taxes. Understanding how to document these gifts is essential for accurate estate planning and future financial guidance.

-

All gifts can reduce taxable estate value but must be recorded properly.

-

Detail what was given, to whom, and their estimated values.

-

Certain significant gifts must be officially reported to tax authorities.

What financial information should you compile?

A comprehensive look into your finances is essential when filling out the questionnaire. This includes real estate, stocks, bonds, and overall financial situation that needs historical detail for clarity.

-

List all owned properties, including addresses and estimated values.

-

Include stocks, bonds, bank accounts, and any other investments.

-

Consider any outstanding mortgages and provide estimates of your assets’ values.

How can interactive tools assist in document management?

Using tools like pdfFiller can simplify the document completion process of your estate planning questionnaire form. These tools allow you to fill out, edit, and sign your forms securely in one platform.

-

Easily fill out your estate planning forms online from any device.

-

Make necessary revisions or adjustments as required for accuracy.

-

Sign your documents electronically, adding another layer of convenience.

What legal compliance should you consider?

Understanding the legal requirements surrounding estate planning in your specific state is vital. This ensures that your plans will hold up legally after your passing.

-

Research your jurisdiction’s estate planning regulations.

-

Consult local legal experts to ensure compliance with all applicable laws.

-

Consider hiring estate planning attorneys or experts for guidance.

How do you access template forms with pdfFiller?

Finding and using relevant estate planning forms through pdfFiller is straightforward. The platform provides customizable templates to fit your specific needs.

-

Search for estate planning forms readily available in various formats.

-

Follow step-by-step instructions to tailor the templates to your personal circumstances.

-

Securely save your completed forms and easily share them with relevant parties.

What should you do after completing the questionnaire?

Once you've filled out your estate planning questionnaire form, the next steps are pivotal in ensuring your estate plan is fully realized. From discussions with legal advisors to communicating your plans with family members, being proactive is key.

-

Review your completed questionnaire and ensure all information is accurate.

-

Meet with legal advisors to finalize your estate plan based on the questionnaire.

-

Share your estate plan with family members to avoid confusion later.

How to fill out the estate planning questionnaire and

-

1.Obtain a copy of the estate planning questionnaire in PDF format from pdfFiller.

-

2.Open the PDF document using the pdfFiller editor.

-

3.Begin by entering your personal information such as full name, address, and contact details in the designated fields.

-

4.Follow the prompts to list your assets, including real estate, bank accounts, retirement accounts, and personal property.

-

5.Provide information about your debts and liabilities to assess your net worth.

-

6.Answer questions regarding your wishes for guardianship if you have dependents.

-

7.Indicate your preferences for healthcare directives and power of attorney.

-

8.Review your input for accuracy and completeness.

-

9.Once finished, save your responses and download the completed questionnaire in your preferred format.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.