Get the free Accounting for Personal Representative template

Show details

Accounting by Personal Representative of Estate. This official probate court form is used to account to the probate court all the expenses incurred by the estate under the direction of the personal

pdfFiller is not affiliated with any government organization

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is accounting for personal representative

Accounting for personal representative is a formal record detailing the financial transactions and management of the estate by the executor or administrator of a deceased person's estate.

pdfFiller scores top ratings on review platforms

The PDF filler is great. The fields are easy to navagate and the the form gets to the numbrs easilly

So far all is formatted well for my document needs..

Excelente ferramenta para vários tipos de trabalhos.

This is an excellent platform for editing PDF's. I dare say I prefer it to Adobe!

Filled version was great, but was not able to save a blank copy.

PDF filler is great and easy to use.. Love it

Who needs accounting for personal representative?

Explore how professionals across industries use pdfFiller.

Accounting for Personal Representative Form Guide

How do you understand the personal representative's role?

A personal representative is an individual appointed to manage the estate of a deceased person through the probate process. Their primary responsibilities include gathering the deceased's assets, paying debts, and distributing remaining assets to beneficiaries. Accurate accounting is vital during this process, as it helps prevent legal disputes and ensures proper adherence to the law.

-

A personal representative acts on behalf of the estate, ensuring all tasks are completed according to legal requirements.

-

Detailed and accurate accounting aids in a smooth probate process and reassures beneficiaries about the estate's management.

-

Failing to provide proper accounting can lead to legal challenges and potential penalties under Arkansas probate law.

What are the key components of the accounting form?

Key components of the accounting for personal representative form ensure completeness and legal compliance. Each section plays a crucial role in presenting a clear overview of the estate's financial status during the probate process.

-

This section indicates the form's purpose, helping those reviewing it to quickly identify its relevance.

-

The timeline element establishes the period the accounting covers, ensuring clarity in reporting.

-

Arkansas law mandates the submission of an accounting form, helping to track the estate's financial activities.

-

This includes detailed sections on charges, credits, and a summary that recaps financial activity.

How do you fill out the form step-by-step?

Filling out the accounting for personal representative form is straightforward yet requires attention to detail. This guide walks users through critical stages of the process to ensure accuracy and compliance.

-

Start by entering key details like dates and the accounting period to establish the timeline for the report.

-

List all income and property received during the accounting period, providing clarity on estate growth.

-

Identify and classify all expenses incurred, dividing them into relevant types for easier understanding.

-

Ensure accuracy by carefully checking the totals, confirming the remaining balances are correctly computed.

What interactive tools can assist in document management?

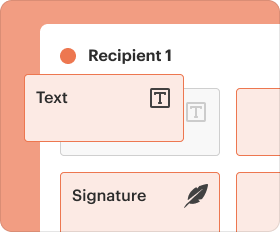

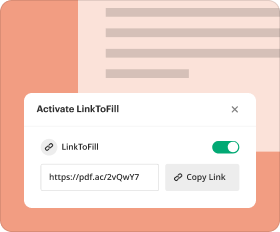

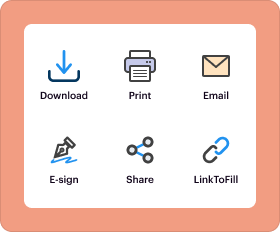

pdfFiller offers various interactive tools for seamless management of the accounting form. These tools enhance the editing and signing process, ensuring that personal representatives can complete their tasks efficiently.

-

Users can easily upload and modify the accounting template, adapting it to their specific needs.

-

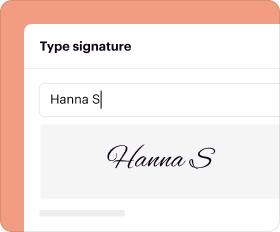

pdfFiller allows for electronic signatures, streamlining the signature collection process for personal representatives.

-

This feature enables teams to work together on documents, improving efficiency and oversight.

-

Managing documents via cloud storage creates easy access to files from anywhere, ensuring flexibility.

How to ensure compliance and best practices?

Following established best practices ensures compliance with Arkansas laws when managing personal representative accounts. Understanding the rules and deadlines can help prevent common mistakes.

-

Familiarize yourself with state regulations regarding the duties of personal representatives to avoid legal mishaps.

-

Be aware of specific deadlines to submit the accounting form, ensuring compliance with probate timelines.

-

Recognize frequent pitfalls, such as incomplete information or errors in calculations, to improve accuracy.

-

Maintain clear communication with beneficiaries and other stakeholders to build trust and transparency in financial reporting.

What are the final steps after accounting submission?

Closing the estate is a significant step following the submission of the accounting form. It involves several key requirements to ensure that all matters related to the estate are resolved.

-

Ensure all debts are paid and assets properly distributed before initiating the estate closure.

-

Determine the appropriate time for asset distribution, ensuring it aligns with the requirements specified in the accounting.

-

It's important to properly handle and report fee structures to avoid disputes among beneficiaries.

-

Submitting periodic status reports ensures that all parties are kept informed throughout the process.

How to fill out the accounting for personal representative

-

1.Begin by gathering all financial documents related to the estate, including bank statements, tax returns, and receipts for expenses.

-

2.Open the accounting for personal representative form on pdfFiller and review the layout for sections regarding income, expenses, and assets.

-

3.In the income section, list all sources of income generated by the estate, such as rental income or dividends, along with the corresponding amounts and dates.

-

4.Proceed to the expenses section, detailing all payments made on behalf of the estate, including funeral costs, legal fees, and outstanding debts, ensuring accuracy in amounts and descriptions.

-

5.For the assets section, provide a comprehensive listing of the estate's assets, including real estate, stocks, or personal property, with current valuations.

-

6.Double-check all entries for accuracy and clarity to ensure that all financial transactions are well-documented.

-

7.Once completed, save the document and review any required signatures from necessary parties.

-

8.Finally, submit the completed form to the appropriate court or share it with beneficiaries and advisors as needed.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.