Last updated on Feb 17, 2026

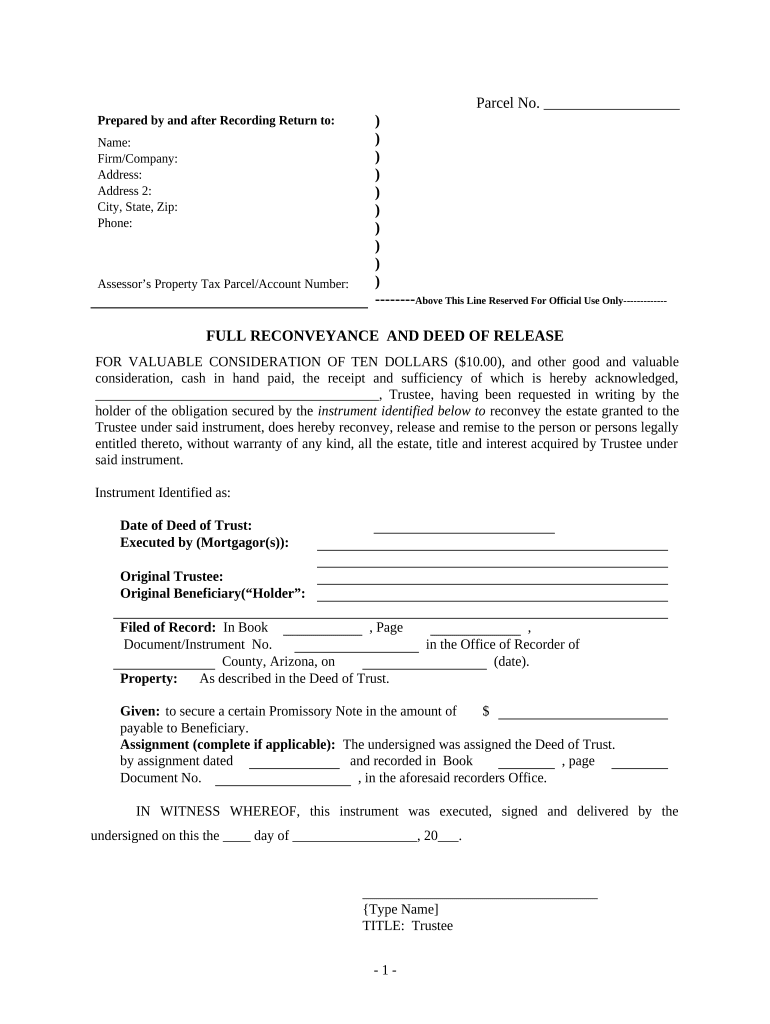

Get the free Full Reconveyance and Deed of Release - Satisfaction, Release or Cancellation of Dee...

Show details

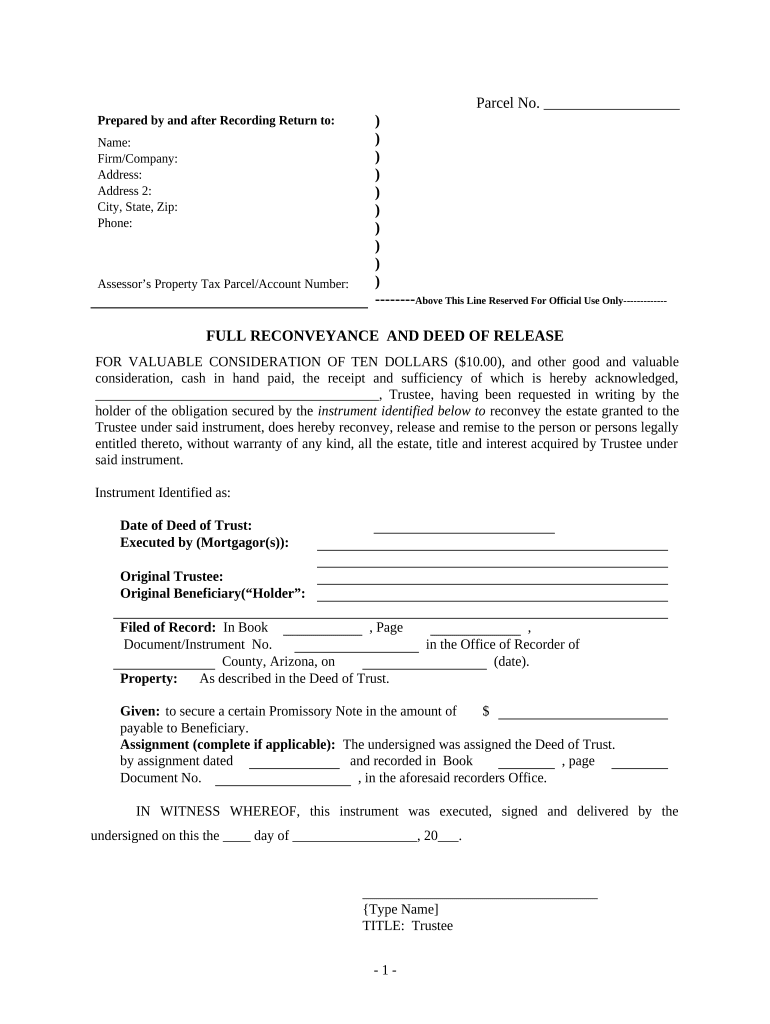

This form is for the satisfaction or release of a mortgage for the state of Arizona by an Individual. This form complies with all state statutory laws and requires signing in front of a notary public.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is full reconveyance and deed

A full reconveyance and deed is a legal document that transfers ownership of property back to the borrower after a mortgage has been paid in full.

pdfFiller scores top ratings on review platforms

somewhat complicated

Good but if comes with app better

Great

What's to say? it's convenient. Easy to use.

Its has helped me streamline my document processing.

love it

Who needs full reconveyance and deed?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Full Reconveyance and Deed Form on pdfFiller

What is full reconveyance?

Full reconveyance is the legal process of releasing a property from a mortgage or deed of trust, signifying that the borrower has fulfilled their obligations. It serves as a formal document that indicates the lender no longer has a claim on the property, thereby allowing the owner to gain full title. Understanding this process is crucial for anyone involved in property transactions.

-

A legal instrument that releases a property from the encumbrance of a mortgage.

-

It signifies that the loan is paid off, allowing the homeowner to move forward unobstructed by previous debts.

-

Terms such as Trustee (the entity holding the deed), Beneficiary (the lender), and Mortgagor (the borrower) are vital to understanding reconveyance.

Why is it important to fill out the full reconveyance form correctly?

Filling out the full reconveyance form accurately is crucial as inaccuracies can lead to legal complications. Moreover, common errors may delay the process or require additional documentation, wasting both time and resources. Utilizing tools like pdfFiller can streamline this process and reduce the risk of mistakes.

-

Incorrect data can lead to denied claims and prolonged encumbrance on the property.

-

Common mistakes include misspellings, incorrect descriptions of the property, or missing signatures.

-

pdfFiller provides real-time validation and editing features that help ensure accuracy in document preparation.

How do you navigate the full reconveyance form fields?

Navigating the fields of the full reconveyance form can be daunting without the right guidance. Each section of the form must be filled out systematically to avoid any last-minute issues. Following a structured approach not only helps in filling out the form but also ensures compliance with legal standards.

-

Start by entering clear identifying information about the property and its parcel number.

-

Detail the trustee's name and contact information to validate their role in the reconveyance process.

-

Include pertinent details such as the trust document's date, parties involved, and related legal references.

-

Ensure that all required signatures are present and arrange for notarization to finalize the document.

What interactive tools does pdfFiller offer for full reconveyance forms?

pdfFiller is designed to empower users with advanced tools that simplify the process of filling out full reconveyance forms. These features not only enhance efficiency but also ensure that every document meets the necessary standards.

-

Easily edit, fill, and format the form using a user-friendly interface.

-

Seamlessly add electronic signatures to the document, ensuring compliance with legal standards.

-

Invite team members to collaborate in real-time, making adjustments as necessary to streamline the process.

-

pdfFiller provides secured storage options for your forms, ensuring they remain accessible yet confidential.

What compliance and legal standards should you follow for full reconveyance?

Different states have specific requirements for the execution of a full reconveyance. Understanding these can prevent any issues during the filing process. For example, Arizona has unique regulations that must be adhered to when completing such documents.

-

Familiarize yourself with Arizona's specific legislation regarding full reconveyance documentation and filing procedures.

-

These officials oversee the proper recording of forms, helping ensure compliance with local legal requirements.

-

Research pertinent laws to confirm that all steps have been taken to execute a valid reconveyance.

When is a full reconveyance required?

Understanding when a full reconveyance is necessary can aid in property management decisions. It’s most commonly applied when mortgages are fully paid or before selling the property.

-

Typically required after the mortgage has been paid off or if a loan has been refinanced.

-

A typical use case includes a homeowner selling their property after paying off the mortgage.

-

Changes like refinancing may necessitate filing a new reconveyance to reflect the updated terms.

How to fill out the full reconveyance and deed

-

1.Access pdfFiller and upload the 'Full Reconveyance and Deed' document template.

-

2.Enter the name of the property owner in the designated field at the top of the document.

-

3.Provide the property's legal description, including its address and parcel number, in the specified sections.

-

4.Include the name and address of the lender in the appropriate fields to confirm the release of the mortgage.

-

5.Indicate the date of the document's execution, ensuring it is accurate to reflect the payment completion.

-

6.Sign the document with the owner's signature, and if applicable, have the signature notarized to validate the transfer.

-

7.Review all entered information for accuracy, ensuring there are no missing details or errors before finalization.

-

8.Once verified, save the completed document as a PDF and download it for distribution to the relevant parties.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.