Last updated on Feb 20, 2026

Get the free pdffiller

Show details

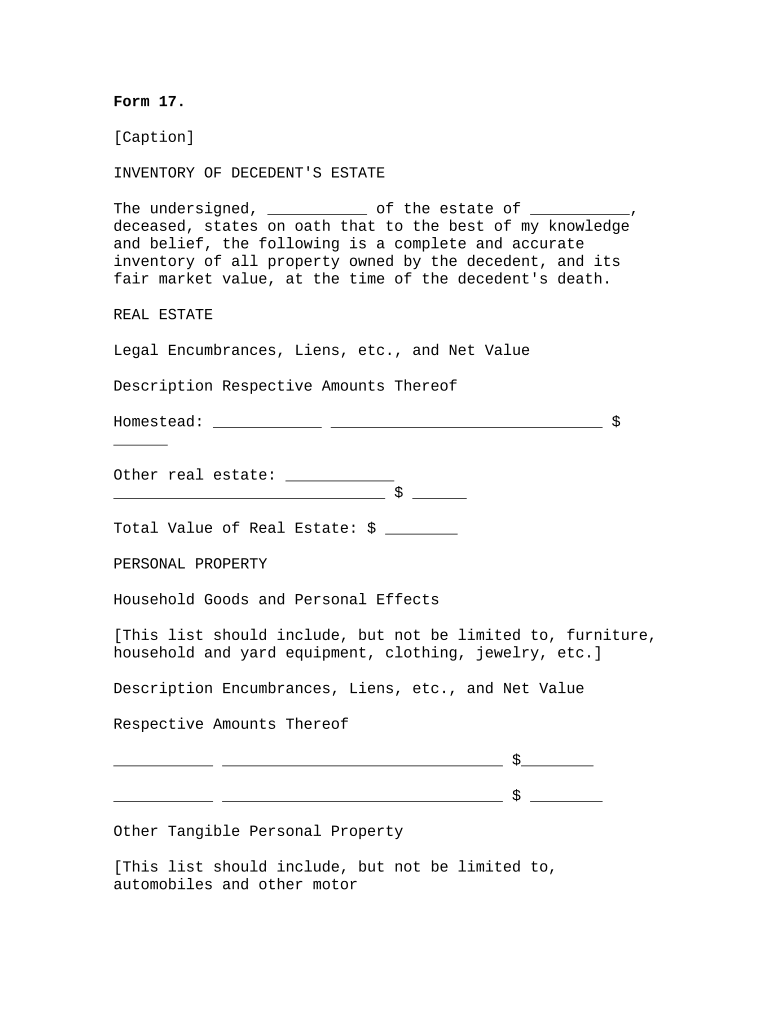

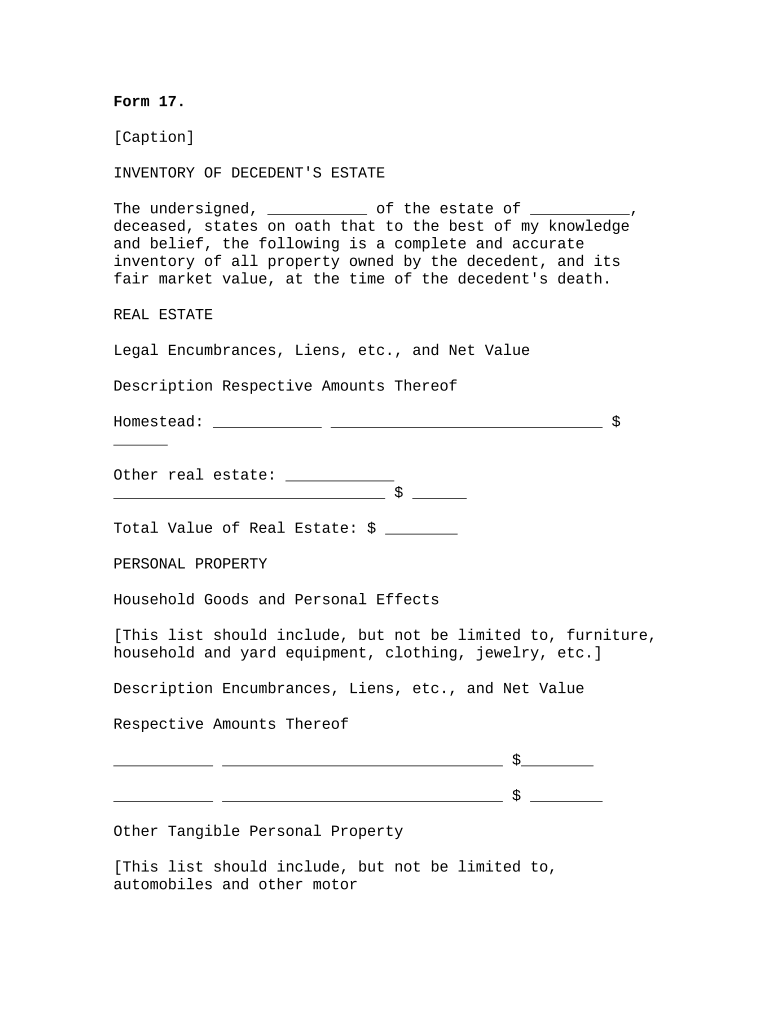

Inventory of Decedent's Estate. This probate court form is submitted by the personal representative to the court to document the assets and liabilities that are part of the decedent's estate.

pdfFiller is not affiliated with any government organization

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is inventory of decedents estate

An inventory of decedent's estate is a detailed list of the assets and liabilities of a deceased person's estate.

pdfFiller scores top ratings on review platforms

It seems like a great app, but I haven't had time to use it to it's full potential yet.

excellent software and it does what it isi supposed to do

Just started, Awesome so far. Thank You

PDFfiller really makes it easy to fill in forms to make your documents look professional.

PDFfiller is user friendly and excellent.

HAD TO GET HELP FROM SUPPORT AND THEY WAS GREAT

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

A Comprehensive Guide to Completing the Inventory of Decedent's Estate Form

How do you understand the inventory of decedent's estate form?

The Inventory of Decedent's Estate Form is a crucial document in estate management, detailing all assets owned by a deceased person. Accurately completing this form is vital as it assists in the probate process, ensuring that assets are managed and distributed according to the decedent's wishes. This form not only streamlines the legal proceedings but also provides transparency to beneficiaries.

-

It’s a record that lists all the decedent's assets and liabilities.

-

Ensures accurate estate distribution and compliance with legal requirements.

-

Facilitates a smoother probate process, reducing the potential for disputes.

What do you need to prepare for the inventory process?

Before you begin the inventory process, gather essential documents, including the decedent's will, financial statements, and any property deeds. Identifying all assets is crucial for a comprehensive listing, as it aids in fulfilling legal obligations regarding their valuation. By preparing thoroughly, you safeguard accurate reporting and protect the estate’s integrity.

-

Collect wills, bank statements, deeds, and any relevant financial records.

-

Ensure all tangible and intangible assets are accounted for.

-

Understand any state-specific laws regarding estate inventory reporting.

How do you complete the form step-by-step?

Completing the Inventory of Decedent's Estate Form involves several detailed steps to ensure accuracy. This includes listing various categories of assets like real estate and personal property. Each step builds on the last, providing a structured way to gather and report the necessary information.

-

Identify all properties owned by the decedent. Assess legal encumbrances, if any, and calculate net values.

-

Classify household items and evaluate tangible personal property, as well as intangible assets such as stocks and bonds.

How do you value and organize the assets?

Determining the fair market value of each asset is essential. Organizing assets into clear categories simplifies the process of reporting and minimizes errors. Summarizing total values at the end allows for a transparent overview of the estate's worth.

-

Conduct valuations to ensure accurate representation of each asset.

-

Grouping assets by type enhances clarity and accessibility of information.

-

Summarize values to reflect the complete estate picture for legal and financial clarity.

What are the final steps for executing the form?

After compiling the inventory, it’s critical to review the document for accuracy. Understanding the signature and affidavit requirements is essential, as providing false information can have legal consequences. Knowing common mistakes can help avoid issues and ensure smooth processing.

-

Ensure every detail is correct to avoid complications in probate.

-

Know who must sign the form and any accompanying affidavit.

-

Be aware of errors like omitting assets or misvaluing items.

How can pdfFiller tools enhance form management?

Using pdfFiller’s tools can streamline your experience with the Inventory of Decedent's Estate Form. Editing and customizing the form directly on the platform simplifies the process, while secure eSigning ensures document integrity. Additional collaboration features allow for input from legal advisors, making it easier to submit accurate inventories.

-

Customize the form effortlessly with intuitive editing tools.

-

Sign documents safely and conveniently without physical paperwork.

-

Work with legal advisors to refine and perfect your inventory.

What are the common challenges in completing the inventory?

Challenges often arise during the inventory process, particularly in the areas of asset valuation and data gathering. Missing information can complicate the completion and may lead to legal issues down the line. Being aware of these challenges can better prepare you to handle them efficiently.

-

Identifying correct asset values can be tricky due to fluctuating market conditions.

-

Locating all required data is vital to ensure no details are overlooked.

-

Incorrect or incomplete reporting can lead to legal ramifications for executors.

What should be included in the summary section of the inventory?

The summary section of the Inventory of Decedent's Estate Form should compile the total values of all asset categories, giving a clear picture of the estate. This section serves as a capstone to the entire process, emphasizing the importance of accuracy to ensure compliance with legal standards and to fulfill obligations owed to the decedent.

-

Carefully aggregate values from all categories for an overall total.

-

Note any ongoing obligations or debts owed to the decedent.

-

Reinforcing the critical nature of precision in this summary.

How to fill out the pdffiller template

-

1.Download the inventory of decedent's estate form from pdfFiller or access it directly online.

-

2.Open the PDF file in pdfFiller to start filling it out.

-

3.Begin with the decedent's personal information, including their full name, date of birth, and date of death.

-

4.List all assets owned by the decedent, such as real estate, bank accounts, investments, and personal property, with their estimated values.

-

5.Include any liabilities, such as debts, outstanding loans, or mortgages that the decedent had.

-

6.Review the instructions provided on the form for any specific requirements or additional information needed.

-

7.Ensure that all information is accurate and up-to-date to avoid complications during the probate process.

-

8.Once complete, save the filled document and print it if necessary for submission to the probate court or relevant parties.

-

9.Consider consulting with a legal professional to ensure compliance with local laws and requirements.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.